Decision Points

Roths declining sales to Latin America The financial risk of countertrade The precedent being established if Roth should decide to take the shoes in exchange for gears The relative importance of the Argentine market The possible financial gain versus the complications and extra work to close the countertrade deal

Discussion Questions

-

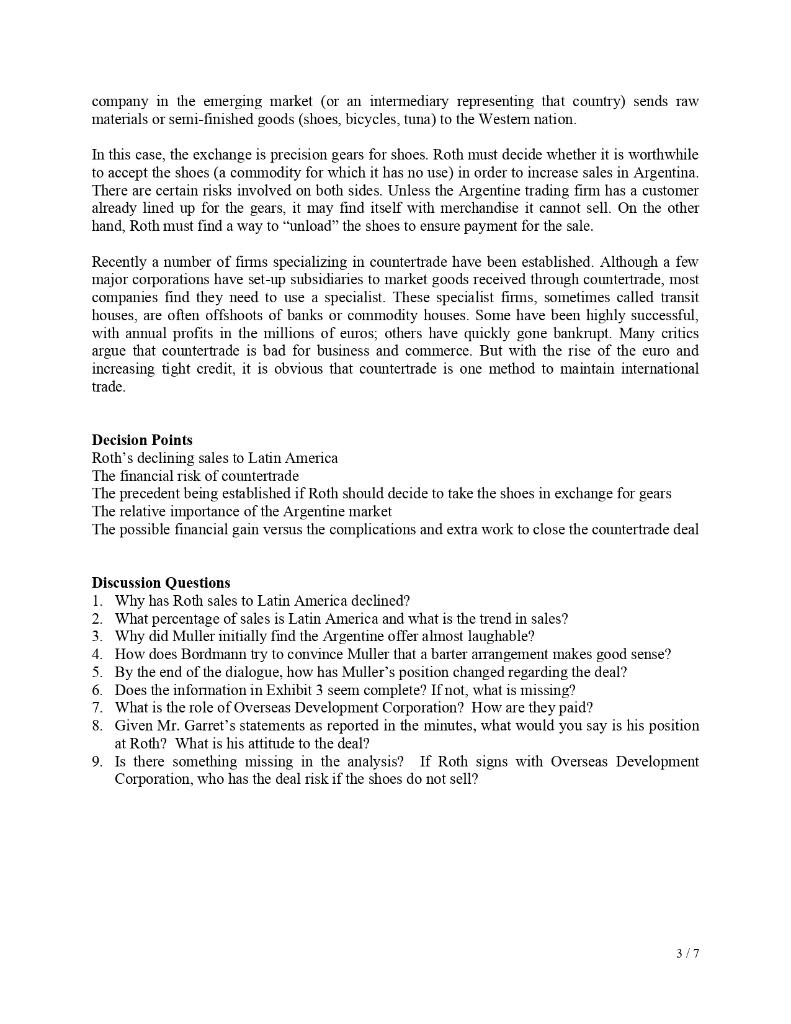

Why has Roth sales to Latin America declined?

-

What percentage of sales is Latin America and what is the trend in sales?

-

Why did Muller initially find the Argentine offer almost laughable?

-

How does Bordmann try to convince Muller that a barter arrangement makes good sense?

-

By the end of the dialogue, how has Mullers position changed regarding the deal?

