Answered step by step

Verified Expert Solution

Question

1 Approved Answer

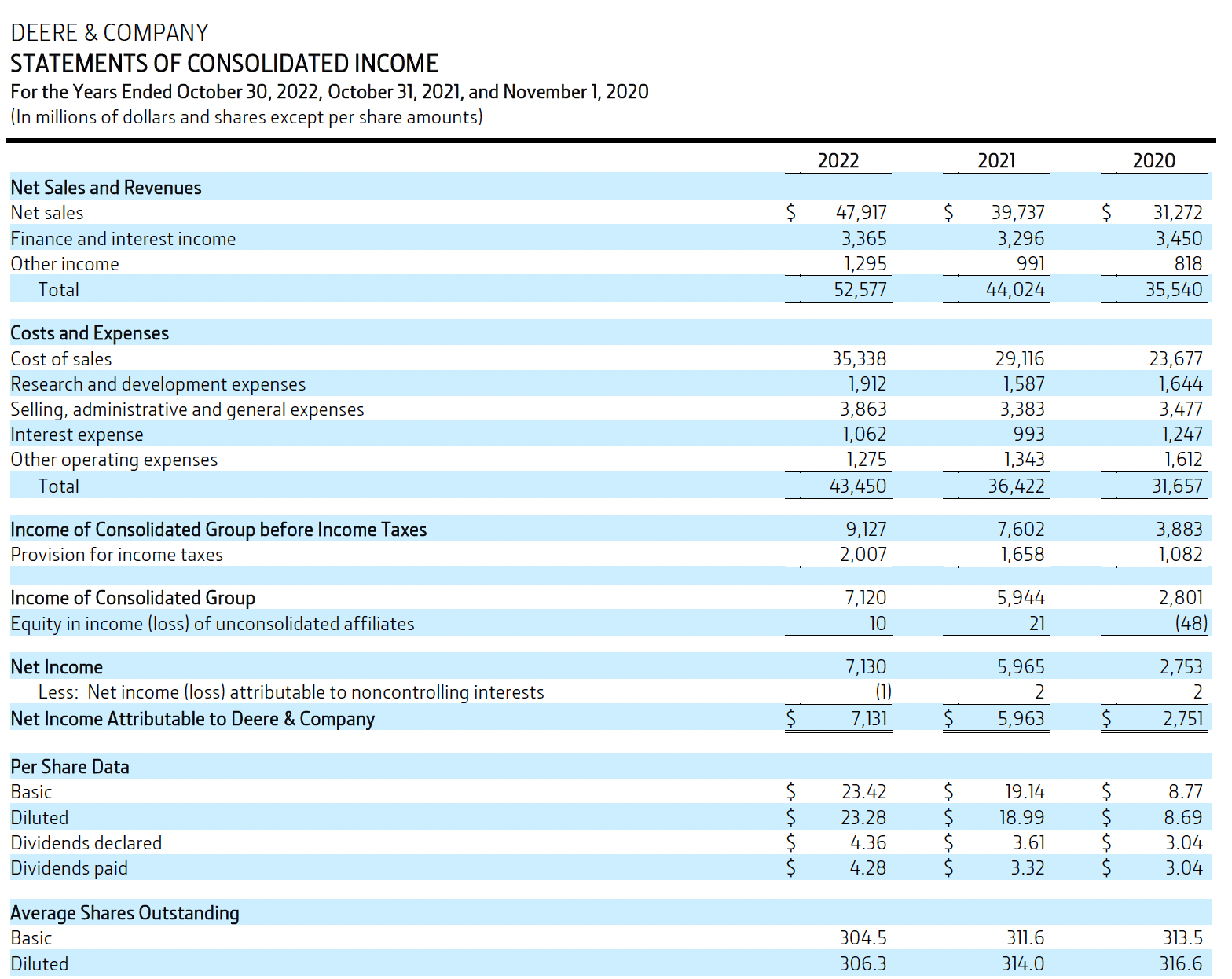

DEERE & COMPANY STATEMENTS OF CONSOLIDATED INCOME For the Years Ended October 30, 2022, October 31, 2021, and November 1, 2020 (In millions of

