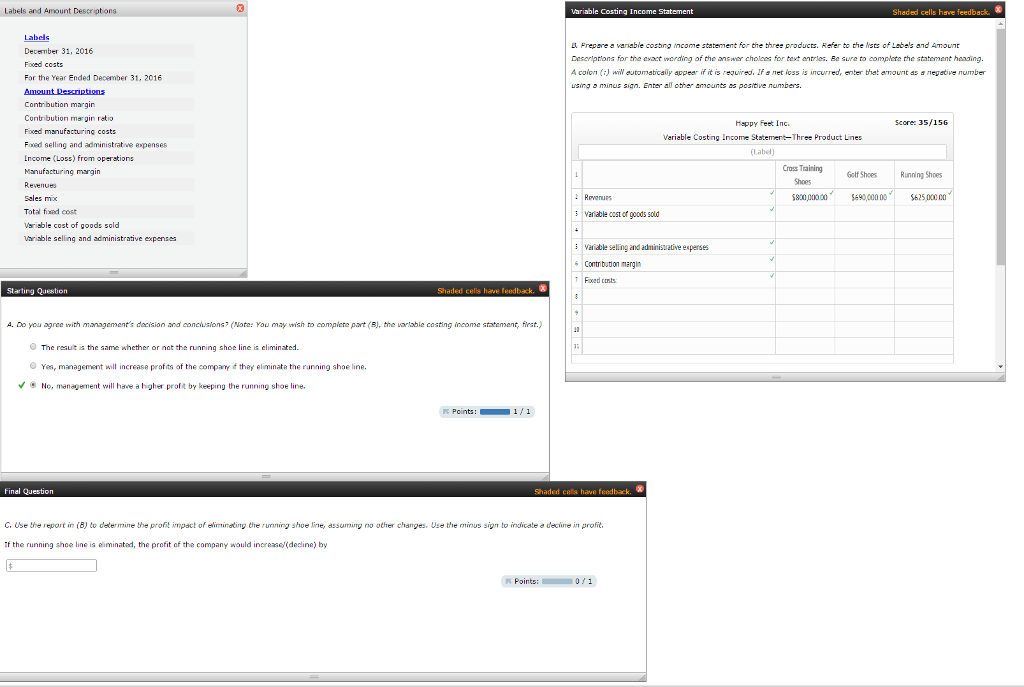

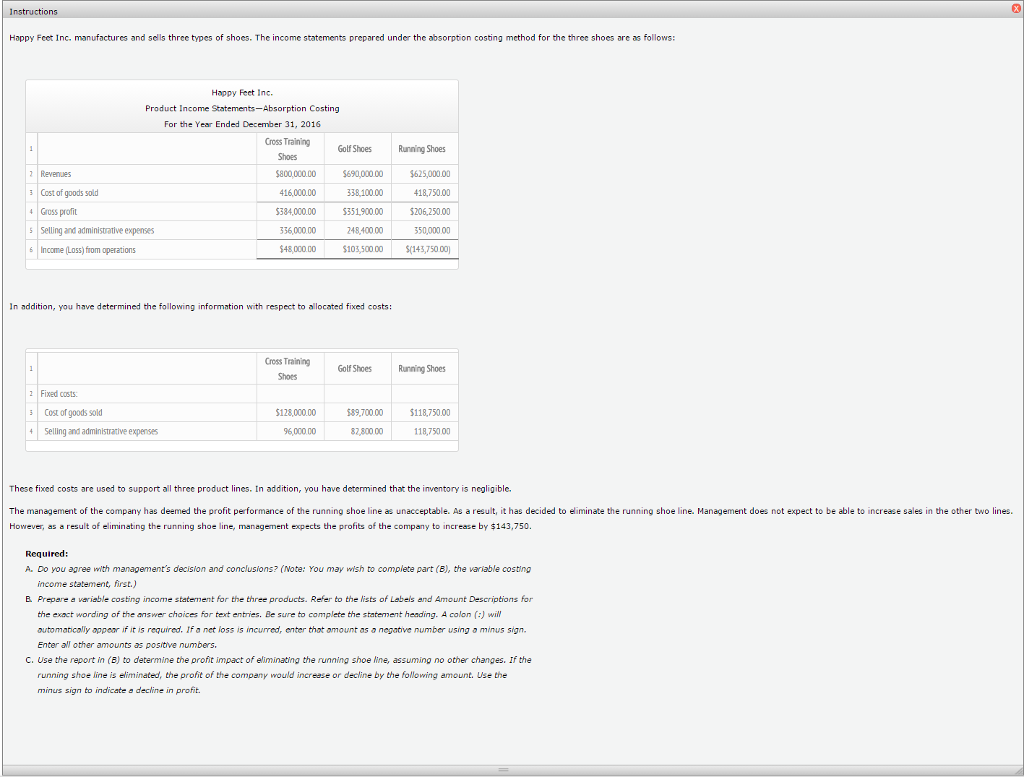

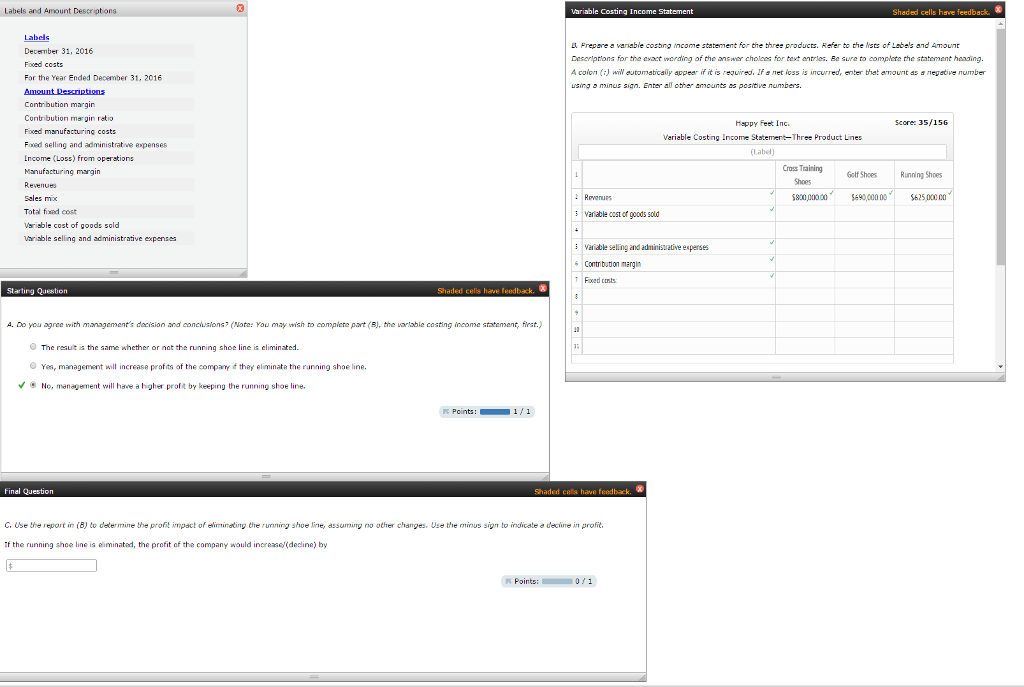

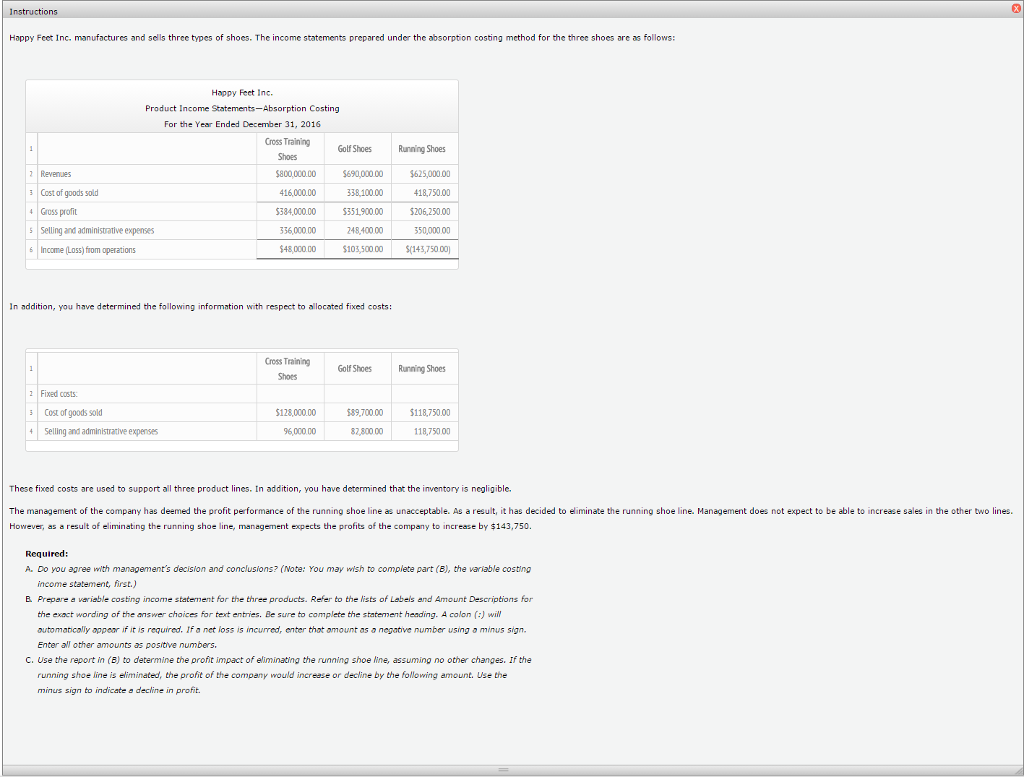

December 31, 2016 Fixed costs For the year Ended December 31, 2016 Contribution margin Contribution margin ratio Fixed manufacturing costs Fixed selling and administrative expenses Income (Loss) From operations manufacturing margin Revenues Sales mix Total fixed cost Variable cost of goods sold variables and administrative expenses Prepare a Variable costing income statement for the three products. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to compute the statement heading. A colon will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign. Enter al other amounts as positive numbers. Do you agree with management's decision and conclusions? The result is the same whether or not the running shoe line is eliminated. Yes, management will increase profits of the company if they eliminate the running shoe line. No, management will have a higher profit by keeping the running shoe line. Use the report in (B) to determine the profit impact of eliminating the running shoe line, assuming no other changes. Use the minus sign to indicate a decline in profit. If the running shoe line is eliminated, the profit of the company would increases(decline) by Happy Peer Inc. manufactures and sidles three types of shoes. The income statements prepared under the absorption costing method for the three shoes arc as follows: In addition, you have determined the following information with respect to allocated fixed costs: These fixed costs are used to support ail three product lines. In addition, you have