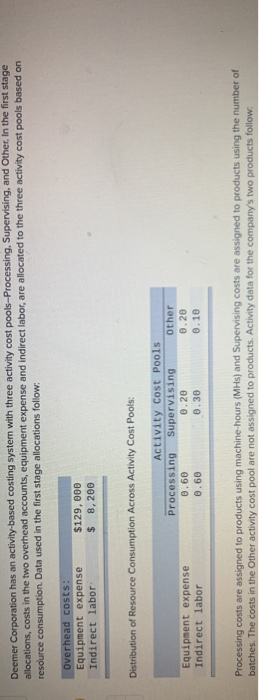

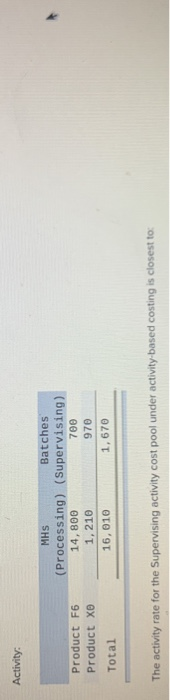

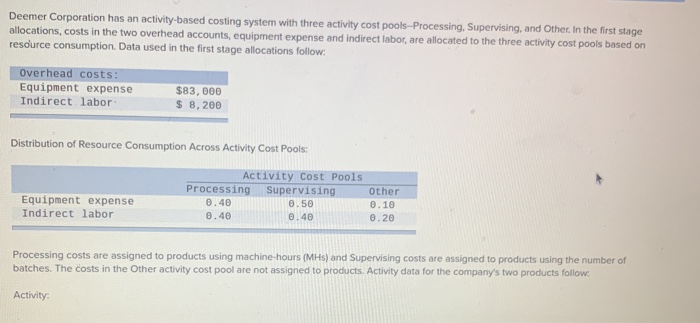

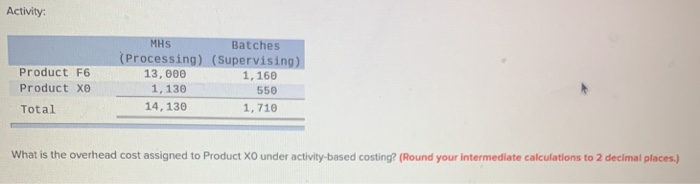

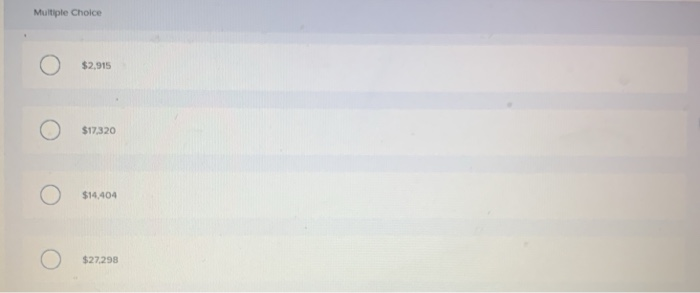

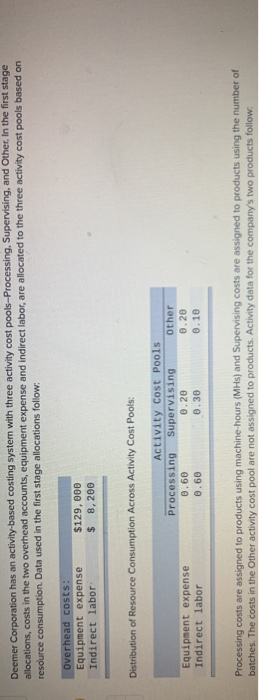

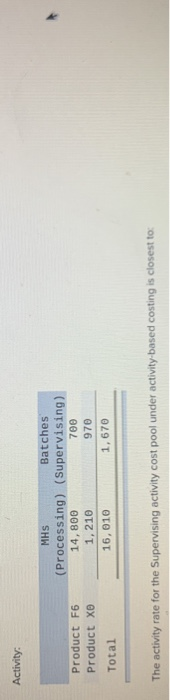

Deemer Corporation has an activity-based costing system with three activity cost pools-Processing. Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment expense Indirect labor $129,000 $ 8, 200 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Processing Supervising other Equipment expense 0.60 0.20 0.20 Indirect labor 0.60 0.30 0.10 Processing costs are assigned to products using machine hours (MHS) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow. Activity: Product F6 Product XD Total MHS Batches (Processing) (Supervising) 14,800 700 1,210 970 16,010 1,670 The activity rate for the Supervising activity cost pool under activity-based costing is closest to Multiple Choice $12.22 per batch $6.11 per batch $8216 per batch O $16.92 per batch Deemer Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment expense Indirect labor $83,000 $ 8,200 Distribution of Resource Consumption Across Activity Cost Pools: Equipment expense Indirect labor Activity Cost Pools Processing Supervising Other 0.40 0.50 0.10 0.40 0.40 0.20 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: Activity: Product F6 Product xo MHS Batches (Processing) (Supervising) 13,000 1,160 1,130 550 14, 130 1, 710 Total What is the overhead cost assigned to Product XO under activity-based costing? (Round your intermediate calculations to 2 decimal places.) Multiple Choice $2,915 $17,320 $14,404 $27.298