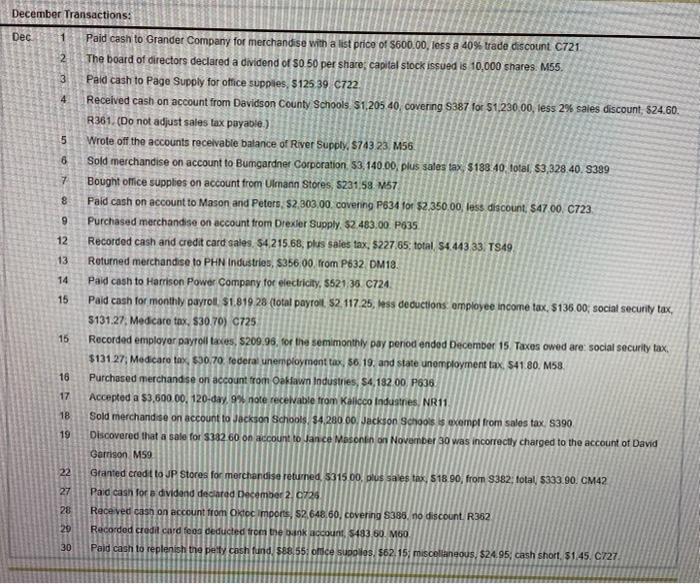

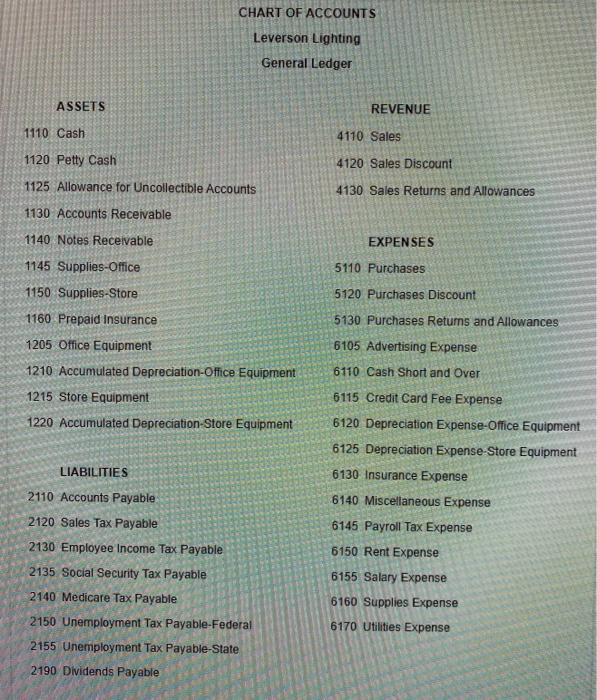

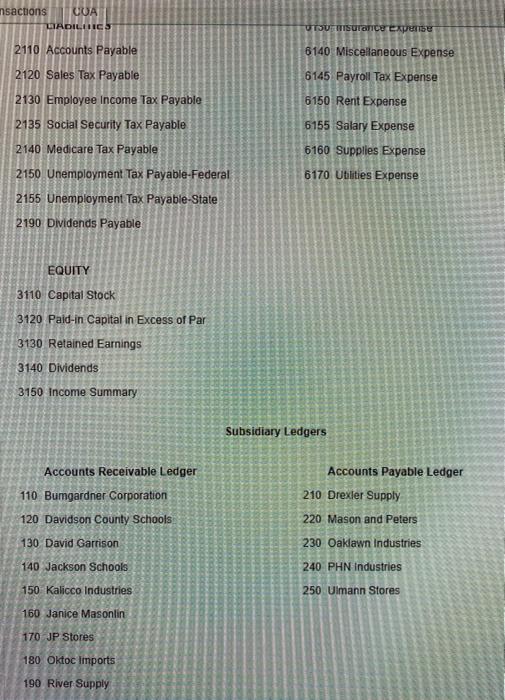

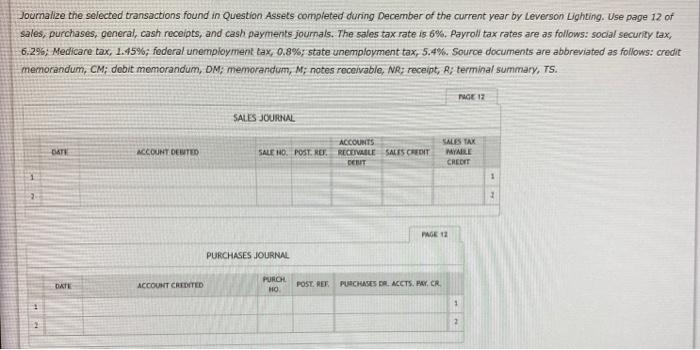

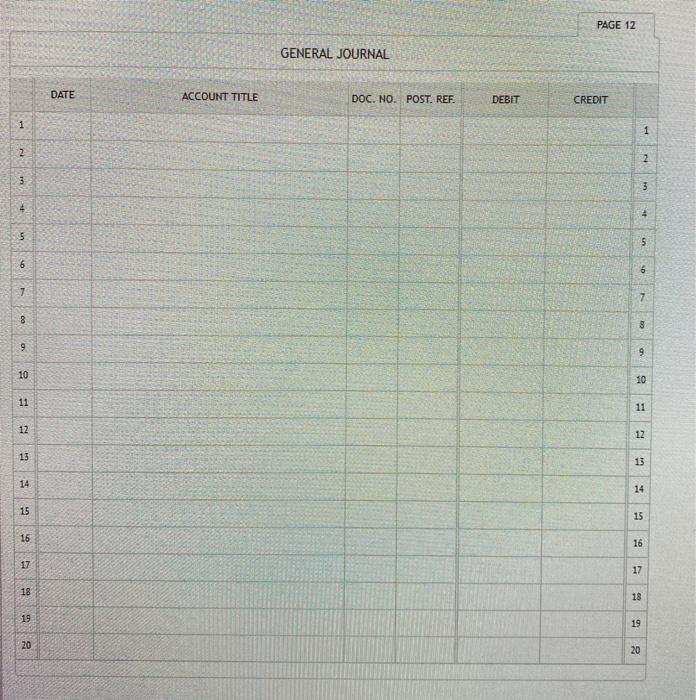

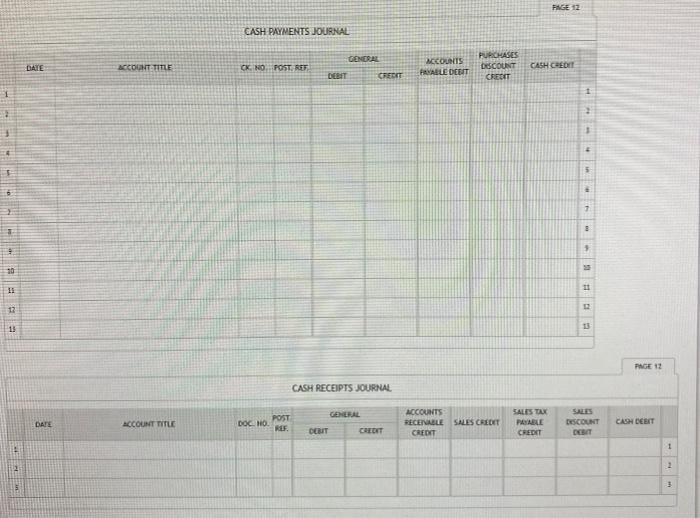

December Transactions: Dec 1 2 3 4 5 6 7 8 9 12 13 14 Paid cash to Grander Company for merchandise with a list price of $600.00, less a 40% trade discount C721 The board of directors declared a dividend of $0.50 per share, capital stock issued is 10,000 shares. M55. Pald cash to Page Supply for office supplies, $125 39 C722 Received cash on account from Davidson County Schools S1,205 40, covering S387 for $1,230.00, less 2% sales discount, $24.60 R361. (Do not adjust sales tax payable) Wrote off the accounts receivable balance of River Supply, $743 23. M56 Sold merchandise on account to Bumgardner Corporation 53,140.00, plus sales tax, $188 40 total, 63,328 40. 8389 Bought office supplies on account from Ulenann Stores, 5231.58 M57 Faid cash on account to Mason and Peters $2,303.00, covering P634 for $2.350.00, less discount, $47.00 C723 Purchased merchandise on account from Drexler Supply $2 483.00. P635 Recorded cash and credit card sales. $4215.68, plus sales tax, $227.65, total $4.443 33. TS49 Returned merchandise to PHN Industries, $356 00, from P632 DM13 Paid cash to Harrison Power Company for electricity, 5521:30 C724 Paid cash for monthly payroll $1.819.28 (total payroll $2.117.25, less deductions employee income tax $136.00, social security tax, $131.27. Medicare tax, $30.70) C725 Recorded employer payroll taxes, S209.95, for the semimonthly pay penod ended December 15 Taxes owed are: social security tax, $131 27; Medicare tax, 530,70 federa unemployment tax, 56, 19. and state unemployment tax, S41.80, M58. Purchased merchandise on account from Oaklawn Industries, S4,19200 P636 Accepted a $3,600.00, 120-day 9% note receivable from Kallcco Industnes, NR11 Sold merchandise on account to Jackson Schools $4,280 00. Jackson Schools exempt from sales tax. 8390 Discovered that a sale for $382 60 on account to Jance Masonin on November 30 was incorrectly charged to the account of David Garrison M59 Granted credit to JP Stores for merchandise returned 5315.00, plus saves tax, S18 90, from $382 total $333.90. CM42 Paid cash for a