-

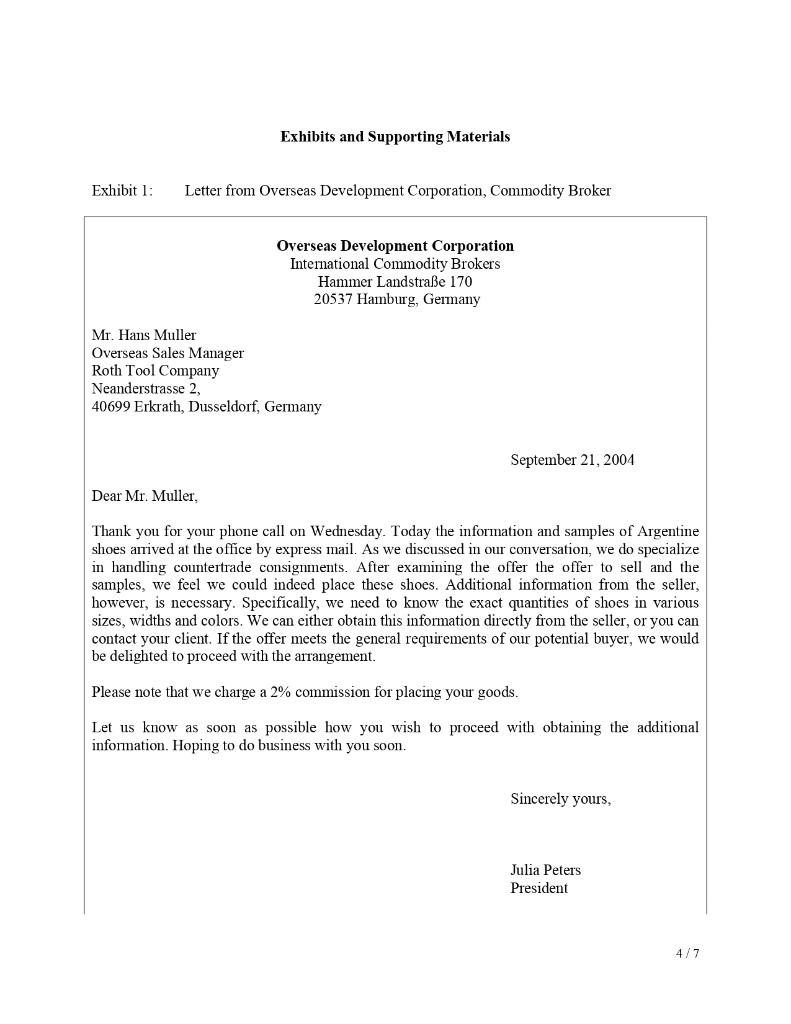

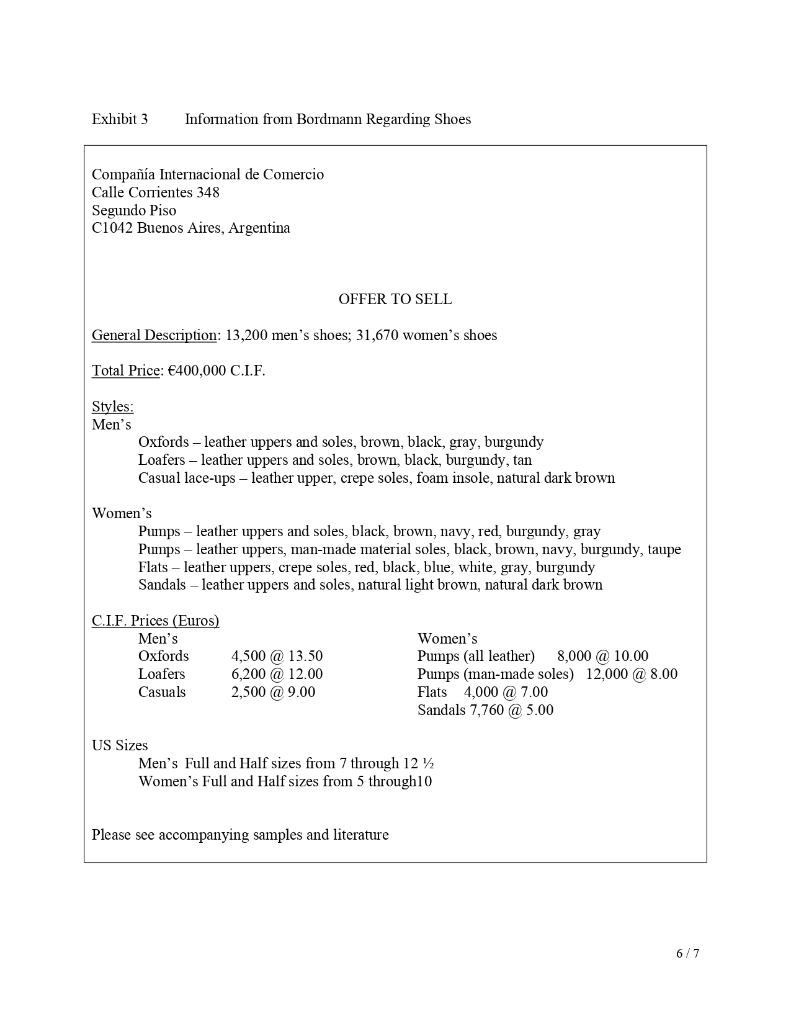

Does the information in Exhibit 3 seem complete? If not, what is missing?

