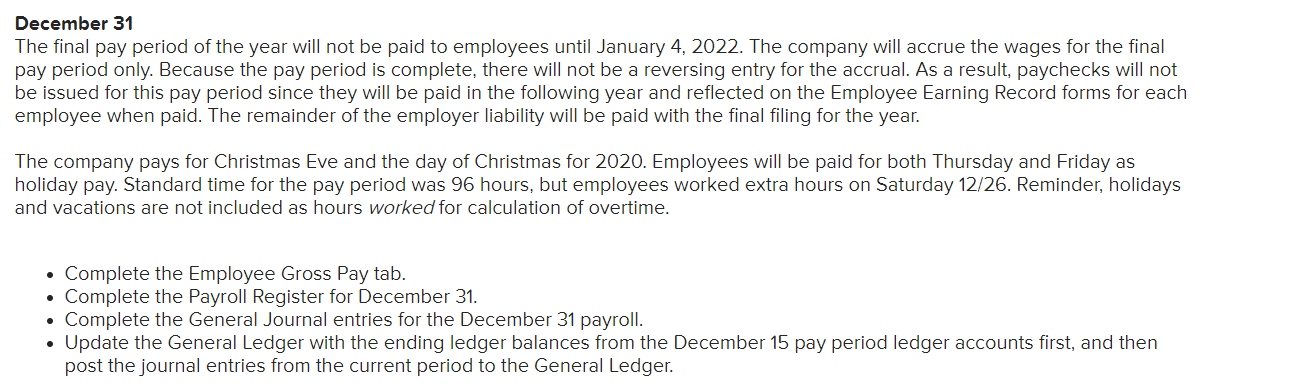

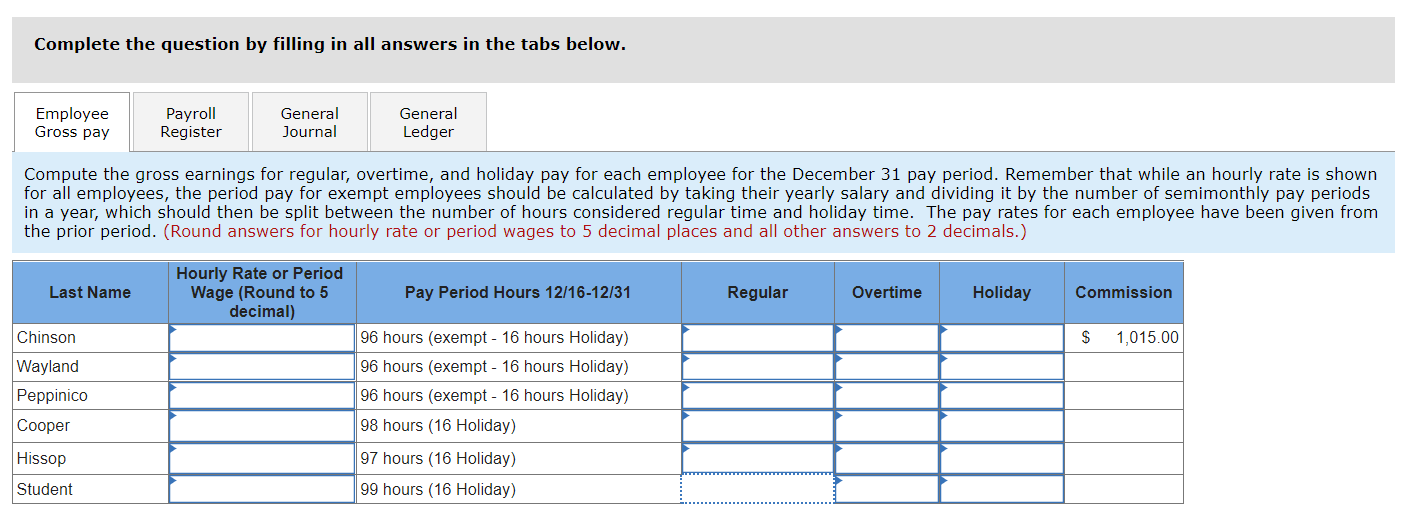

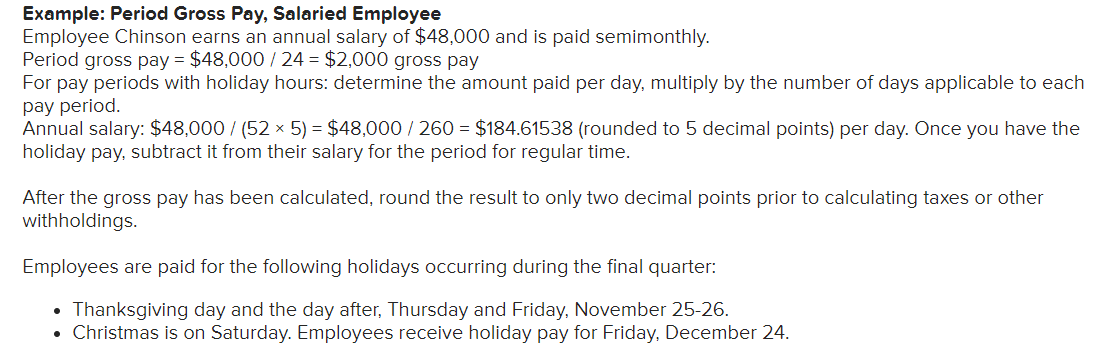

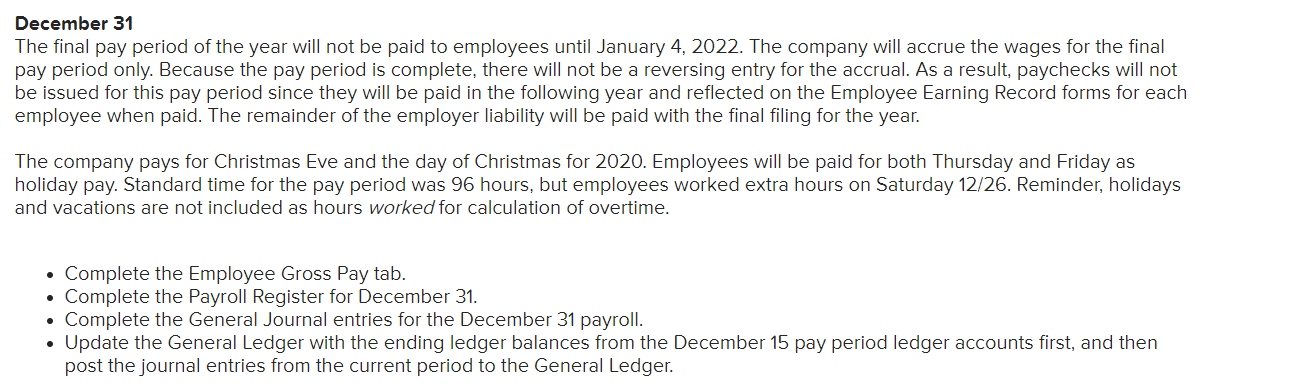

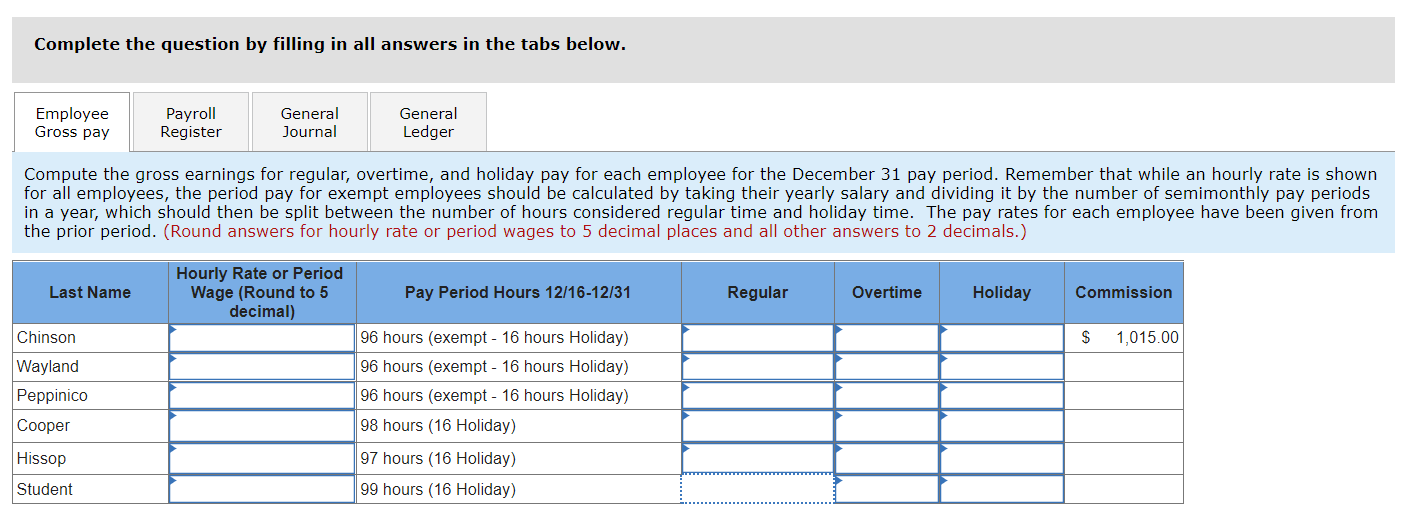

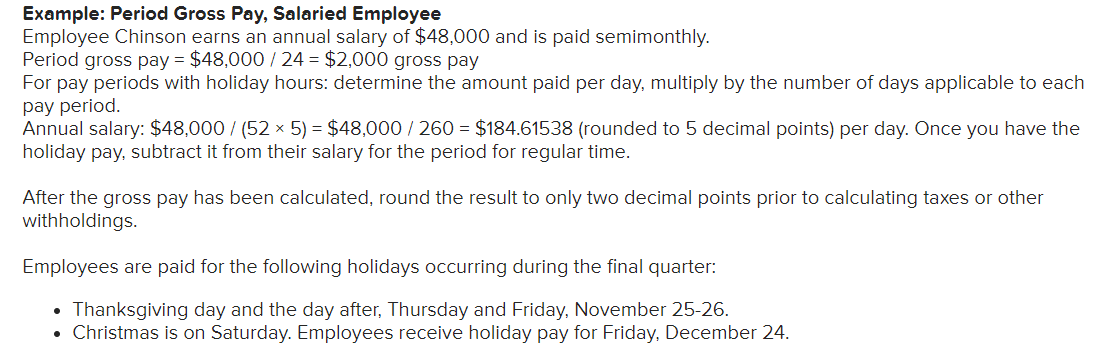

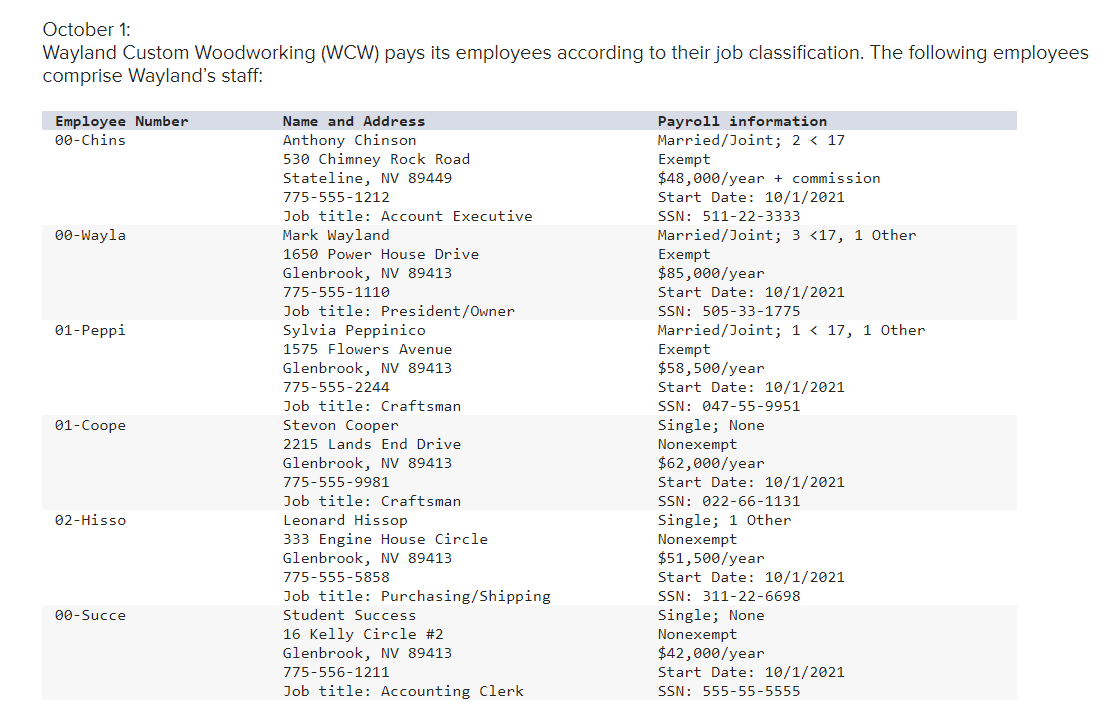

December 31 The final pay period of the year will not be paid to employees until January 4, 2022. The company will accrue the wages for the final pay period only. Because the pay period is complete, there will not be a reversing entry for the accrual. As a result, paychecks will not be issued for this pay period since they will be paid in the following year and reflected on the Employee Earning Record forms for each employee when paid. The remainder of the employer liability will be paid with the