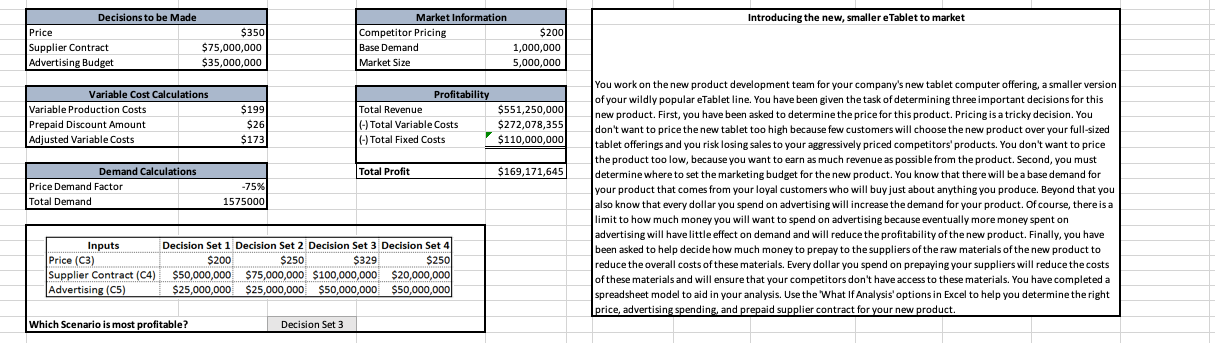

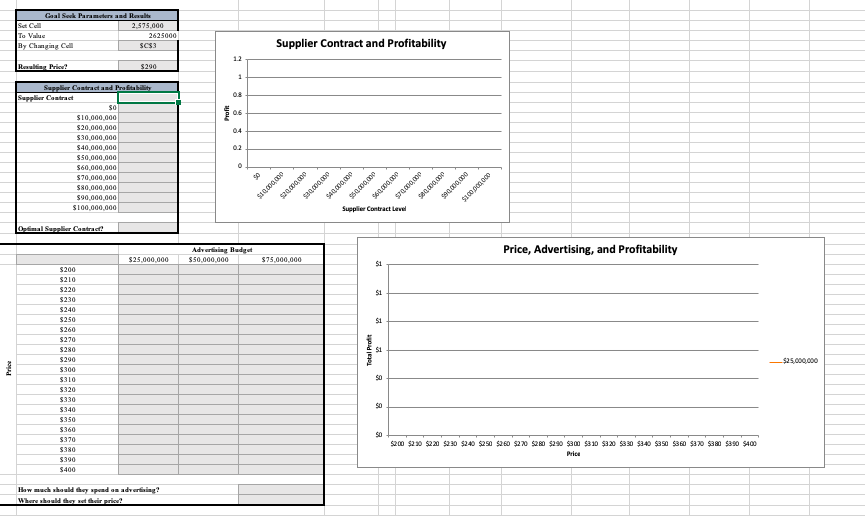

Decisions to be Made Market Information Introducing the new, smaller eTablet to market Price $350 Competitor Pricing $200 Supplier Contract $75,000,000 Base Demand 1,000,000 Advertising Budget $35,000,000 Market Size 5,000,000 You work on the new product development team for your company's new tablet computer offering, a smaller version Variable Cost Calculations Profitability of your wildly popular eTablet line. You have been given the task of determining three important decisions for this Variable Production Costs $195 Total Revenue $551,250,000 new product. First, you have been asked to determine the price for this product. Pricing is a tricky decision. You Prepaid Discount Amount $26 (-) Total Variable Costs $272,078,355 don't want to price the new tablet too high because few customers will choose the new product over your full-sized Adjusted Variable Costs $173 (-) Total Fixed Costs $110,000,000 tablet offerings and you risk losing sales to your aggressively priced competitors' products. You don't want to price the product too low, because you want to earn as much revenue as possible from the product. Second, you must Demand Calculations Total Profit $169,171,645 determine where to set the marketing budget for the new product. You know that there will be a base demand for Price Demand Factor -75% your product that comes from your loyal customers who will buy just about anything you produce. Beyond that you Total Demand 1575000 also know that every dollar you spend on advertising will increase the demand for your product. Of course, there is a limit to how much money you will want to spend on advertising because eventually more money spent on advertising will have little effect on demand and will reduce the profitability of the new product. Finally, you have Inputs Decision Set 1 Decision Set 2 Decision Set 3 Decision Set 4 been asked to help decide how much money to prepay to the suppliers of the raw materials of the new product to Price (C3) $200 $250 $329 $250 reduce the overall costs of these materials. Every dollar you spend on prepaying your suppliers will reduce the costs Supplier Contract (C4) $50,000,000 $75,000,000 $100,000,000 $20,000,000 of these materials and will ensure that your competitors don't have access to these materials. You have completed a Advertising (C5) $25,000,000 $25,000,000 $50,000,000 $50,000,000 spreadsheet model to aid in your analysis. Use the 'What If Analysis' options in Excel to help you determine the right price, advertising spending, and prepaid supplier contract for your new product. Which Scenario is most profitable? Decision Set 3Set Cell 2.575,000 To Value 2625000 By Changing Cell SC3 Supplier Contract and Profitability By Price? 5290 Suppher Contract and Profitability Supplier Contract $0 $10.060.060 $20.060.080 $40.060.080 02 $50.060.800 $60.060 080 $90.060 060 $100 Lefinal SuppEar Contract! Adverthing Budget Price, Advertising, and Profitability $25.006.060 $50.060.060 $75.000.060 $200 $210 $220 51 $230 $240 $250 $260 $270 $280 Total Prod 51 $290 -$25,00 01080 Price $300 DIES 50 $320 $330 $340 $350 $360 $370 5200 $230 $220 5230 $243 5250 5260 $270 5280 $240 $300 $310 $320 5350 $340 $350 5360 $370 $380 $350 $400 OBES Price $390 $400 How much should they spend an advertising? Where should they at their price