-

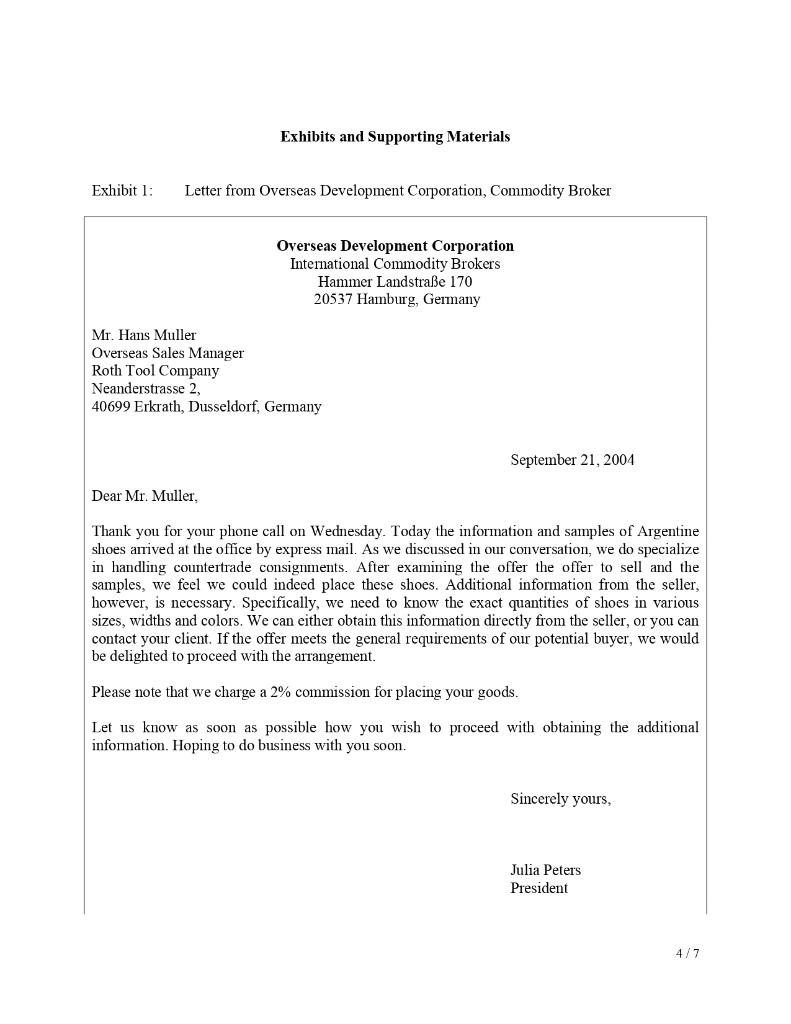

What is the role of Overseas Development Corporation? How are they paid?