dividend declared December 2012 Receved cash on account from Oktoc imports, 52 648 60, covering S385, no discount. R362 Recorded credit card food deducted from the count, $493 60. MOO Paid cash to replenish the petty cash fund $88.55. ofice supo los $62.15. miscoltaneous, $24.95, cash short, $1.45. C727 15 15 16 17 18 19 22 27 28 20 30 CHART OF ACCOUNTS Leverson Lighting General Ledger ASSETS REVENUE 1110 Cash 4110 Sales 1120 Petty Cash 1125 Allowance for Uncollectible Accounts 4120 Sales Discount 4130 Sales Returns and Allowances 1130 Accounts Receivable 1140 Notes Receivable EXPENSES 1145 Supplies Office 5110 Purchases 1150 Supplies-Store 1160 Prepaid Insurance 1205 Office Equipment 1210 Accumulated Depreciation Office Equipment 1215 Store Equipment 1220 Accumulated Depreciation Store Equipment 5120 Purchases Discount 5130 Purchases Returns and Allowances 6105 Advertising Expense 6110 Cash Short and Over LIABILITIES 2110 Accounts Payable 2120 Sales Tax Payable 2130 Employee Income Tax Payable 2135 Social Security Tax Payable 2140 Medicare Tax Payable 2150 Unemployment Tax Payable-Federal 2155 Unemployment Tax Payable-State 2190 Dividends Payable 6115 Credit Card Fee Expense 6120 Depreciation Expense-Office Equipment 6125 Depreciation Expense-Store Equipment 6130 Insurance Expense 6140 Miscellaneous Expense 6145 Payroll Tax Expense 6150 Rent Expense 6155 Salary Expense 6160 Supplies Expense 6170 Utilities Expense nsactions CUA LADILICS UTSUITSUTSTICO Expense 2110 Accounts Payable 6140 Miscellaneous Expense 2120 Sales Tax Payable 6145 Payroll Tax Expense 2130 Employee Income Tax Payable 6150 Rent Expense 2135 Social Security Tax Payable 6155 Salary Expense 2140 Medicare Tax Payable 6160 Supplies Expense 2150 Unemployment Tax Payable-Federal 6170 Ublities Expense 2155 Unemployment Tax Payable-State 2190 Dividends Payable EQUITY 3110 Capital Stock 3120 Paid-in Capital in Excess of Par 3130 Retained Earnings 3140 Dividends 3150 Income Summary Subsidiary Ledgers Accounts Receivable Ledger 110 Bumgardner Corporation Accounts Payable Ledger 210 Drexler Supply 120 Davidson County Schools 220 Mason and Peters 130 David Garrison 230 Oaklawn Industries 140 Jackson Schools 240 PHN Industries 150 Kalicco Industries 250 Ulmann Stores 160 Janice Masonlin 170 JP Stores 180 Oktoc Imports 190 