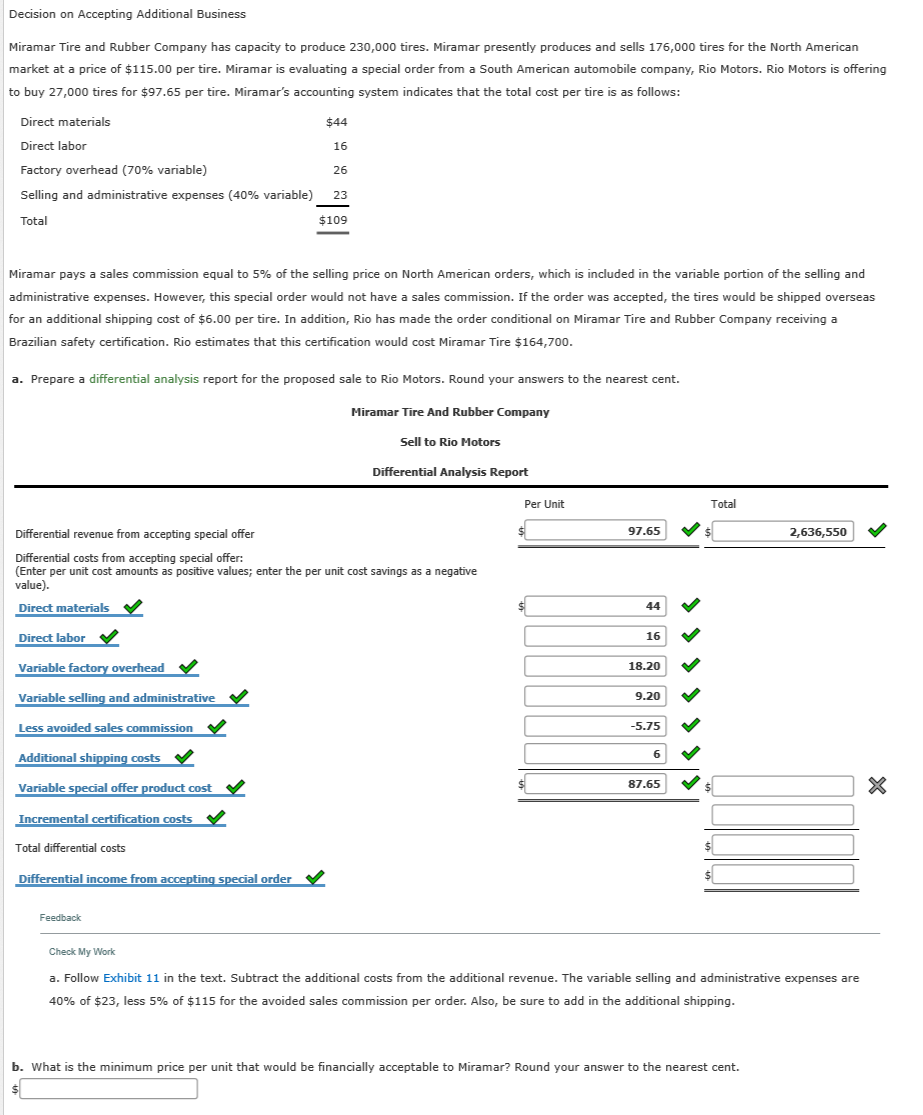

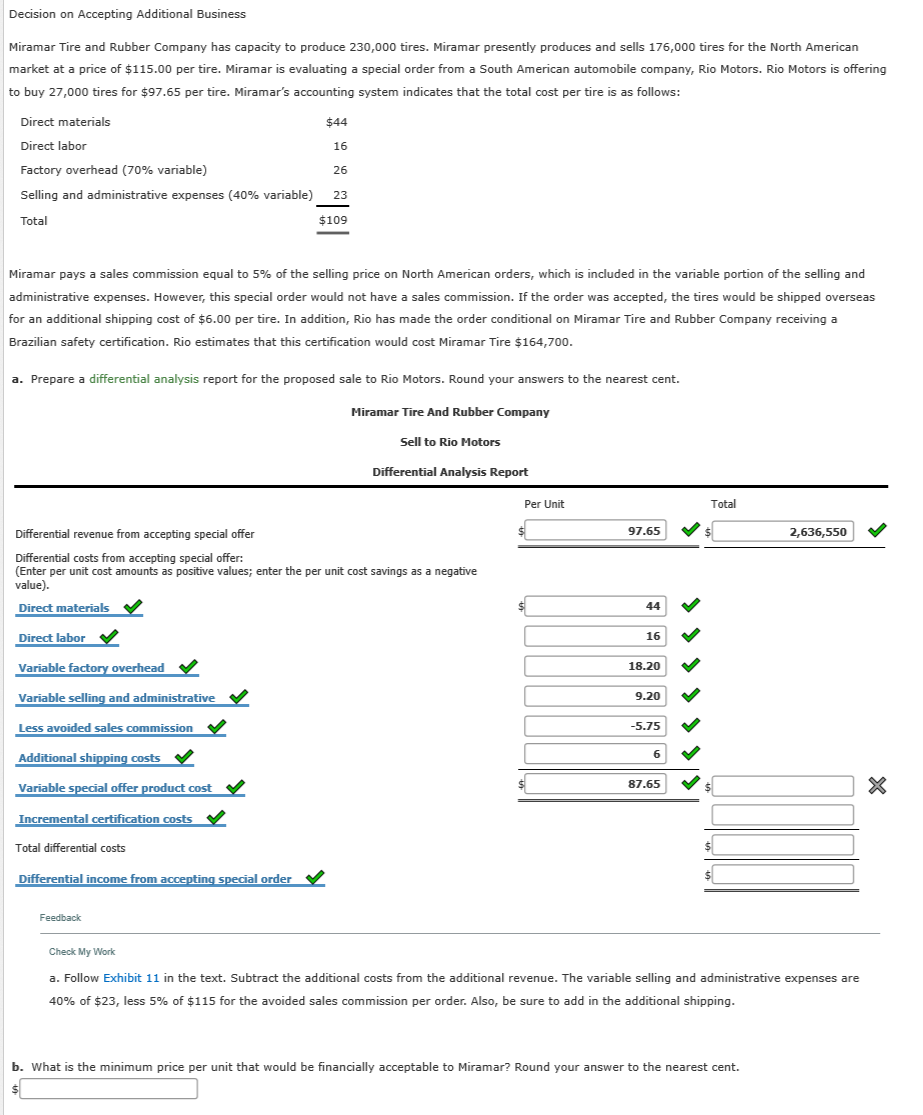

Decision on Accepting Additional Business Miramar Tire and Rubber Company has capacity to produce 230,000 tires. Miramar presently produces and sells 176,000 tires for the North American market at a price of $115.00 per tire. Miramar is evaluating a special order from a South American automobile company, Rio Motors. Rio Motors is offering to buy 27,000 tires for $97.65 per tire. Miramar's accounting system indicates that the total cost per tire is as follows: Direct materials Direct labor Factory overhead (70% variable) Selling and administrative expenses (40% variable) $44 16 26 23 Total $109 Miramar pays a sales commission equal to 5% of the selling price on North American orders, which is included in the variable portion of the selling and administrative expenses. However, this special order would not have a sales commission. If the order was accepted, the tires would be shipped overseas for an additional shipping cost of $6.00 per tire. In addition, Rio has made the order conditional on Miramar Tire and Rubber Company receiving a Brazilian safety certification. Rio estimates that this certification would cost Miramar Tire $164,700. a. Prepare a differential analysis report for the proposed sale to Rio Motors. Round your answers to the nearest cent. Miramar Tire And Rubber Company Sell to Rio Motors Differential Analysis Report Per Unit Total 2,636,550 Differential revenue from accepting special offer Differential costs from accepting special offer: (Enter per unit cost amounts as positive values; enter the per unit cost savings as a negative value). Direct materials 44 Direct labor 16 Variable factory overhead 18.20 Variable selling and administrative 9.20 Less avoided sales commission V -5.75 Additional shipping costs Variable special offer product cost 87.65 V Incremental certification costs V Total differential costs Differential income from accepting special order Feedback Check My Work a. Follow Exhibit 11 in the text. Subtract the additional costs from the additional revenue. The variable selling and administrative expenses are 40% of $23, less 5% of $115 for the avoided sales commission per order. Also, be sure to add in the additional shipping. b. What is the minimum price per unit that would be financially acceptable to Miramar? Round your answer to the nearest cent