final filing for the year. The company pays for Christmas Eve and the day of Christmas for 2020 . Employees will be paid for both Thursday and Friday as holiday pay. Standard time for the pay period was 96 hours, but employees worked extra hours on Saturday 12/26. Reminder, holidays and vacations are not included as hours worked for calculation of overtime. - Complete the Employee Gross Pay tab. - Complete the Payroll Register for December 31. - Complete the General Journal entries for the December 31 payroll. - Update the General Ledger with the ending ledger balances from the December 15 pay period ledger accounts first, and then post the journal entries from the current period to the General Ledger. Complete the question by filling in all answers in the tabs below. Compute the gross earnings for regular, overtime, and holiday pay for each employee for the December 31 pay period. Remember that while an hourly rate is shown for all employees, the period pay for exempt employees should be calculated by taking their yearly salary and dividing it by the number of semimonthly pay periods in a year, which should then be split between the number of hours considered regular time and holiday time. The pay rates for each employee have been given from the prior period. (Round answers for hourly rate or period wages to 5 decimal places and all other answers to 2 decimals.) Example: Period Gross Pay, Salaried Employee Employee Chinson earns an annual salary of $48,000 and is paid semimonthly. Period gross pay =$48,000/24=$2,000 gross pay For pay periods with holiday hours: determine the amount paid per day, multiply by the number of days applicable to each pay period. Annual salary: $48,000/(525)=$48,000/260=$184.61538 (rounded to 5 decimal points) per day. Once you have the holiday pay, subtract it from their salary for the period for regular time. After the gross pay has been calculated, round the result to only two decimal points prior to calculating taxes or other withholdings. Employees are paid for the following holidays occurring during the final quarter: - Thanksgiving day and the day after, Thursday and Friday, November 25-26. - Christmas is on Saturday. Employees receive holiday pay for Friday, December 24. October 1: Wayland Custom Woodworking (WCW) pays its employees according to their job classification. The following employees comprise Wayland's staff