River Supply Journalize the selected transactions found in Question Assets completed during December of the current year by Leverson Lighting. Use page 12 of sales, purchases, general, cash receipts, and cash payments journals. The sales tax rate is 6%. Payroll tax rates are as follows: social security tax, 6.296; Medicare tax, 1.45%; federal unemployment tax, 0.8%; state unemployment tax, 5.4%. Source documents are abbreviated as follows: credit memorandum, CM; debit memorandum, DM, memorandum, M; notes receivable, NR: receipt, R; terminal summary, TS. PAGE 12 SALES JOURNAL DATE ACCOUNT DESTED ACCOUNTS SALE NO. POST. REF. RECEIVABLE SALES CREDIT DEUT SALES TAX MYALE CREDIT 2 2 PAGE 12 PURCHASES JOURNAL DATE ACCOUNT CREDITED PURO HO POST. RET PURCHASES BRACCTS. WW CR PAGE 12 GENERAL JOURNAL DATE ACCOUNT TITLE DOC. NO. POST. REF. DEBIT CREDIT 1 2 2 3 3 4 5 on 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 $19 19 20 20 PAGE 12 CASH PAYMENTS JOURNAL GENERAL DATE ACCOUNT TITLE CK NO POST. REF MCCOUNTS PARABLE DEBIT PURCHASES DSCOUNT CREDIT CASH CREDIT CERET 1 2 5 + 1 : 3 11 11 12 15 13 PAGE 12 CASH RECEIPTS JOURNAL GENERAL DATE ACCOUNT TITLE POST DOC. NO. REF ACCOUNTS RECENELE SALES CREDIT CREDIT SALES TAX PARABLE CREDIT DESCOUNT CASH DEBIT DEBIT 1 2 3 December Transactions: Dec 1 2 3 4 5 6 7 8 9 12 13 14 Paid cash to Grander Company for merchandise with a list price of $600.00, less a 40% trade discount C721 The board of directors declared a dividend of $0.50 per share, capital stock issued is 10,000 shares. M55. Pald cash to Page Supply for office supplies, $125 39 C722 Received cash on account from Davidson County Schools S1,205 40, covering S387 for $1,230.00, less 2% sales discount, $24.60 R361. (Do not adjust sales tax payable) Wrote off the accounts receivable balance of River Supply, $743 23. M56 Sold merchandise on account to Bumgardner Corporation 53,140.00, plus sales tax, $188 40 total, 63,328 40. 8389 Bought office supplies on account from Ulenann Stores, 5231.58 M57 Faid cash on account to Mason and Peters $2,303.00, covering P634 for $2.350.00, less discount, $47.00 C723 Purchased merchandise on account from Drexler Supply $2 483.00. P635 Recorded cash and credit card sales. $4215.68, plus sales tax, $227.65, total $4.443 33. TS49 Returned merchandise to PHN