-

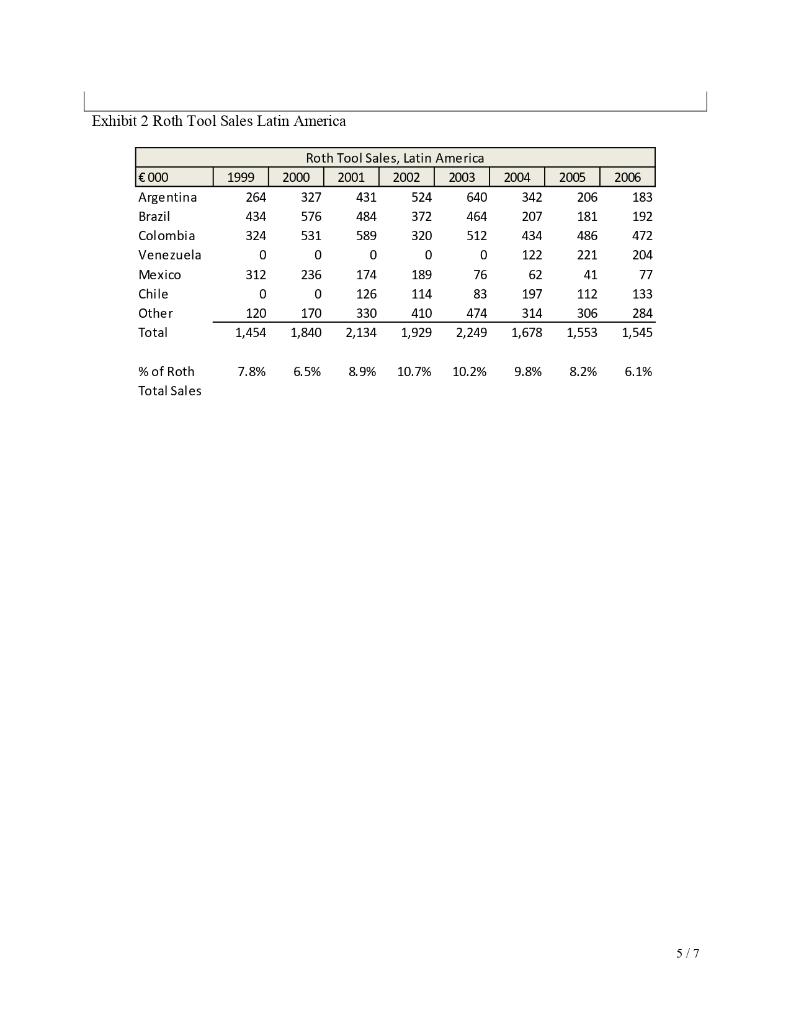

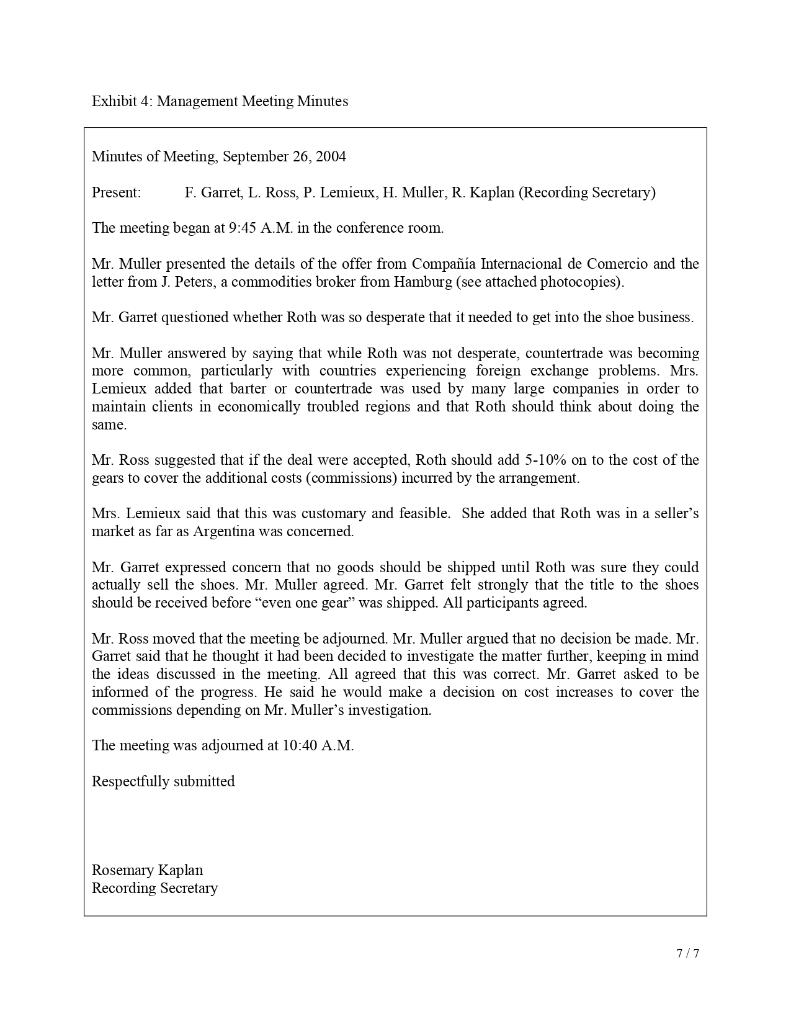

Given Mr. Garrets statements as reported in the minutes, what would you say is his position

at Roth? What is his attitude to the deal?

-

Is there something missing in the analysis? If Roth signs with Overseas Development

Corporation, who has the deal risk if the shoes do not sell?

