DEFGHIJ Please help me to solve this problem, thank you so much!!!!!

I will very appreciate it!

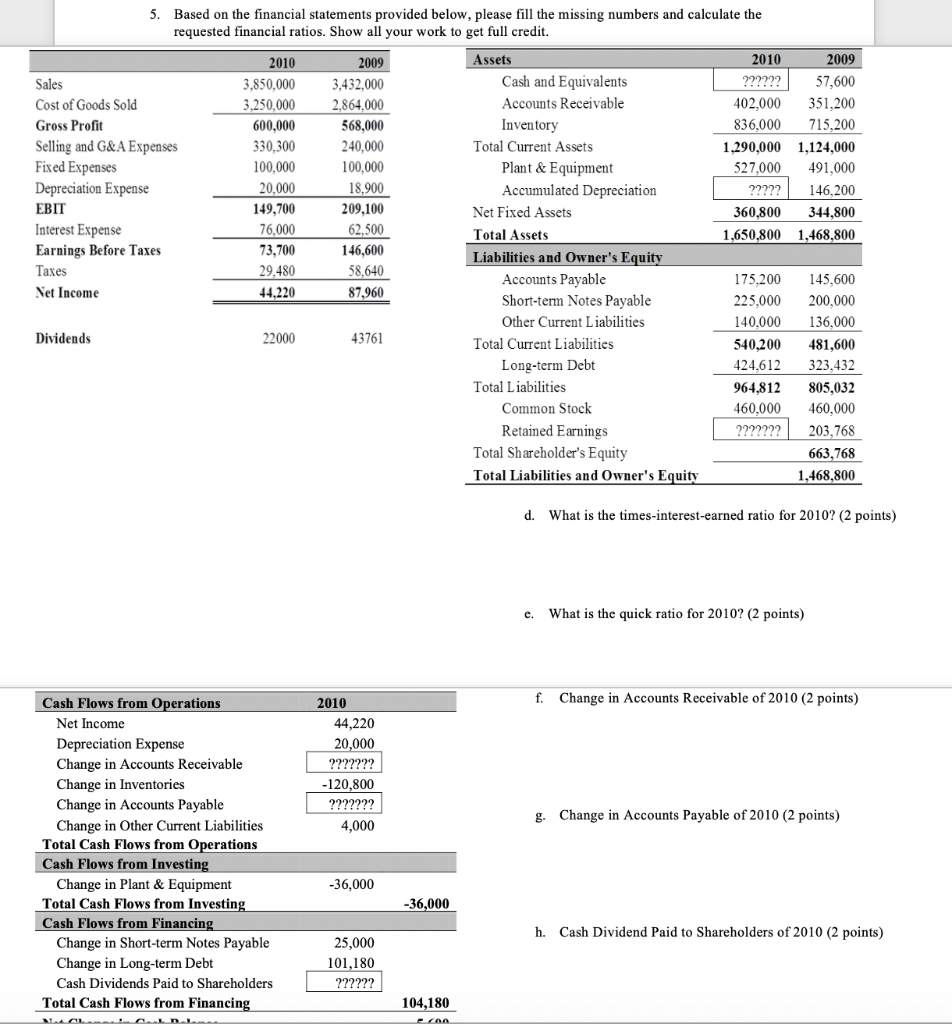

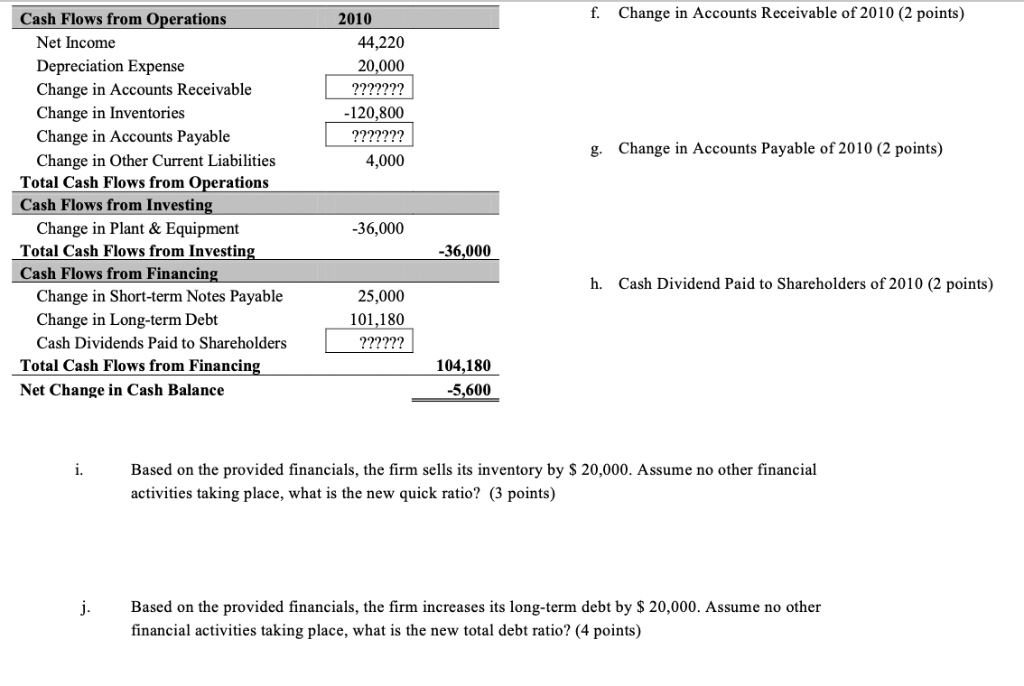

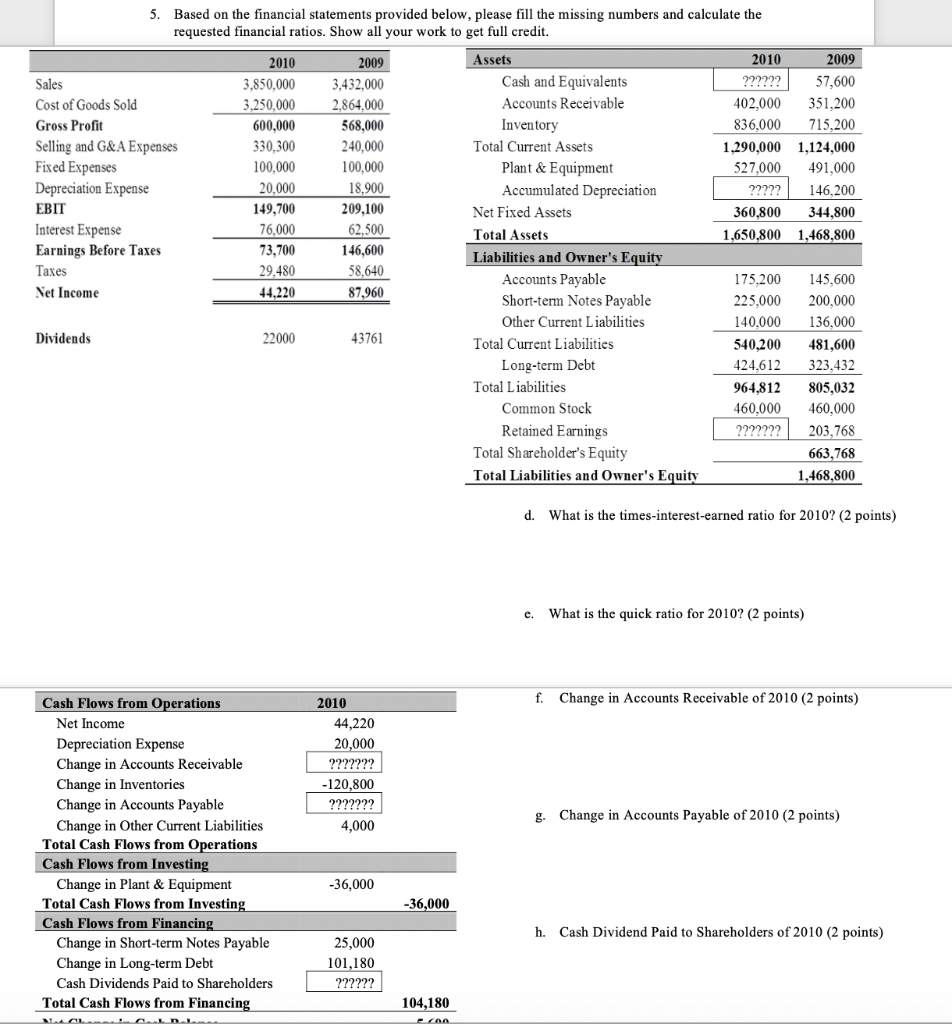

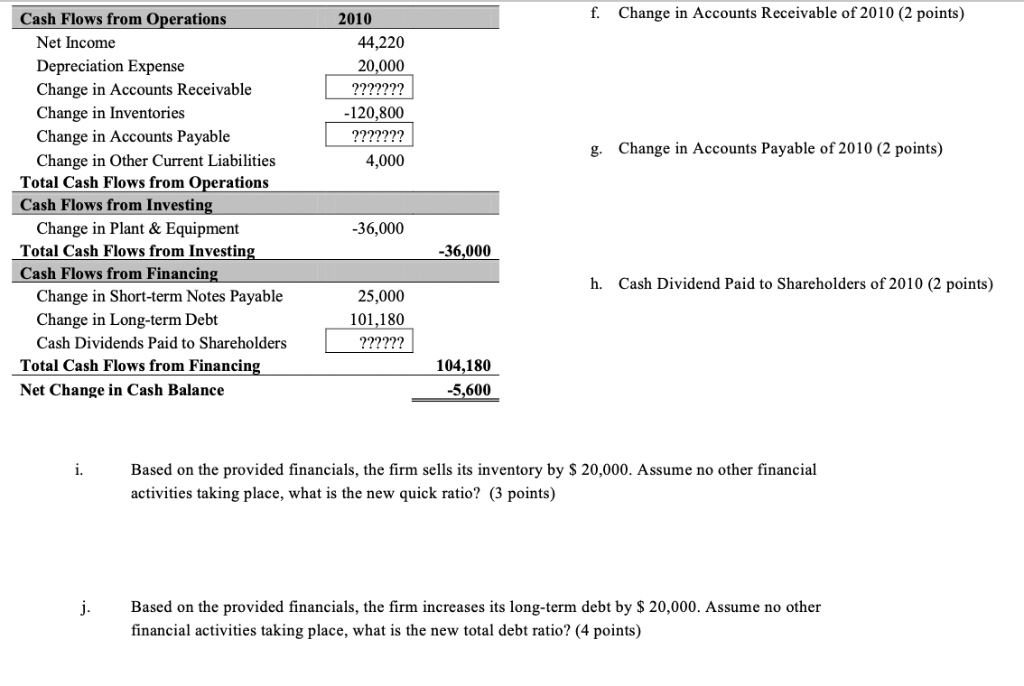

5. Based on the financial statements provided below, please fill the missing numbers and calculate the requested financial ratios. Show all your work to get full credit. Assets 2009 2010 2009 Cash and Equivalents ?????? 57,600 3,850,000 3,432,000 es Accounts Receivable 402,000 351.200 Cost of Goods Sold .250,000 2864.000 Gross 836.000 715.200 568,000 600,000 Selling and G&A Expenses Fixed Expenses Depreciation Expense 330,300 240,000 Total Current Assets 1,290,000 1,124,000 100,000 100,000 Plant & Equipment 527,000 491,00 20,000 18,900 Accumulated Depreciation ????? 146,200 209,100 Net Fixed Assets 360,800 344,800 76,000 Interest Expense Total Assets 1.650,800 1.468.800 Earnings Before Taxes Liabilities and Owner's Equit 29,480 58.640 Taxes Accounts Payable 175.200 145,600 Net Income 87,960 Short-term Notes