Answered step by step

Verified Expert Solution

Question

1 Approved Answer

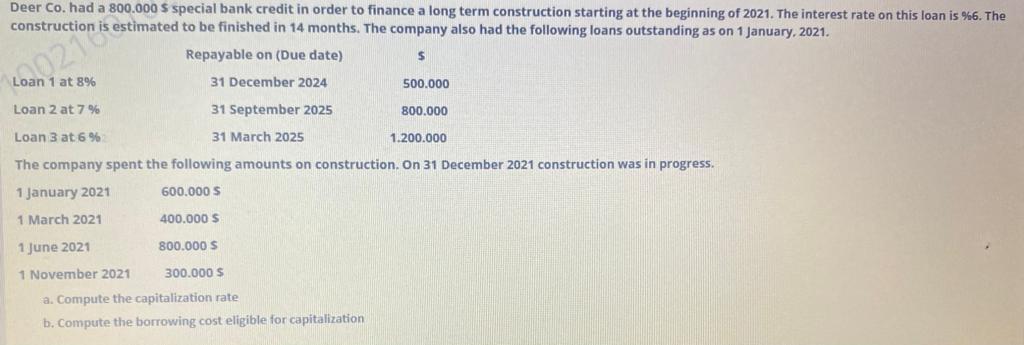

Deer Co. had a 800.000 $ special bank credit in order to finance a long term construction starting at the beginning of 2021. The

Deer Co. had a 800.000 $ special bank credit in order to finance a long term construction starting at the beginning of 2021. The interest rate on this loan is %6. The construction is estimated to be finished in 14 months. The company also had the following loans outstanding as on 1 January, 2021. Repayable on (Due date) $ 31 December 2024 Loan 21onis Loan 2 at 7% 800.000 Loan 3 at 6 % 1.200.000 The company spent the following amounts on construction. On 31 December 2021 construction was in progress. 600.000 $ 400.000 $ 800.000 $ 300.000 $ a. Compute the capitalization rate b. Compute the borrowing cost eligible for capitalization Loan 1 at 8% 1 January 2021 1 March 2021 1 June 2021 1 November 2021 31 September 2025 31 March 2025 500.000

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the capitalization rate we need to determine the weighted average interest rate of the outstanding loans Step 1 Calculate the weight of e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started