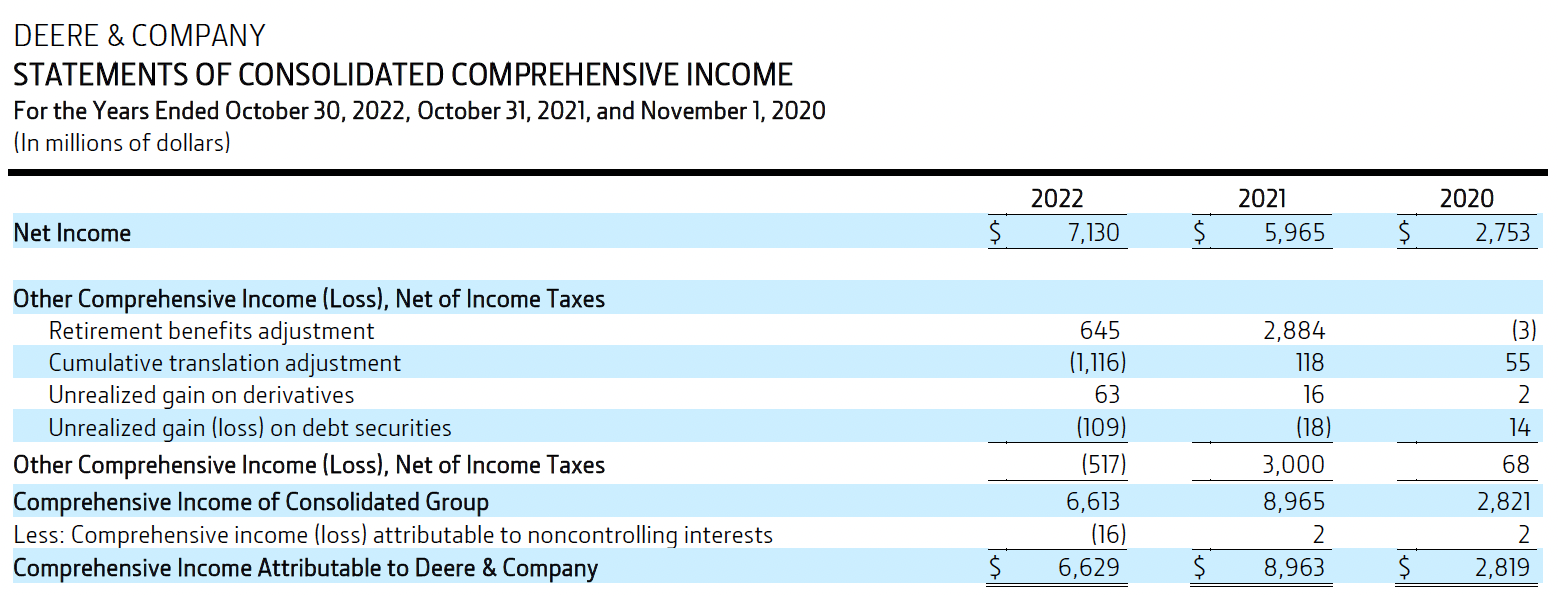

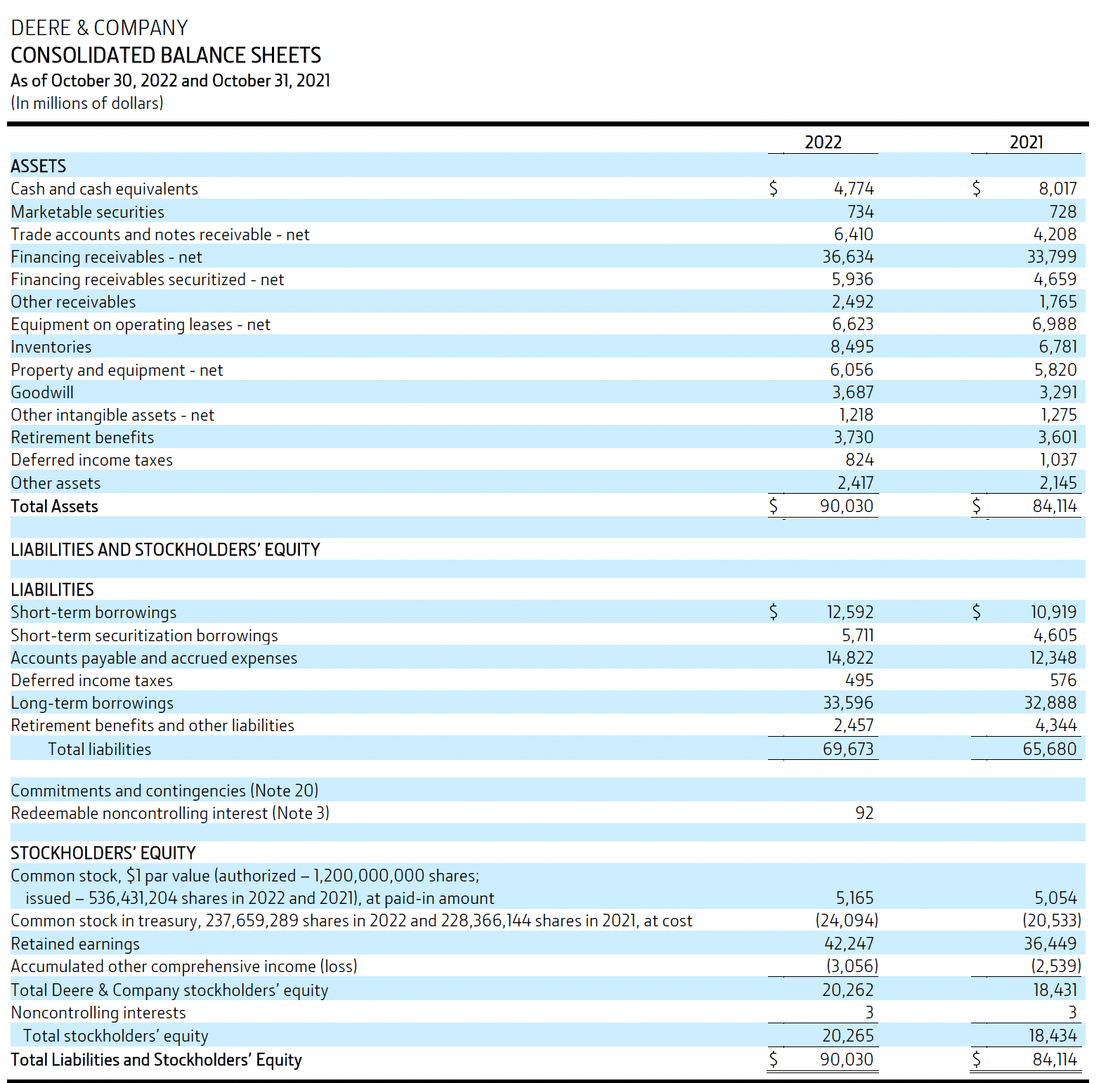

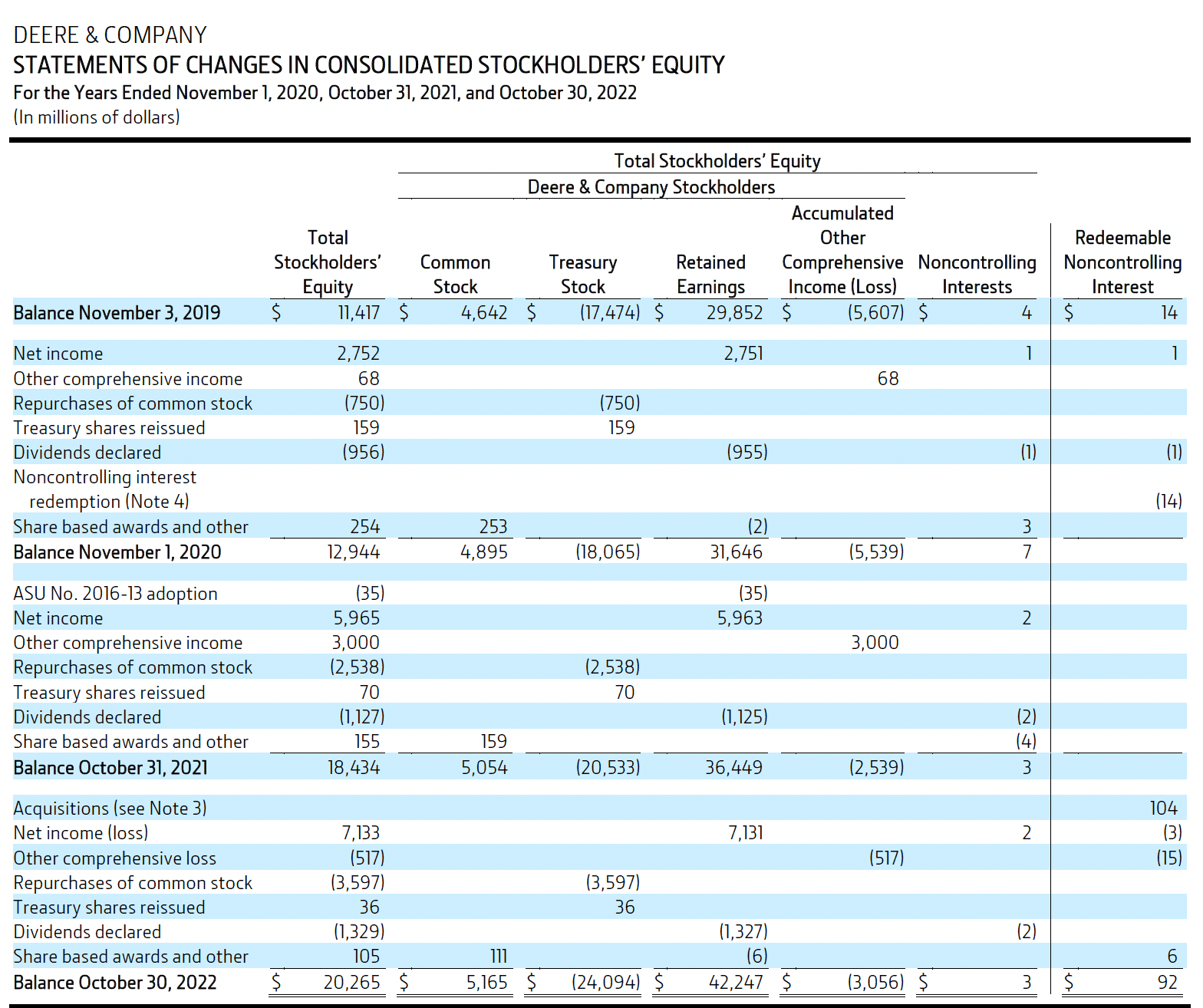

DEERE & COMPANY STATEMENTS OF CONSOLIDATED INCOME For the Years Ended October 30, 2022, October 31, 2021, and November 1, 2020 (In millions of dollars and shares except per share amounts) Net Sales and Revenues Net sales Finance and interest income Other income Total Costs and Expenses Cost of sales Research and development expenses Selling, administrative and general expenses Interest expense Other operating expenses Total Income of Consolidated Group before Income Taxes Provision for income taxes Income of Consolidated Group Equity in income (loss) of unconsolidated affiliates Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Deere & Company Per Share Data Basic Diluted Dividends declared Dividends paid Average Shares Outstanding Basic Diluted $ $ e 2022 47,917 3,365 1,295 52,577 35,338 1,912 3,863 1,062 1,275 43,450 9,127 2,007 7,120 10 7,130 (1) 7,131 23.42 23.28 4.36 4.28 304.5 306.3 $ erererer $ 2021 39,737 3,296 991 44,024 29,116 1,587 3,383 993 1,343 36,422 7,602 1,658 5,944 21 5,965 2 5,963 19.14 18.99 $ 311.6 314.0 $ erererer $ $ 3.61 $ 3.32 $ 2020 31,272 3,450 818 35,540 23,677 1,644 3,477 1,247 1,612 31,657 3,883 1,082 2,801 (48) 2,753 2 2,751 8.77 8.69 3.04 3.04 313.5 316.6 DEERE & COMPANY STATEMENTS OF CONSOLIDATED COMPREHENSIVE INCOME For the Years Ended October 30, 2022, October 31, 2021, and November 1, 2020 (In millions of