Payable 225.000 200,000 Other Current L iabilities 40.000 136.000 22000 Dividends 43761 Total Current Liabilities 540,200 481,600 Long-term Debt 424.612323.432 Total L iabilities 964.812805,032 Common Stock 460.000 460,000 Retained Earnings ????? 203,768 Total Shareholder's Equity 663,768 Total Liabilities and Owner's Equitv 1,468,800 d. What is the times-interest-earned ratio for 2010? (2 points) What is the quick ratio for 2010? (2 points) c. f. Change in Accounts Receivable of 2010 (2 points) Cash Flows from Operations 2010 Net Income 44,220 Depreciation Expense Change in Accounts Receivable Change in Inventories Change in Accounts Payable Change in Other Current Liabilities 20,000 -120,800 Change in Accounts Payable of 2010 (2 points) g. 4,000 Total Cash Flows from Operations Cash Flows from Investin Change in Plant & Equipment 36,000 Total Cash Flows from Investin -36,000 Cash Flows from Financin h. Cash Dividend Paid to Shareholders of 2010 (2 points) Change in Short-term Notes Payable Change in Long-term Debt 25,000 101,180 Cash Dividends Paid to Shareholders 104,180 Total Cash Flows from Financin f. Change in Accounts Receivable of 2010 (2 points) Cash Flows from Operations Net Income 44,220 20,000 Depreciation Expense Change in Accounts Receivable Change in Inventories Change in Accounts Payable -120,800 Change in Accounts Payable of 2010 (2 points) g. 4,000 Change in Other Current Liabilities Total Cash Flows from Operations Cash Flows from Investin Change in Plant & Equipment -36,000 Total Cash Flows from Investin -36,000 Cash Flows from Financin h. Cash Dividend Paid to Shareholders of 2010 (2 points) Change in Short-term Notes Payable Change in Long-term Debt 25,000 101,180 Cash Dividends Paid to Shareholders Total Cash Flows from Financin 104,180 5,600 Net Change in Cash Balance Based on the provided financials, the firm sells its inventory by S 20,000. Assume no other financial activities taking place, what is the new quick ratio? (3 points) j.Based on the provided financials, the firm increases its long-term debt by $ 20,000. Assume no other financial activities taking place, what is the new total debt ratio? (4 points)