Answered step by step

Verified Expert Solution

Question

1 Approved Answer

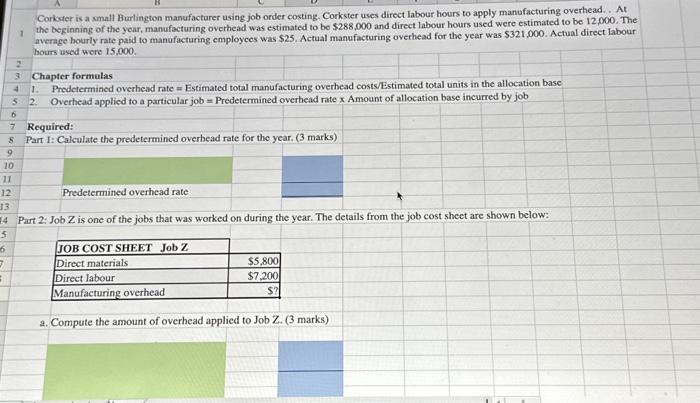

6 7 9 10 11 3 1 2 3 Chapter formulas 4 1. Predetermined overhead rate= Estimated total manufacturing overhead costs/Estimated total units in

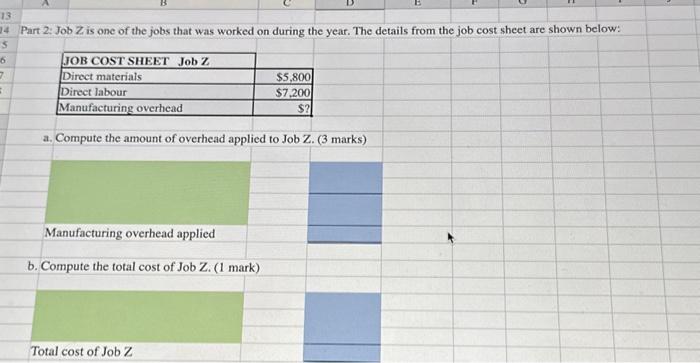

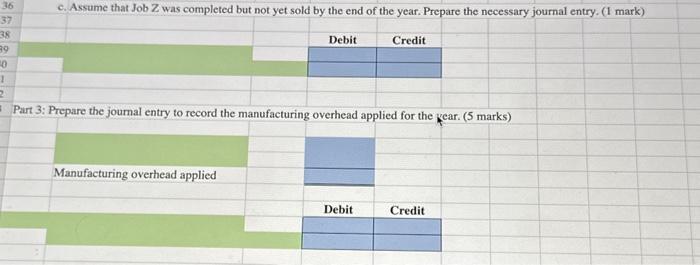

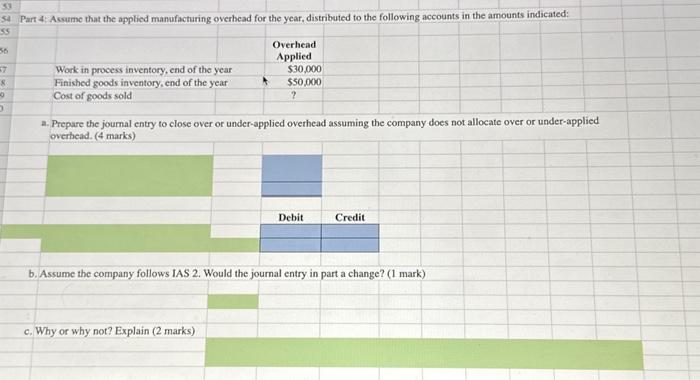

6 7 9 10 11 3 1 2 3 Chapter formulas 4 1. Predetermined overhead rate= Estimated total manufacturing overhead costs/Estimated total units in the allocation base 5 2 Overhead applied to a particular job= Predetermined overhead rate x Amount of allocation base incurred by job 6 8 Corkster is a small Burlington manufacturer using job order costing. Corkster uses direct labour hours to apply manufacturing overhead.. At the beginning of the year, manufacturing overhead was estimated to be $288,000 and direct labour hours used were estimated to be 12,000. The average hourly rate paid to manufacturing employees was $25. Actual manufacturing overhead for the year was $321,000. Actual direct labour hours used were 15,000. 7 Required: Part I: Calculate the predetermined overhead rate for the year. (3 marks) 12 Predetermined overhead rate 13 4 Part 2: Job Z is one of the jobs that was worked on during the year. The details from the job cost sheet are shown below: 5 JOB COST SHEET Job Z Direct materials Direct labour Manufacturing overhead a. Compute the amount of overhead applied to Job Z. (3 marks) $5,800 $7,200 13 24 Part 2: Job Z is one of the jobs that was worked on during the year. The details from the job cost sheet are shown below: 3. 6 7 = B JOB COST SHEET Job Z Direct materials Direct labour $5,800 $7,200 $? Manufacturing overhead a. Compute the amount of overhead applied to Job Z. (3 marks) Manufacturing overhead applied b. Compute the total cost of Job Z. (1 mark) Total cost of Job Z 36 37 38 39 10 1 2 c. Assume that Job Z was completed but not yet sold by the end of the year. Prepare the necessary journal entry. (1 mark) Credit Debit Part 3: Prepare the journal entry to record the manufacturing overhead applied for the year. (5 marks) Manufacturing overhead applied Debit Credit 33 54 Part 4: Assume that the applied manufacturing overhead for the year, distributed to the following accounts in the amounts indicated: 55 56 37 8. 0 D Work in process inventory, end of the year Finished goods inventory, end of the year Cost of goods sold Overhead Applied $30,000 $50,000 ? a. Prepare the journal entry to close over or under-applied overhead assuming the company does not allocate over or under-applied overhead. (4 marks) c. Why or why not? Explain (2 marks) Debit Credit b. Assume the company follows IAS 2. Would the journal entry in part a change? (1 mark)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the predetermined overhead rate In this case the estimated total manufacturing overhead costs are 288000 and the estimated total units in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started