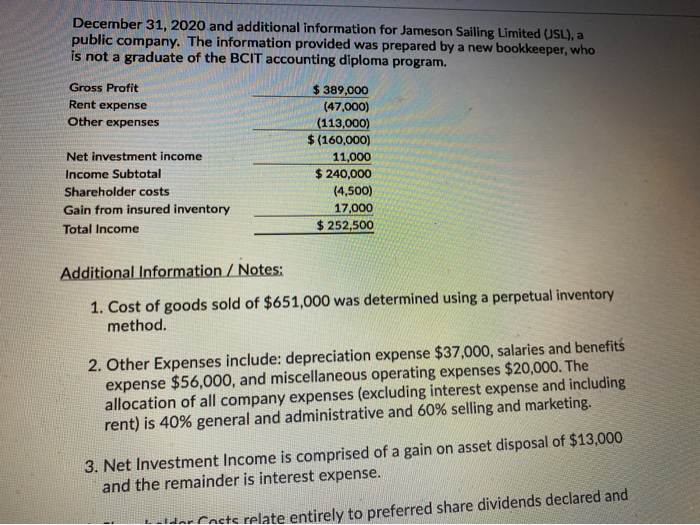

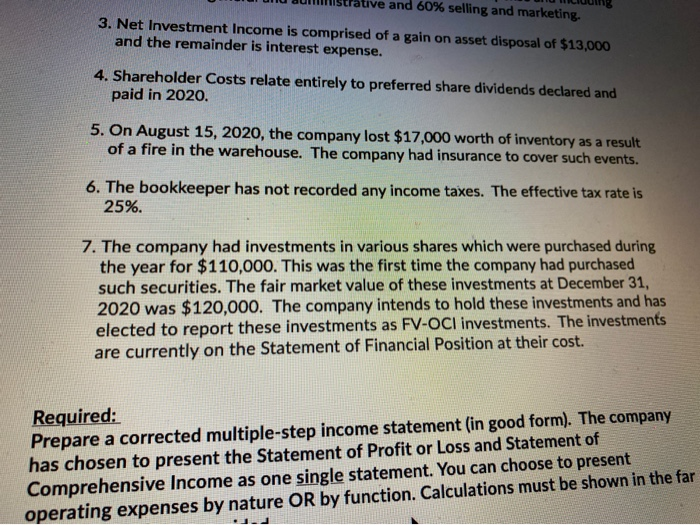

December 31, 2020 and additional information for Jameson Sailing Limited (ISL), a public company. The information provided was prepared by a new bookkeeper, who is not a graduate of the BCIT accounting diploma program. Gross Profit Rent expense Other expenses Net investment income Income Subtotal Shareholder costs Gain from insured inventory Total Income $ 389,000 (47,000) (113,000) $(160,000) 11,000 $ 240,000 (4,500) 17,000 $ 252,500 Additional Information/Notes: 1. Cost of goods sold of $651,000 was determined using a perpetual inventory method. 2. Other Expenses include: depreciation expense $37,000, salaries and benefits expense $56,000, and miscellaneous operating expenses $20,000. The allocation of all company expenses (excluding interest expense and including rent) is 40% general and administrative and 60% selling and marketing. 3. Net Investment Income is comprised of a gain on asset disposal of $13,000 and the remainder is interest expense. Her Cncte relate entirely to preferred share dividends declared and ative and 60% selling and marketing. 3. Net Investment Income is comprised of a gain on asset disposal of $13,000 and the remainder is interest expense. 4. Shareholder Costs relate entirely to preferred share dividends declared and paid in 2020. 5. On August 15, 2020, the company lost $17,000 worth of inventory as a result of a fire in the warehouse. The company had insurance to cover such events. 6. The bookkeeper has not recorded any income taxes. The effective tax rate is 25%. 7. The company had investments in various shares which were purchased during the year for $110,000. This was the first time the company had purchased such securities. The fair market value of these investments at December 31, 2020 was $120,000. The company intends to hold these investments and has elected to report these investments as FV-OCI investments. The investments are currently on the Statement of Financial Position at their cost. Required: Prepare a corrected multiple-step income statement (in good form). The company has chosen to present the Statement of Profit or Loss and Statement of Comprehensive Income as one single statement. You can choose to present operating expenses by nature OR by function. Calculations must be shown in the far