dollars) Net Income Other Comprehensive Income (Loss), Net of Income Taxes Retirement benefits adjustment Cumulative translation adjustment Unrealized gain on derivatives Unrealized gain (loss) on debt securities Other Comprehensive Income (Loss), Net of Income Taxes Comprehensive Income of Consolidated Group Less: Comprehensive income (loss) attributable to noncontrolling interests Comprehensive Income Attributable to Deere & Company |es|| $ 2022 7,130 645 (1,116) 63 (109) (517) 6,613 (16) 6,629 $ 2021 5,965 2,884 118 16 (18) 3,000 8,965 2 8,963 $ 2020 2,753 (3) 55 2 14 68 2,821 2 2,819 DEERE & COMPANY CONSOLIDATED BALANCE SHEETS As of October 30, 2022 and October 31, 2021 (In millions of dollars) ASSETS Cash and cash equivalents Marketable securities Trade accounts and notes receivable - net Financing receivables - net Financing receivables securitized - net Other receivables Equipment on operating leases - net Inventories Property and equipment - net Goodwill Other intangible assets - net Retirement benefits Deferred income taxes Other assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY LIABILITIES Short-term borrowings Short-term securitization borrowings Accounts payable and accrued expenses Deferred income taxes Long-term borrowings Retirement benefits and other liabilities Total liabilities Commitments and contingencies (Note 20) Redeemable noncontrolling interest (Note 3) STOCKHOLDERS' EQUITY Common stock, $1 par value (authorized - 1,200,000,000 shares; issued - 536,431,204 shares in 2022 and 2021), at paid-in amount Common stock in treasury, 237,659,289 shares in 2022 and 228,366,144 shares in 2021, at cost Retained earnings Accumulated other comprehensive income (loss) Total Deere & Company stockholders' equity Noncontrolling interests Total stockholders' equity Total Liabilities and Stockholders' Equity n 2022 2,417 $ 90,030 $ 4,774 734 6,410 36,634 5,936 2,492 6,623 8,495 6,056 3,687 1,218 3,730 824 12,592 5,711 14,822 495 33,596 2,457 69,673 92 5,165 (24,094) 42,247 (3,056) 20,262 3 20,265 90,030 $ $ $ $ 2021 8,017 728 4,208 33,799 4,659 1,765 6,988 6,781 5,820 3,291 1,275 3,601 1,037 2,145 84,114 10,919 4,605 12,348 576 32,888 4,344 65,680 5,054 (20,533) 36,449 (2,539) 18,431 3 18,434 84,114 DEERE & COMPANY STATEMENTS OF CHANGES IN CONSOLIDATED STOCKHOLDERS' EQUITY For the Years Ended November 1, 2020, October 31, 2021, and October 30, 2022 (In millions of dollars) Balance November 3, 2019 Net income Other comprehensive income Repurchases of common stock Treasury shares reissued Dividends declared Noncontrolling interest redemption (Note 4) Share based awards and other Balance November 1, 2020 ASU No. 2016-13 adoption Net income Other comprehensive income Repurchases of common stock Treasury shares reissued Dividends declared Share based awards and other Balance October 31, 2021 Acquisitions (see Note 3) Net income (loss) Other comprehensive loss Repurchases of common stock Treasury shares reissued Dividends