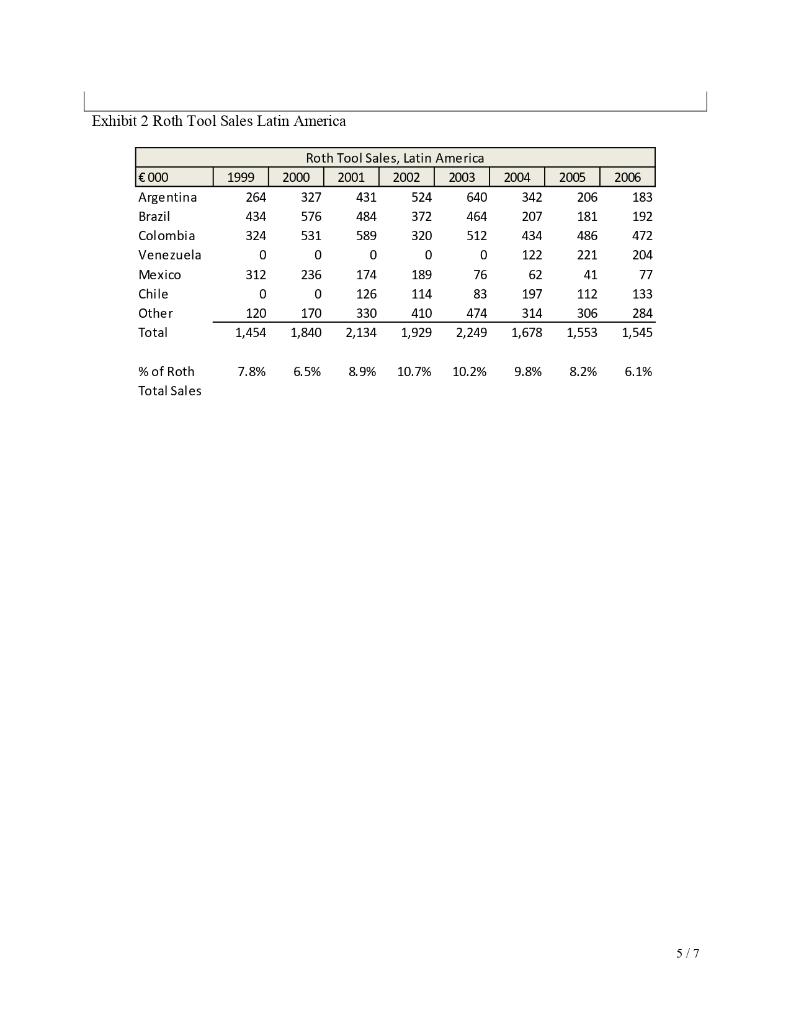

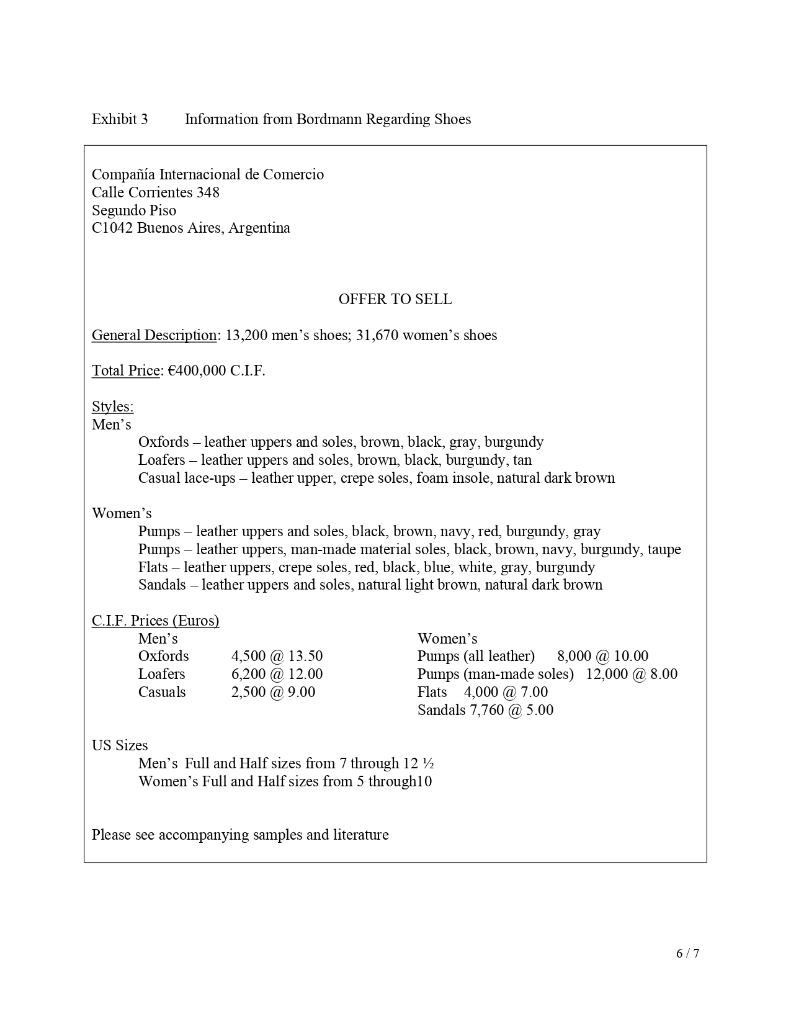

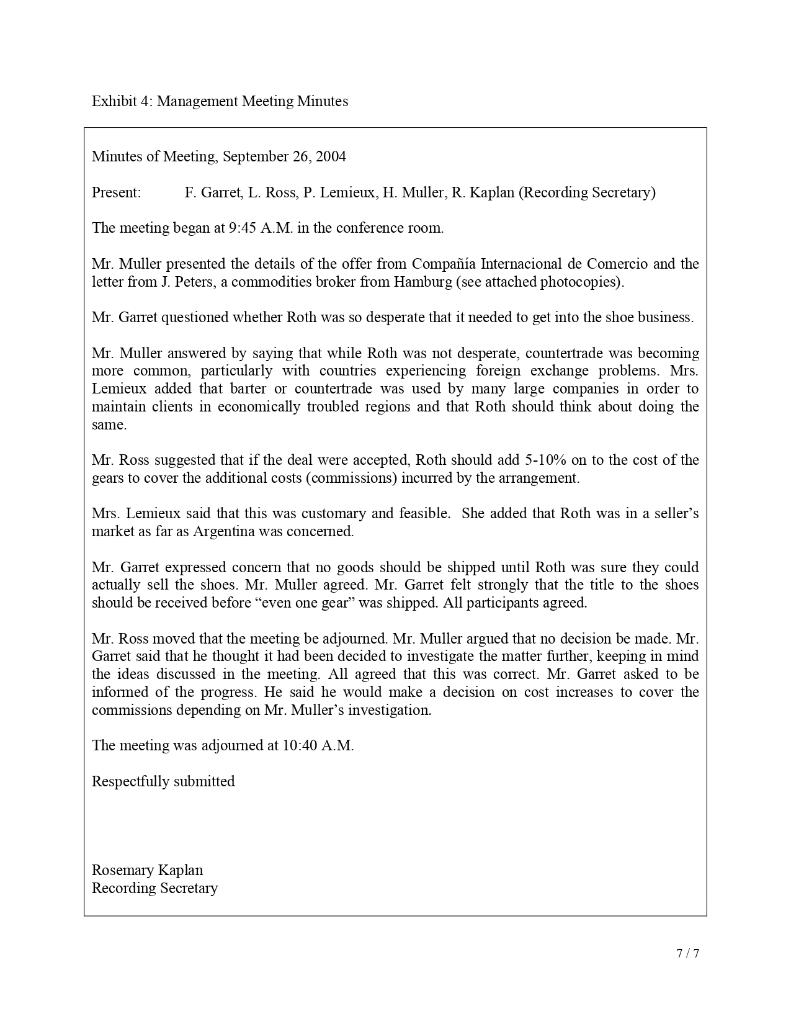

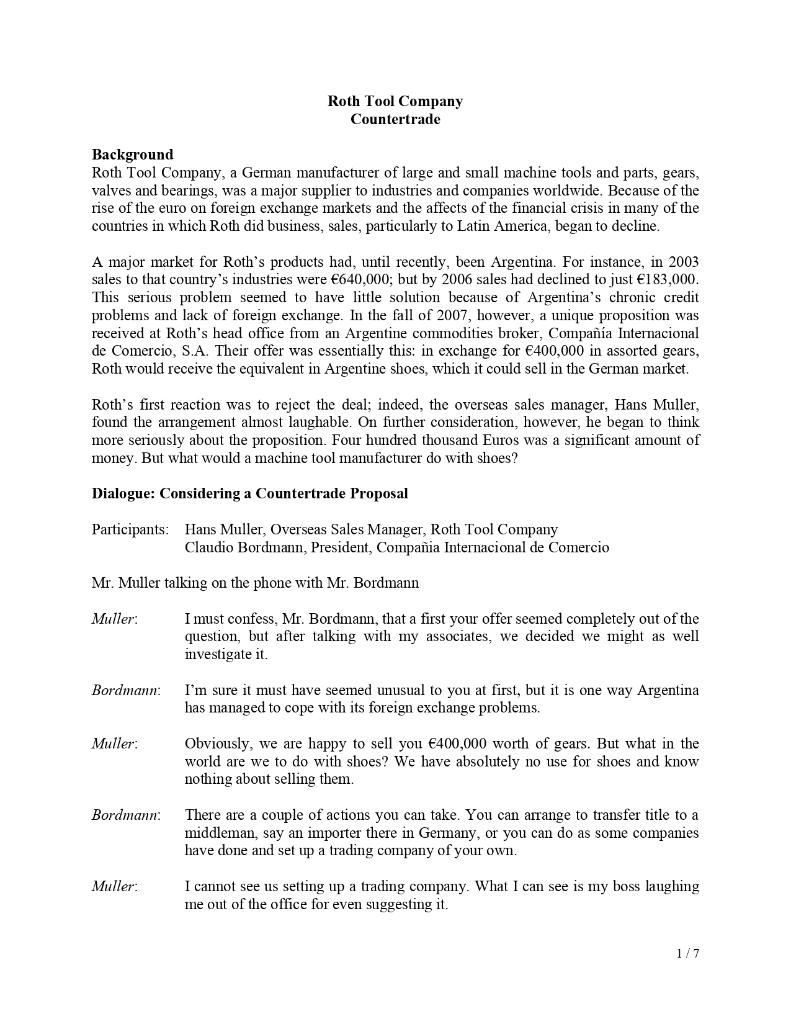

Roth Tool Company Countertrade Background Roth Tool Company, a German manufacturer of large and small machine tools and parts, gears, valves and bearings, was a major supplier to industries and companies worldwide. Because of the rise of the euro on foreign exchange markets and the affects of the financial crisis in many of the countries in which Roth did business, sales, particularly to Latin America, began to decline. A major market for Roth's products had, until recently, been Argentina. For instance, in 2003 sales to that country's industries were 640,000; but by 2006 sales had declined to just 183,000. This serious problem seemed to have little solution because of Argentina's chronic credit problems and lack of foreign exchange. In the fall of 2007, however, a unique proposition was received at Roth's head office from an Argentine commodities broker, Compaa Internacional de Comercio, S.A. Their offer was essentially this: in exchange for 400,000 in assorted gears, Roth would receive the equivalent in Argentine shoes, which it could sell in the German market. Roth's first reaction was to reject the deal; indeed, the overseas sales manager, Hans Muller, found the arrangement almost laughable. On further consideration, however, he began to think more seriously about the proposition. Four hundred thousand Euros was a significant amount of money. But what would a machine tool manufacturer do with shoes? Dialogue: Considering a Countertrade Proposal Participants: Hans Muller, Overseas Sales Manager, Roth Tool Company Claudio Bordmann, President, Compaia Internacional de Comercio Mr. Muller talking on the phone with Mr. Bordmann Muller: I must confess, Mr. Bordmann, that a first your offer seemed completely out of the question, but after talking with my associates, we decided we might as well investigate it Bordmann: Muller: I'm sure it must have seemed unusual to you at first, but it is one way Argentina has managed to cope with its foreign exchange problems. Obviously, we are happy to sell you 400,000 worth of gears. But what in the world are we to do with shoes? We have absolutely no use for shoes and know nothing about selling them. Bordmann: There are a couple of actions you can take. You can arrange to transfer title to a middleman, say an importer there in Germany, or you can do as some companies have done and set up a trading company of your own. Muller I cannot see us setting up a trading company. What I can see is my boss laughing me out of the office for even suggesting it. 1/7 Bordmann: That is usually the first reaction. But a company such as yours that deals extensively in emerging markets might want to consider it. Muller: Well, that is another matter. What about this deal? How would it work? Bordmann: It is simple. You send us 400,000 in parts; we send you the title for 400,000 in shoes. When you sell the shoes, we deliver them wherever you want. That