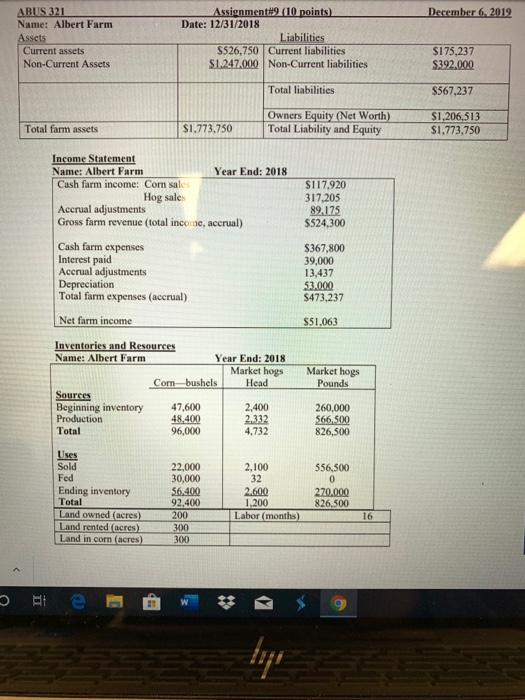

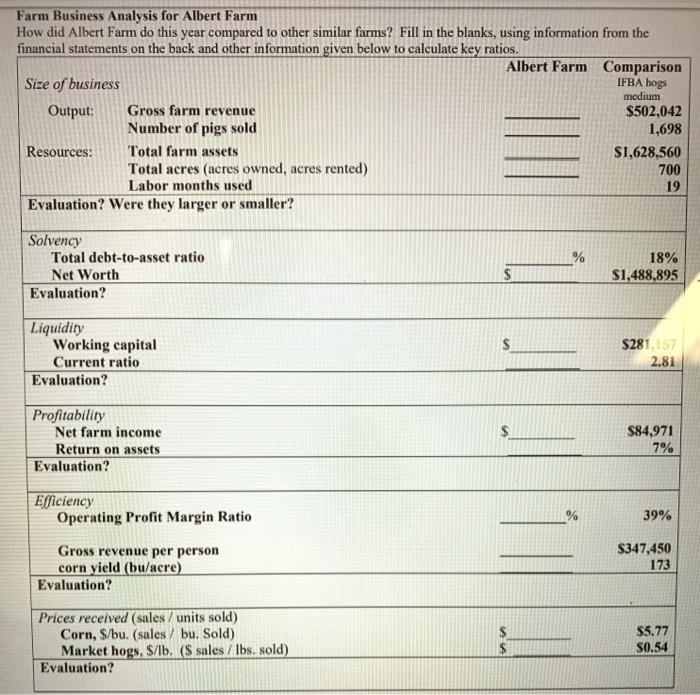

December 6, 2012 ABUS 321 Name: Albert Farm Assets Current assets Non-Current Assets Assignment#9 (10 points) Date: 12/31/2018 Liabilities S526,750 Current liabilities $1.247.000 Non-Current liabilities $175,237 $392.000 Total liabilities $567,237 Total farm assets $1,773,750 Owners Equity (Net Worth) Total Liability and Equity S1,206,513 $1,773,750 Income Statement Name: Albert Farm Year End: 2018 Cash farm income: Com sale Hog sales Accrual adjustments Gross farm revenue (total income, accrual) S117,920 317,205 89.175 $524,300 Cash farm expenses Interest paid Accrual adjustments Depreciation Total farm expenses (accrual) $367,800 39,000 13,437 53.000 S473,237 Net farm income S51,063 Market hogs Pounds Inventories and Resources Name: Albert Farm Year End: 2018 Market hogs Combushels Head Sources Beginning inventory 47.600 2.400 Production 48.400 2.332 Total 96,000 4,732 260,000 566,500 826,500 556,500 0 Uses Sold Fed Ending inventory Total Land owned (acres) Land rented (acres) Land in com acres) 22,000 30,000 56,400 92,400 200 300 300 2.100 32 2.600 1.200 Labor (months) 270.000 826,500 16 eie w * 5 9 Farm Business Analysis for Albert Farm How did Albert Farm do this year compared to other similar farms? Fill in the blanks, using information from the financial statements on the back and other information given below to calculate key ratios. Albert Farm Comparison Size of business IFBA hogs medium Output: Gross farm revenue $502,042 Number of pigs sold 1,698 Resources: Total farm assets $1,628,560 Total acres (acres owned, acres rented) 700 Labor months used 19 Evaluation? Were they larger or smaller? Solvency Total debt-to-asset ratio Net Worth Evaluation? 18% $1,488,895 Liquidity Working capital Current ratio Evaluation? $281,157 2.81 Profitability Net farm income Return on assets Evaluation? $84,971 7% Efficiency Operating Profit Margin Ratio 39% Gross revenue per person corn yield (bu/acre) Evaluation? $347,450 173 Prices received (sales/ units sold) Corn, $/bu. (sales/ bu. Sold) Market hogs, S/Ib. (S sales / lbs. sold) Evaluation? $5.77 S0.54 December 6, 2012 ABUS 321 Name: Albert Farm Assets Current assets Non-Current Assets Assignment#9 (10 points) Date: 12/31/2018 Liabilities S526,750 Current liabilities $1.247.000 Non-Current liabilities $175,237 $392.000 Total liabilities $567,237 Total farm assets $1,773,750 Owners Equity (Net Worth) Total Liability and Equity S1,206,513 $1,773,750 Income Statement Name: Albert Farm Year End: 2018 Cash farm income: Com sale Hog sales Accrual adjustments Gross farm revenue (total income, accrual) S117,920 317,205 89.175 $524,300 Cash farm expenses Interest paid Accrual adjustments Depreciation Total farm expenses (accrual) $367,800 39,000 13,437 53.000 S473,237 Net farm income S51,063 Market hogs Pounds Inventories and Resources Name: Albert Farm Year End: 2018 Market hogs Combushels Head Sources Beginning inventory 47.600 2.400 Production 48.400 2.332 Total 96,000 4,732 260,000 566,500 826,500 556,500 0 Uses Sold Fed Ending inventory Total Land owned (acres) Land rented (acres) Land in com acres) 22,000 30,000 56,400 92,400 200 300 300 2.100 32 2.600 1.200 Labor (months) 270.000 826,500 16 eie w * 5 9 Farm Business Analysis for Albert Farm How did Albert Farm do this year compared to other similar farms? Fill in the blanks, using information from the financial statements on the back and other information given below to calculate key ratios. Albert Farm Comparison Size of business IFBA hogs medium Output: Gross farm revenue $502,042 Number of pigs sold 1,698 Resources: Total farm assets $1,628,560 Total acres (acres owned, acres rented) 700 Labor months used 19 Evaluation? Were they larger or smaller? Solvency Total debt-to-asset ratio Net Worth Evaluation? 18% $1,488,895 Liquidity Working capital Current ratio Evaluation? $281,157 2.81 Profitability Net farm income Return on assets Evaluation? $84,971 7% Efficiency Operating Profit Margin Ratio 39% Gross revenue per person corn yield (bu/acre) Evaluation? $347,450 173 Prices received (sales/ units sold) Corn, $/bu. (sales/ bu. Sold) Market hogs, S/Ib. (S sales / lbs. sold) Evaluation? $5.77 S0.54