Industries, $356 00, from P632 DM13 Paid cash to Harrison Power Company for electricity, 5521:30 C724 Paid cash for monthly payroll $1.819.28 (total payroll $2.117.25, less deductions employee income tax $136.00, social security tax, $131.27. Medicare tax, $30.70) C725 Recorded employer payroll taxes, S209.95, for the semimonthly pay penod ended December 15 Taxes owed are: social security tax, $131 27; Medicare tax, 530,70 federa unemployment tax, 56, 19. and state unemployment tax, S41.80, M58. Purchased merchandise on account from Oaklawn Industries, S4,19200 P636 Accepted a $3,600.00, 120-day 9% note receivable from Kallcco Industnes, NR11 Sold merchandise on account to Jackson Schools $4,280 00. Jackson Schools exempt from sales tax. 8390 Discovered that a sale for $382 60 on account to Jance Masonin on November 30 was incorrectly charged to the account of David Garrison M59 Granted credit to JP Stores for merchandise returned 5315.00, plus saves tax, S18 90, from $382 total $333.90. CM42 Paid cash for a dividend declared December 2012 Receved cash on account from Oktoc imports, 52 648 60, covering S385, no discount. R362 Recorded credit card food deducted from the count, $493 60. MOO Paid cash to replenish the petty cash fund $88.55. ofice supo los $62.15. miscoltaneous, $24.95, cash short, $1.45. C727 15 15 16 17 18 19 22 27 28 20 30 CHART OF ACCOUNTS Leverson Lighting General Ledger ASSETS REVENUE 1110 Cash 4110 Sales 1120 Petty Cash 1125 Allowance for Uncollectible Accounts 4120 Sales Discount 4130 Sales Returns and Allowances 1130 Accounts Receivable 1140 Notes Receivable EXPENSES 1145 Supplies Office 5110 Purchases 1150 Supplies-Store 1160 Prepaid Insurance 1205 Office Equipment 1210 Accumulated Depreciation Office Equipment 1215 Store Equipment 1220 Accumulated Depreciation Store Equipment 5120 Purchases Discount 5130 Purchases Returns and Allowances 6105 Advertising Expense 6110 Cash Short and Over LIABILITIES 2110 Accounts Payable 2120 Sales Tax Payable 2130 Employee Income Tax Payable 2135 Social Security Tax Payable 2140 Medicare Tax Payable 2150 Unemployment Tax Payable-Federal 2155 Unemployment Tax Payable-State 2190 Dividends Payable 6115 Credit Card Fee Expense 6120 Depreciation Expense-Office Equipment 6125 Depreciation Expense-Store Equipment 6130 Insurance