way you do not have to house them. Muller: Hmm. But suppose we cannot sell the shoes? Bordmann: That should not be a problem. They are excellent shoes and the price is extremely low. Muller: But I do not know anything about shoes! I do not know what a good shoe is or what a good price is. Bordmann: That is where the specialist comes in. If you hand the deal over to a commodities specialist, he should be able to evaluate the product and sell it. Muller: I don't know. The whole business sounds very risky. Bordmann: It's not risky. You can even make an extra profit on it. Muller: How? Bordmann: Take a small commission on the sale of the shoes, say 2-3%. Muller: Well, Mr. Bordmann, I obviously can't make a decision now. Let me talk to some commodity specialists and to my associates. Maybe if they feel we can move the shoes, we might consider it. I think, I should say, I know that Roth is going to be reluctant to ship 400,000 worth of gears without first having some assurance we will actually get paid. Do this for me - send me the specifications on the shoes - even soine samples. Also, a breakdown on what gears you want to purchase. Then we can talk some more. Bordmann: Okay, I'll get the shoes off to you right away and also a tentative order for the gears. Thank you for considering the proposal. I feel sure we can work something out. Some Points to Keep in Mind Although relatively unknown, countertrade is the exchange of goods for goods. Originally confined primarily to trading between Eastem and Western Europe in the 1980s and 1990s, the mechanism has expanded worldwide. The exchange of goods is generally concentrated between Western manufacturing countries and emerging markets. Usually the Westem country sends highly specialized items (cars, cameras, computers, machine tools) to an emerging market; a 2/7 company in the emerging market (or an intermediary representing that country) sends raw materials or semi-finished goods (shoes, bicycles, tuna) to the Westem nation. In this case, the exchange is precision gears for shoes. Roth must decide whether it is worthwhile to accept the shoes (a commodity for which it has no use) in order to increase sales in Argentina. There are certain risks involved on both sides. Unless the Argentine trading firm has a customer already lined up for the gears, it may find itself with merchandise it cannot sell. On the other hand, Roth must find a way to "unload the shoes to ensure payment for the sale. Recently a number of firms specializing in countertrade have been established. Although a few major corporations have set-up subsidiaries to market goods received through countertrade, most companies find they need to use a specialist. These specialist firms, sometimes called transit houses, are often offshoots of banks or commodity houses. Some have been highly successful, with annual profits in the millions of euros; others have quickly gone bankrupt. Many critics argue that countertrade is bad for business and commerce. But with the rise of the euro and increasing tight credit, it is obvious that