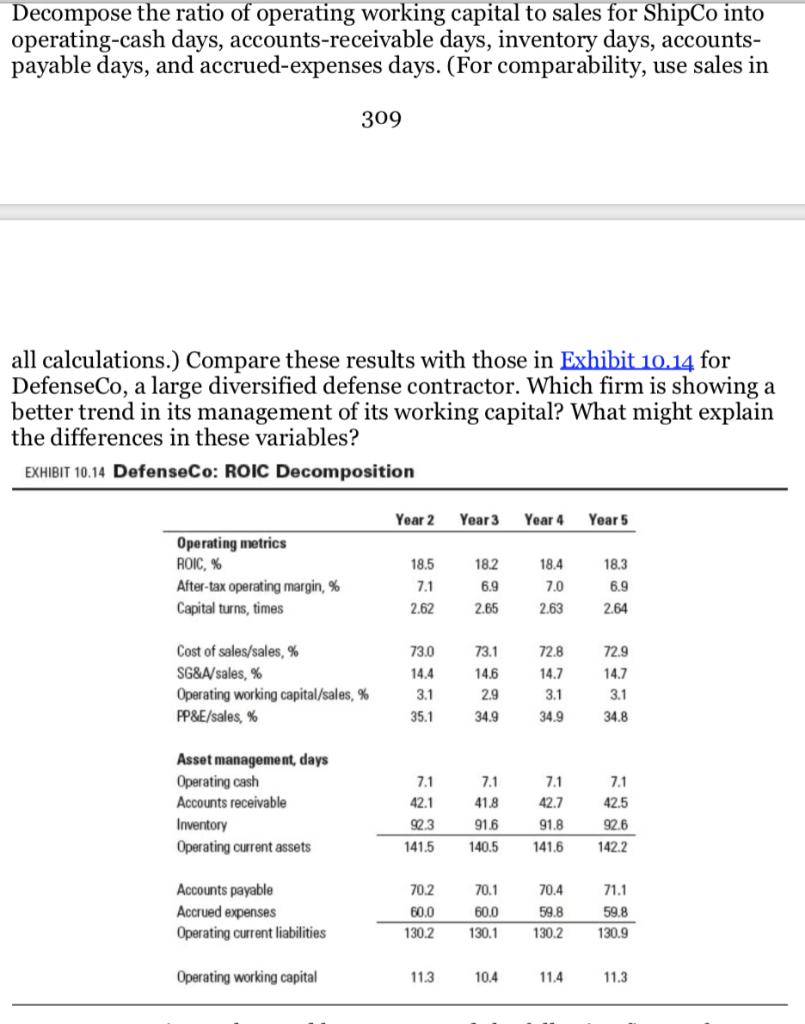

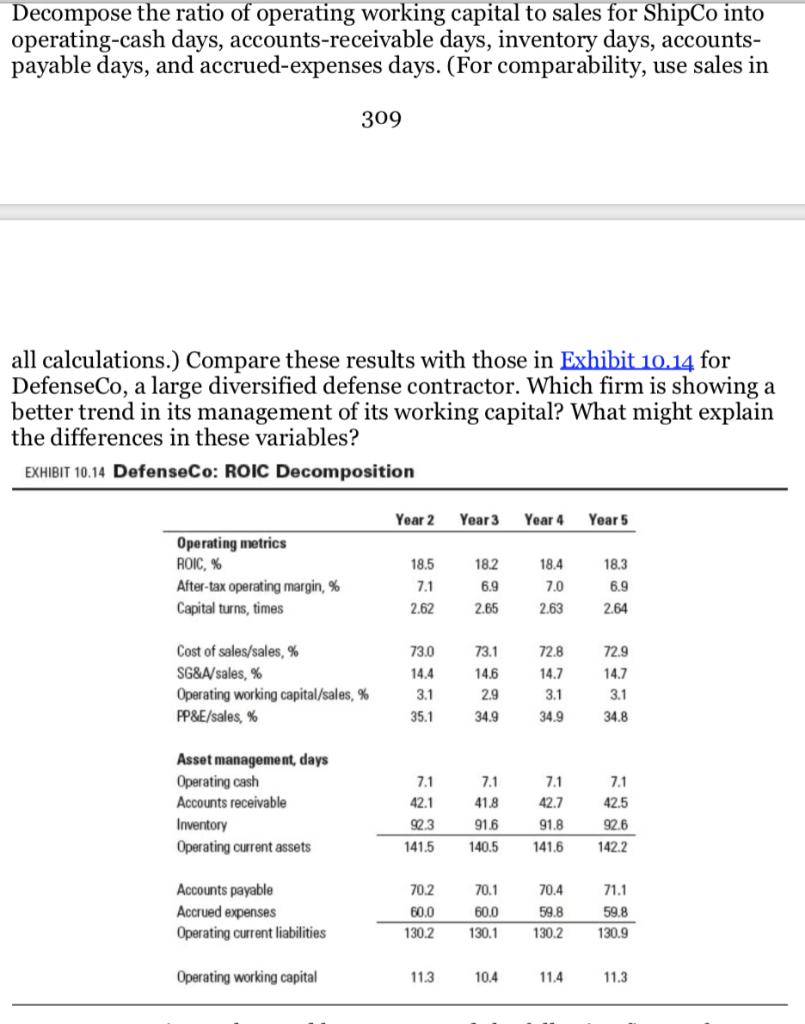

Decompose the ratio of operating working capital to sales for ShipCo into operating-cash days, accounts-receivable days, inventory days, accounts- payable days, and accrued-expenses days. (For comparability, use sales irn 309 all calculations.) Compare these results with those in Exhibit 10.14 for DefenseCo, a large diversified defense contractor. Which firm is showing a better trend in its management of its working capital? What might explain the differences in these variables? EXHIBIT 10.14 DefenseCo: ROIC Decomposition Year 2 Year3 Year 4 Year5 Operating metrics ROIC. % After-tax operating margin, % Capital turns, times 18.5 7.1 2.62 8.4 7.0 263 18.3 6.9 264 18.2 2.65 Cost of sales/sales, % SG&A/sales, % Operating working capital/sales, % PP&E/sales, % 73.0 4.4 3.1 35.1 73.1 14.6 2.9 34.9 72.8 14.7 3.1 34.9 72.9 14.7 4.8 Asset management, days Operating cash Accounts receivable Inventory Operating current assets 7.1 42.1 2.3 7.1 42.7 91.8 41.8 42.5 92.6 91.6 415 1405 146 142. Accounts payable Accrued expenses Operating current liabilities 70.2 60.0 302 130. 