declared Share based awards and other Balance October 30, 2022 Total Stockholders' Equity $ 11,417 $ 2,752 68 (750) 159 (956) 254 12,944 (35) 5,965 3,000 (2,538) 70 (1,127) 155 18,434 7,133 (517) (3,597) 36 (1,329) 105 20,265 $ Common Stock 4,642 $ 253 4,895 159 5,054 Deere & Company Stockholders Total Stockholders' Equity 111 5,165 $ Treasury Stock (17,474) $ (750) 159 (18,065) (2,538) 70 (20,533) (3,597) 36 (24,094) $ Retained Earnings 29,852 2,751 (955) (2) 31,646 (35) 5,963 (1,125) 36,449 7,131 Accumulated Other Comprehensive Noncontrolling Income (Loss) Interests $ (5,607) $ (1,327) (6) 42,247 $ 68 (5,539) 3,000 (2,539) (517) (3,056) $ 4 1 e 3 7 2 2) 3 (4) 2 3 Redeemable Noncontrolling Interest $ $ 14 1 (14) 104 (3) (15) 01 6 92 1)How much was Deere's Income Tax Expense for fiscal 2022? 2)During fiscal 2022, how much cash did Deere pay for income taxes? 3)Using Deere's dividend payable account, calculate the amount of cash dividends Deere paid during fiscal 2022. 4) Deere reports Common Stock "at paid-in amount." Give your answer in millions of dollars, like the numbers in the financial statements. 5)At fiscal year-end 2022 how many shares of Deere's common stock were outstanding? Don't round your answer to millions - answer with the exact number of shares.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answers to Deere Company Financial Statements Questions 1 How much was Deeres Income Tax Expense for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started