countertrade is one method to maintain international trade. Decision Points Roth's declining sales to Latin America The financial risk of countertrade The precedent being established if Roth should decide to take the shoes in exchange for gears The relative importance of the Argentine market The possible financial gain versus the complications and extra work to close the countertrade deal Discussion Questions 1. Why has Roth sales to Latin America declined? 2. What percentage of sales is Latin America and what is the trend in sales? 3. Why did Muller initially find the Argentine offer almost laughable? 4. How does Bordmann try to convince Muller that a barter arrangement makes good sense? 5. By the end of the dialogue, how has Muller's position changed regarding the deal? 6. Does the information in Exhibit 3 seen complete? If not, what is missing? 7. What is the role of Overseas Development Corporation? How are they paid? 8. Given Mr. Garret's statements as reported in the minutes, what would you say is his position at Roth? What is his attitude to the deal? 9. Is there something missing in the analysis? If Roth signs with Overseas Development Corporation, who has the deal risk if the shoes do not sell? 3/7 Exhibits and Supporting Materials Exhibit 1: Letter from Overseas Development Corporation, Commodity Broker Overseas Development Corporation International Commodity Brokers Hammer Landstrae 170 20537 Hamburg, Germany Mr. Hans Muller Overseas Sales Manager Roth Tool Company Neanderstrasse 2, 40699 Erkrath, Dusseldorf, Germany September 21, 2004 Dear Mr. Muller, Thank you for your phone call on Wednesday. Today the information and samples of Argentine shoes arrived at the office by express mail. As we discussed in our conversation, we do specialize in handling countertrade consignments. After examining the offer the offer to sell and the samples, we feel we could indeed place these shoes. Additional information from the seller, however, is necessary. Specifically, we need to know the exact quantities of shoes in various sizes, widths and colors. We can either obtain this information directly from the seller, or you can contact your client. If the offer meets the general requirements of our potential buyer, we would be delighted to proceed with the arrangement. Please note that we charge a 2% commission for placing your goods. Let us know as soon as possible how you wish to proceed with obtaining the additional information. Hoping to do business with you soon. Sincerely yours, Julia Peters President 4/7 Exhibit 2 Roth Tool Sales Latin America 000 1999 264 434 324 0 312 Argentina Brazil Colombia Venezuela Mexico Chile Other Total Roth Tool Sales, Latin America 2000 2001 2002 2003 327 431 524 640 576 484 372 464 531 589 320 512 0 0 0 0 236 174 189 76 0 126 114 83 170 330 410 474 1.840 2,134 1,929 2,249 2004 342 207 434 122 2005 206 181 486 221 41 112 306 1,553 2006 183 192 472 204 77 133 284 1,545 62 0 120 1,454 197 314 1,678 7.8% 6.5% 8.9% 10.7% 10.2% 9.8% 8.2% 6.1% % of Roth Total Sales 5/7 Exhibit 3 Information from Bordmann