Answered step by step

Verified Expert Solution

Question

1 Approved Answer

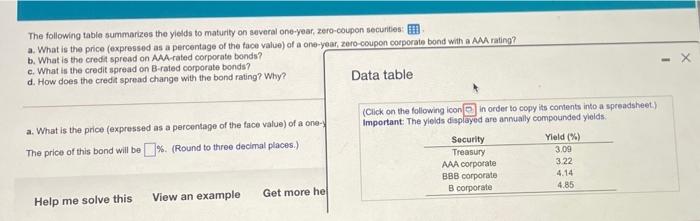

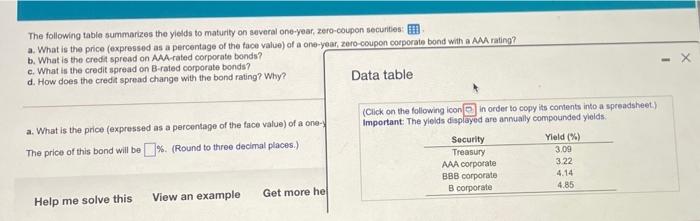

def will like if correct The following table summarizes the yields to maturity on several one-year, zero-coupon securities a. What is the price (expressed as

def will like if correct

The following table summarizes the yields to maturity on several one-year, zero-coupon securities a. What is the price (expressed as a percentage of the face value) of a one-year, 2010-coupon corporate bond with a MA rating? b. What is the credit spread on AAA rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? Data table a. What is the price (expressed as a percentage of the face value) of a one- The price of this bond will be [ % (Round to three decimal places) (Click on the following icon in order to copy its contents into a spreadsheet) Important: The yields displayed are annually compounded yields Security Yield (%) Treasury 3.09 AAA corporate 322 BBB corporate 4.14 B corporate 4.85 Help me solve this View an example Get more hel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started