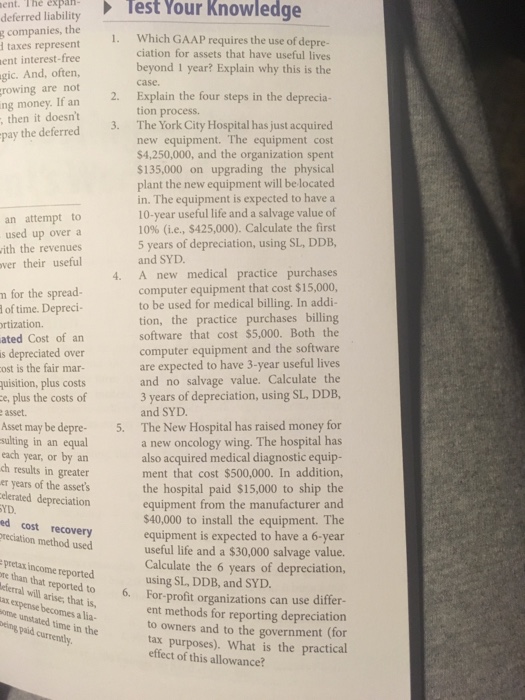

deferred iabilityTest Your Knowledge ent. The expan companies, the l taxes represent interest-free gic. And, often, are not g Which GAAP requires the use of depre- ciation for assets that have useful lives beyond 1 year? Explain why this is the case. 1. ent Ifaxplain the four steps in the deprecia- rowing tion process. The York City Hospital has just acquired new equipment. The equipment cost $4,250,000, and the organization spent $135,000 on upgrading the physical plant the new equipment will be located in. The equipment is expected to have a 10-year useful life and a salvage value of 10% (i.e., S425.000). Calculate the first 5 years of depreciation, using SL, DDB, and SYD. , then it doesn't pay the deferred 3. an attempt to used up over a ith the revenues ver their useful 4. A new medical practice purchases computer equipment that cost $15,000, to be used for medical billing. In addi- tion, the practice purchases billing software that cost $5,000. Both the computer equipment and the software are expected to have 3-year useful lives and no salvage value. Calculate the 3 years of depreciation, using SL, DDB, and SYD n for the spread- of time. Depreci rtization. ated Cost of an s depreciated over ost is the fair mar- quisition, plus costs e, plus the costs of Asset may be depre 5. The New Hospital has raised money for sulting in an equal each year, or by an ch results in greater er years of the asset's elerated depreciation a new oncology wing. The hospital has also acquired medical diagnostic equip- ment that cost $500,000. In addition, the hospital paid $15,000 to ship the equipment from the manufacturer and $40,000 to install the equipment. The equipment is expected to have a 6-year useful life and a $30,000 salvage value. Calculate the 6 years of depreciation, using SL, DDB, and SYD. For-profit organizations can use differ- ent methods for reporting depreciation to owners and to the government (for tax purposes). What is the practical effect of this allowance? YD ed cost recovery reciation method used pretax income reported re than that reported eferral will arise, that is ax expense becomes a lia- ome unstated time in the eing paid currently to 6. deferred iabilityTest Your Knowledge ent. The expan companies, the l taxes represent interest-free gic. And, often, are not g Which GAAP requires the use of depre- ciation for assets that have useful lives beyond 1 year? Explain why this is the case. 1. ent Ifaxplain the four steps in the deprecia- rowing tion process. The York City Hospital has just acquired new equipment. The equipment cost $4,250,000, and the organization spent $135,000 on upgrading the physical plant the new equipment will be located in. The equipment is expected to have a 10-year useful life and a salvage value of 10% (i.e., S425.000). Calculate the first 5 years of depreciation, using SL, DDB, and SYD. , then it doesn't pay the deferred 3. an attempt to used up over a ith the revenues ver their useful 4. A new medical practice purchases computer equipment that cost $15,000, to be used for medical billing. In addi- tion, the practice purchases billing software that cost $5,000. Both the computer equipment and the software are expected to have 3-year useful lives and no salvage value. Calculate the 3 years of depreciation, using SL, DDB, and SYD n for the spread- of time. Depreci rtization. ated Cost of an s depreciated over ost is the fair mar- quisition, plus costs e, plus the costs of Asset may be depre 5. The New Hospital has raised money for sulting in an equal each year, or by an ch results in greater er years of the asset's elerated depreciation a new oncology wing. The hospital has also acquired medical diagnostic equip- ment that cost $500,000. In addition, the hospital paid $15,000 to ship the equipment from the manufacturer and $40,000 to install the equipment. The equipment is expected to have a 6-year useful life and a $30,000 salvage value. Calculate the 6 years of depreciation, using SL, DDB, and SYD. For-profit organizations can use differ- ent methods for reporting depreciation to owners and to the government (for tax purposes). What is the practical effect of this allowance? YD ed cost recovery reciation method used pretax income reported re than that reported eferral will arise, that is ax expense becomes a lia- ome unstated time in the eing paid currently to 6