determined that the inventory is negligible. The management of the company has deemed the profit performance of the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the profits of the company to increase by S143.750. A. Do you agree with management's decision and conclusions? B. Prepare a variable costing income statement for the three products. Refer to the lists and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon(:) will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign. Enter all other amounts as positive numbers. C. Use the report in (B) to determine the profit impact of eliminating the running shoe line, assuming no other changes. If the running shoe line is eliminated, the profit of the company would increase or decline by the following amount. Use the minus sign to indicate a decline in profit. December 31, 2016 Fixed costs For the year Ended December 31, 2016 Contribution margin Contribution margin ratio Fixed manufacturing costs Fixed selling and administrative expenses Income (Loss) From operations manufacturing margin Revenues Sales mix Total fixed cost Variable cost of goods sold variables and administrative expenses Prepare a Variable costing income statement for the three products. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to compute the statement heading. A colon will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign. Enter al other amounts as positive numbers. Do you agree with management's decision and conclusions? The result is the same whether or not the running shoe line is eliminated. Yes, management will increase profits of the company if they eliminate the running shoe line. No, management will have a higher profit by keeping the running shoe line. Use the report in (B) to determine the profit impact of eliminating the running shoe line, assuming no other changes. Use the minus sign to indicate a decline in profit. If the running shoe line is eliminated, the profit of the company would increases(decline) by Happy Peer Inc. manufactures and sidles three types of shoes. The income statements prepared under the absorption costing method for the three shoes arc as follows: In addition, you have determined the following information with respect to allocated fixed costs: These fixed costs are used to support ail three product lines. In addition, you have determined that the inventory is negligible. The management of the company has deemed the profit performance of the running shoe line as unacceptable. As a result, it has decided to eliminate the running shoe line. Management does not expect to be able to increase sales in the other two lines. However, as a result of eliminating the running shoe line, management expects the profits of the company to increase by S143.750. A. Do you agree with management's decision and conclusions? B. Prepare a variable costing income statement for the three products. Refer to the lists and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon(:) will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign. Enter all other amounts as positive numbers. C. Use the report in (B) to determine the profit impact of eliminating the running shoe line, assuming no other changes. If the running shoe line is eliminated, the profit of the company would increase or decline by the following amount. Use the minus sign to indicate a decline in profit