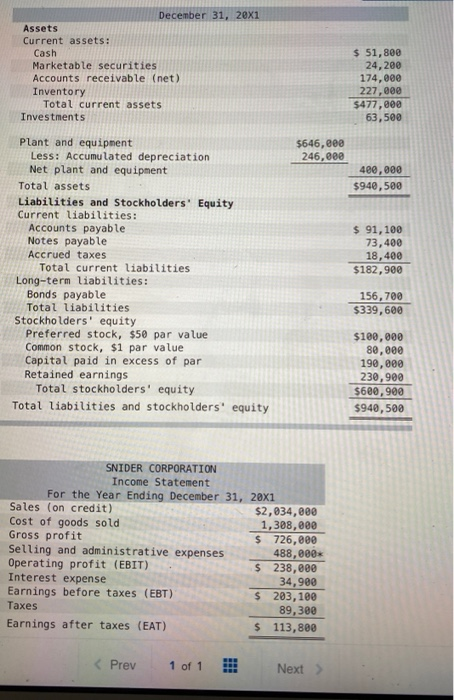

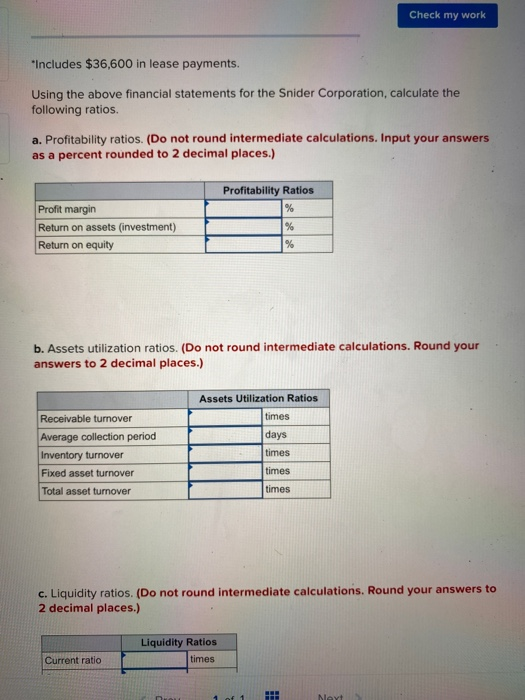

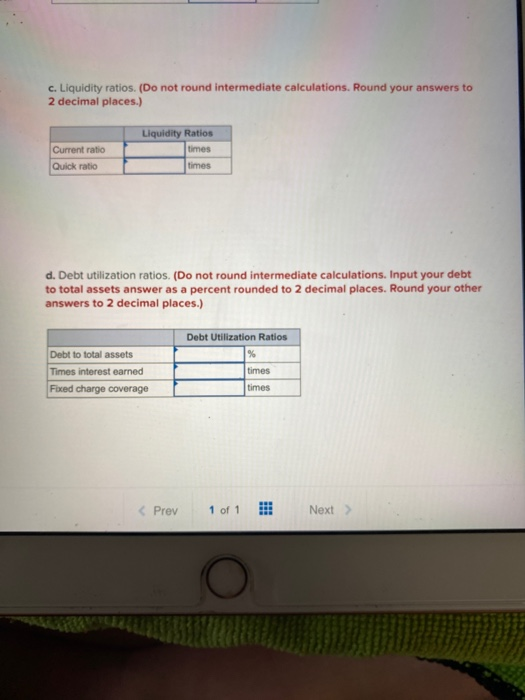

December 31, 20x1 Assets Current assets: Cash Marketable securities Accounts receivable (net) Inventory Total current assets Investments $ 51,800 24,200 174,000 227,000 $477,000 63,500 $646, eee 246,000 400,000 $940,500 $ 91,100 73,400 18,400 $182,900 Plant and equipment Less: Accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' equity Preferred stock, $50 par value Common stock, si par value Capital paid in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 156,700 $339, 600 $100,000 80,000 190,000 230,909 $600,900 $940,500 SNIDER CORPORATION Income Statement For the Year Ending December 31, 20x1 Sales (on credit) $2,034,800 Cost of goods sold 1,308,000 Gross profit $ 726,000 Selling and administrative expenses 488,000 Operating profit (EBIT) $ 238,000 Interest expense 34,900 Earnings before taxes (EBT) $ 203, 100 Taxes 89,380 Earnings after taxes (EAT) $ 113,800 Check my work Includes $36,600 in lease payments. Using the above financial statements for the Snider Corporation, calculate the following ratios. a. Profitability ratios. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Profitability Ratios % Profit margin Return on assets (investment) Return on equity % % b. Assets utilization ratios. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Assets Utilization Ratios times Receivable turnover Average collection period Inventory turnover Fixed asset turnover days times times times Total asset turnover c. Liquidity ratios. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Liquidity Ratios Current ratio times Net c. Liquidity ratios. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Current ratio Liquidity Ratios times times Quick ratio d. Debt utilization ratios. (Do not round intermediate calculations. Input your debt to total assets answer as a percent rounded to 2 decimal places. Round your other answers to 2 decimal places.) Debt Utilization Ratios Debt to total assets Times interest earned Fixed charge coverage times times Prev 1 of 1 Next >