Regarding Shoes Compaa Internacional de Comercio Calle Corrientes 348 Segundo Piso C1042 Buenos Aires, Argentina OFFER TO SELL General Description: 13,200 men's shoes; 31,670 women's shoes Total Price: 400,000 C.I.F. Styles: Men's Oxfords - leather uppers and soles, brown, black, gray, burgundy Loafers - leather uppers and soles, brown, black, burgundy, tan Casual lace-ups - leather upper, crepe soles, foam insole, natural dark brown Women's Punps - leather uppers and soles, black, brown, navy, red, burgundy, gray Pumps - leather uppers, man-made material soles, black, brown, navy, burgundy, taupe Flats - leather uppers, crepe soles, red, black, blue, white, gray, burgundy Sandals - leather uppers and soles, natural light brown, natural dark brown C.I.F. Prices (Euros) Men's Oxfords Loafers Casuals 4,500 @ 13.50 6,200 @ 12.00 2,500 @ 9.00 Women's Pumps (all leather) 8,000 @ 10.00 Pumps (man-made soles) 12,000 @ 8.00 Flats 4,000 @ 7.00 Sandals 7,760 @ 5.00 US Sizes Men's Full and Half sizes from 7 through 12 , Women's Full and Half sizes from 5 through10 Please see accompanying samples and literature 6/7 Exhibit 4: Management Meeting Minutes Minutes of Meeting, September 26, 2004 Present: F. Garret, L. Ross, P. Lemieux, H. Muller, R. Kaplan (Recording Secretary) The meeting began at 9:45 A.M. in the conference room. Mr. Muller presented the details of the offer from Compaa Internacional de Comercio and the letter from J. Peters, a commodities broker from Hamburg (see attached photocopies). Mr. Garret questioned whether Roth was so desperate that it needed to get into the shoe business. Mr. Muller answered by saying that while Roth was not desperate, countertrade was becoming more common, particularly with countries experiencing foreign exchange problems. Mrs. Lemieux added that barter or countertrade was used by many large companies in order to maintain clients in economically troubled regions and that Roth should think about doing the same. Mr. Ross suggested that if the deal were accepted, Roth should add 5-10% on to the cost of the gears to cover the additional costs (commissions) incurred by the arrangement. Mrs. Lemieux said that this was customary and feasible. She added that Roth was in a seller's market as far as Argentina was concemed. Mr. Garret expressed concern that no goods should be shipped until Roth was sure they could actually sell the shoes. Mr. Muller agreed. Mr. Garret felt strongly that the title to the shoes should be received before even one gear" was shipped. All participants agreed. Mr. Ross moved that the meeting be adjourned. Mr. Muller argued that no decision be made. Mr. Garret said that he thought it had been decided to investigate the matter further, keeping in mind the ideas discussed in the meeting. All agreed that this was correct. Mr. Garret asked to be informed of the progress. He said he would make a decision on cost increases to cover the commissions depending on Mr. Muller's investigation. The meeting was adjourned at 10:40 A.M. Respectfully submitted Rosemary Kaplan Recording Secretary 7/7