Expense 6140 Miscellaneous Expense 6145 Payroll Tax Expense 6150 Rent Expense 6155 Salary Expense 6160 Supplies Expense 6170 Utilities Expense nsactions CUA LADILICS UTSUITSUTSTICO Expense 2110 Accounts Payable 6140 Miscellaneous Expense 2120 Sales Tax Payable 6145 Payroll Tax Expense 2130 Employee Income Tax Payable 6150 Rent Expense 2135 Social Security Tax Payable 6155 Salary Expense 2140 Medicare Tax Payable 6160 Supplies Expense 2150 Unemployment Tax Payable-Federal 6170 Ublities Expense 2155 Unemployment Tax Payable-State 2190 Dividends Payable EQUITY 3110 Capital Stock 3120 Paid-in Capital in Excess of Par 3130 Retained Earnings 3140 Dividends 3150 Income Summary Subsidiary Ledgers Accounts Receivable Ledger 110 Bumgardner Corporation Accounts Payable Ledger 210 Drexler Supply 120 Davidson County Schools 220 Mason and Peters 130 David Garrison 230 Oaklawn Industries 140 Jackson Schools 240 PHN Industries 150 Kalicco Industries 250 Ulmann Stores 160 Janice Masonlin 170 JP Stores 180 Oktoc Imports 190 River Supply Journalize the selected transactions found in Question Assets completed during December of the current year by Leverson Lighting. Use page 12 of sales, purchases, general, cash receipts, and cash payments journals. The sales tax rate is 6%. Payroll tax rates are as follows: social security tax, 6.296; Medicare tax, 1.45%; federal unemployment tax, 0.8%; state unemployment tax, 5.4%. Source documents are abbreviated as follows: credit memorandum, CM; debit memorandum, DM, memorandum, M; notes receivable, NR: receipt, R; terminal summary, TS. PAGE 12 SALES JOURNAL DATE ACCOUNT DESTED ACCOUNTS SALE NO. POST. REF. RECEIVABLE SALES CREDIT DEUT SALES TAX MYALE CREDIT 2 2 PAGE 12 PURCHASES JOURNAL DATE ACCOUNT CREDITED PURO HO POST. RET PURCHASES BRACCTS. WW CR PAGE 12 GENERAL JOURNAL DATE ACCOUNT TITLE DOC. NO. POST. REF. DEBIT CREDIT 1 2 2 3 3 4 5 on 6 6 7 7 8 8 9 9 10 10 11 11 12 12 13 13 14 14 15 15 16 16 17 17 18 18 $19 19 20 20 PAGE 12 CASH PAYMENTS JOURNAL GENERAL DATE ACCOUNT TITLE CK NO POST. REF MCCOUNTS PARABLE DEBIT PURCHASES DSCOUNT CREDIT CASH CREDIT CERET 1 2 5 + 1 : 3 11 11 12 15 13 PAGE 12 CASH RECEIPTS JOURNAL GENERAL DATE ACCOUNT TITLE POST DOC. NO. REF ACCOUNTS RECENELE SALES CREDIT CREDIT SALES TAX PARABLE CREDIT DESCOUNT CASH DEBIT DEBIT 1 2 3