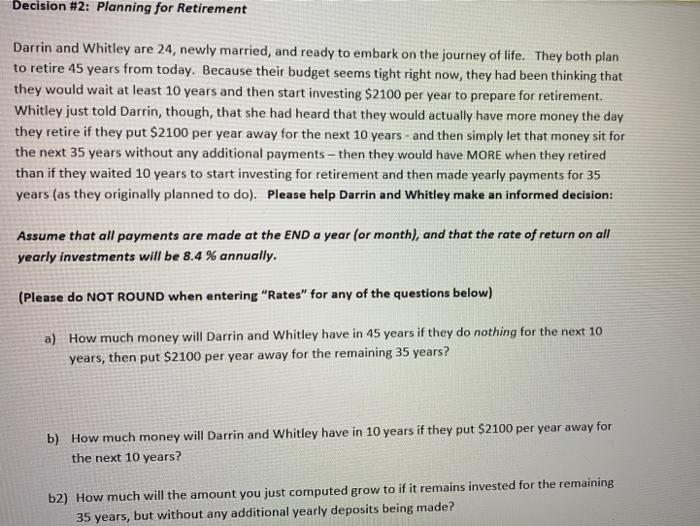

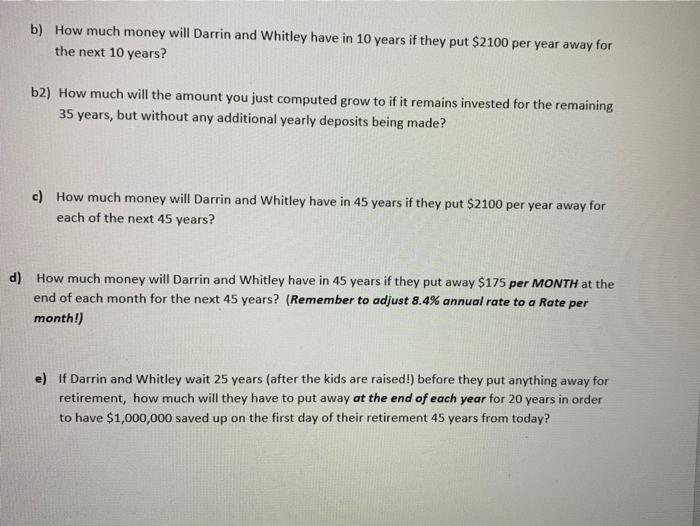

Decision #2: Planning for Retirement Darrin and Whitley are 24, newly married, and ready to embark on the journey of life. They both plan to retire 45 years from today. Because their budget seems tight right now, they had been thinking that they would wait at least 10 years and then start investing $2100 per year to prepare for retirement. Whitley just told Darrin, though, that she had heard that they would actually have more money the day they retire if they put $2100 per year away for the next 10 years - and then simply let that money sit for the next 35 years without any additional payments - then they would have MORE when they retired than if they waited 10 years to start investing for retirement and then made yearly payments for 35 years (as they originally planned to do). Please help Darrin and Whitley make an informed decision: Assume that all payments are made at the END a year (or month), and that the rate of return on all yearly investments will be 8.4 % annually. (Please do NOT ROUND when entering "Rates" for any of the questions below) a) How much money will Darrin and Whitley have in 45 years if they do nothing for the next 10 years, then put $2100 per year away for the remaining 35 years? b) How much money will Darrin and Whitley have in 10 years if they put $2100 per year away for the next 10 years? b2) How much will the amount you just computed grow to if it remains invested for the remaining 35 years, but without any additional yearly deposits being made? b) How much money will Darrin and Whitley have in 10 years if they put $2100 per year away for the next 10 years? b2) How much will the amount you just computed grow to if it remains invested for the remaining 35 years, but without any additional yearly deposits being made? c) How much money will Darrin and Whitley have in 45 years if they put $2100 per year away for each of the next 45 years? d) How much money will Darrin and Whitley have in 45 years if they put away $175 per MONTH at the end of each month for the next 45 years? (Remember to adjust 8.4% annual rate to a Rate per month!) e) If Darrin and Whitley wait 25 years (after the kids are raised!) before they put anything away for retirement, how much will they have to put away at the end of each year for 20 years in order to have $1,000,000 saved up on the first day of their retirement 45 years from today