130 1309 70.1 600 70.4 59.8 71.1 59.8 Operating working capital 11.3 10.4 11.4 11.3 Decompose the ratio of operating working capital to sales for ShipCo into operating-cash days, accounts-receivable days, inventory days, accounts- payable days, and accrued-expenses days. (For comparability, use sales irn 309 all calculations.) Compare these results with those in Exhibit 10.14 for DefenseCo, a large diversified defense contractor. Which firm is showing a better trend in its management of its working capital? What might explain the differences in these variables? EXHIBIT 10.14 DefenseCo: ROIC Decomposition Year 2 Year3 Year 4 Year5 Operating metrics ROIC. % After-tax operating margin, % Capital turns, times 18.5 7.1 2.62 8.4 7.0 263 18.3 6.9 264 18.2 2.65 Cost of sales/sales, % SG&A/sales, % Operating working capital/sales, % PP&E/sales, % 73.0 4.4 3.1 35.1 73.1 14.6 2.9 34.9 72.8 14.7 3.1 34.9 72.9 14.7 4.8 Asset management, days Operating cash Accounts receivable Inventory Operating current assets 7.1 42.1 2.3 7.1 42.7 91.8 41.8 42.5 92.6 91.6 415 1405 146 142. Accounts payable Accrued expenses Operating current liabilities 70.2 60.0 302 130. 130 1309 70.1 600 70.4 59.8 71.1 59.8 Operating working capital 11.3 10.4 11.4 11.3