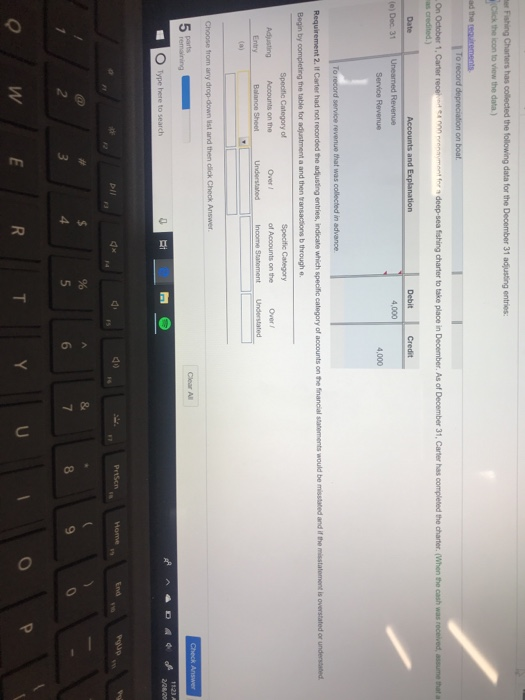

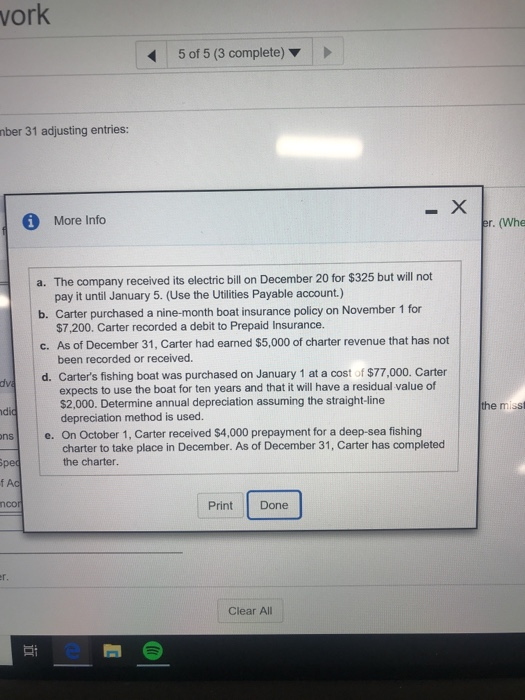

, deep-sea fishing charter to take place in December. As of December 31, Carter has completed the charter. (When the cash was Accounts and Debit Credit 4,000 4,000 Adjusting Accounts on the Over I of Accounts on the Over O Type here to search 10 End 6 2 8 oWER ork 5 of 5 (3 complete) nber 31 adjusting entries: More Info er. (Whe a. The company received its electric bill on December 20 for $325 but will not b. Carter purchased a nine-month boat insurance policy on November 1 for c. As of December 31, Carter had eaned $5,000 of charter revenue that has not d. Carter's fishing boat was purchased on January 1 at a cost of $77,000. Carter pay it until January 5. (Use the Utilities Payable account.) $7,200. Carter recorded a debit to Prepaid Insurance. been recorded or received. expects to use the boat for ten years and that it will have a residual value of $2,000. Determine annual depreciation assuming the straight-line depreciation method is used. the miss e. On October 1, Carter received $4,000 prepayment for a deep-sea fishing ns charter to take place in December. As of December 31, Carter has completed the charter. nco Print Done Clear All , deep-sea fishing charter to take place in December. As of December 31, Carter has completed the charter. (When the cash was Accounts and Debit Credit 4,000 4,000 Adjusting Accounts on the Over I of Accounts on the Over O Type here to search 10 End 6 2 8 oWER ork 5 of 5 (3 complete) nber 31 adjusting entries: More Info er. (Whe a. The company received its electric bill on December 20 for $325 but will not b. Carter purchased a nine-month boat insurance policy on November 1 for c. As of December 31, Carter had eaned $5,000 of charter revenue that has not d. Carter's fishing boat was purchased on January 1 at a cost of $77,000. Carter pay it until January 5. (Use the Utilities Payable account.) $7,200. Carter recorded a debit to Prepaid Insurance. been recorded or received. expects to use the boat for ten years and that it will have a residual value of $2,000. Determine annual depreciation assuming the straight-line depreciation method is used. the miss e. On October 1, Carter received $4,000 prepayment for a deep-sea fishing ns charter to take place in December. As of December 31, Carter has completed the charter. nco Print Done Clear All