Answered step by step

Verified Expert Solution

Question

1 Approved Answer

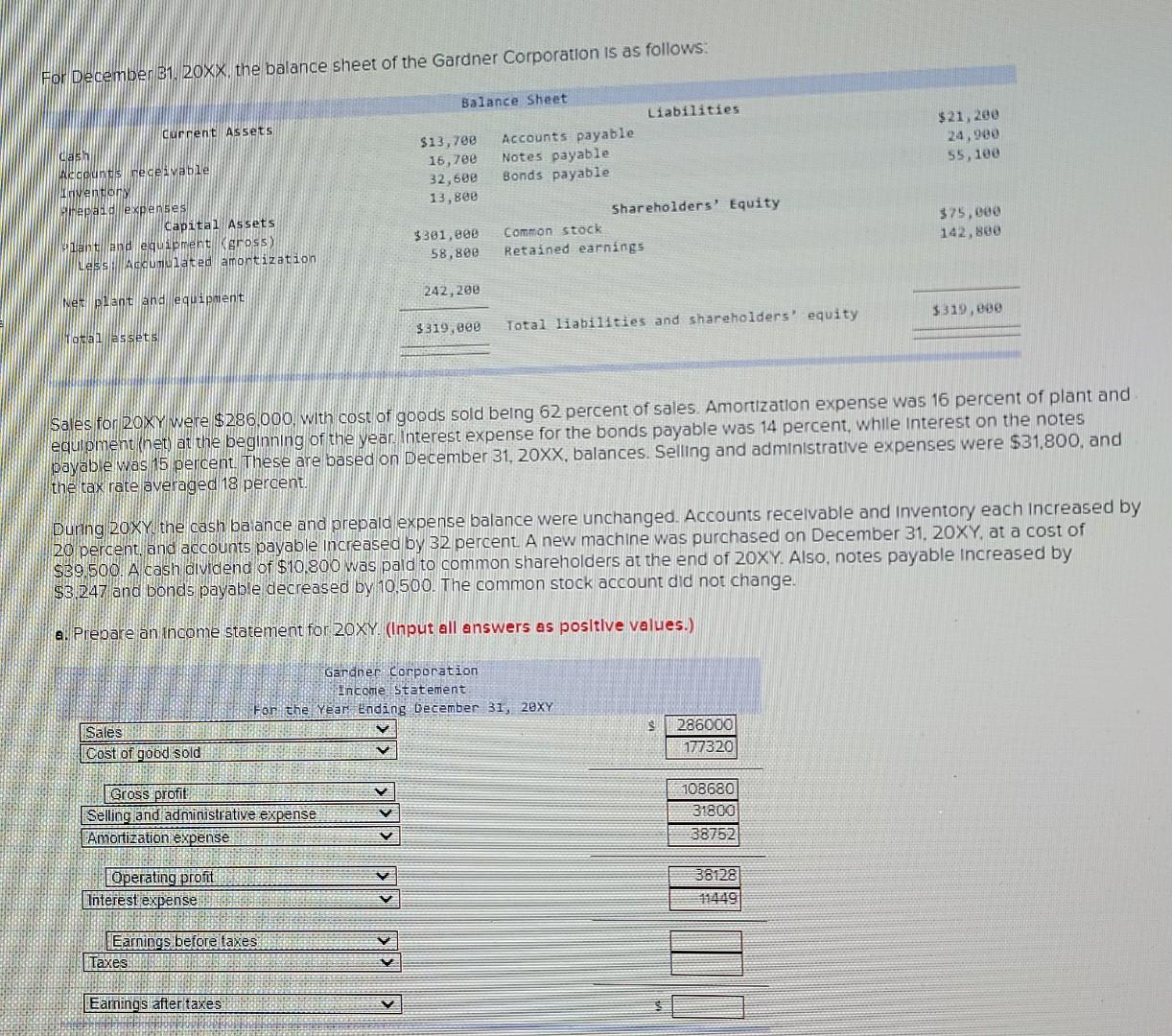

For December 31, 20XX, the balance sheet of the Gardner Corporation is as follows: Balance Sheet Liabilities current Assets $21,200 24,900 55,100 Accounts payable Notes

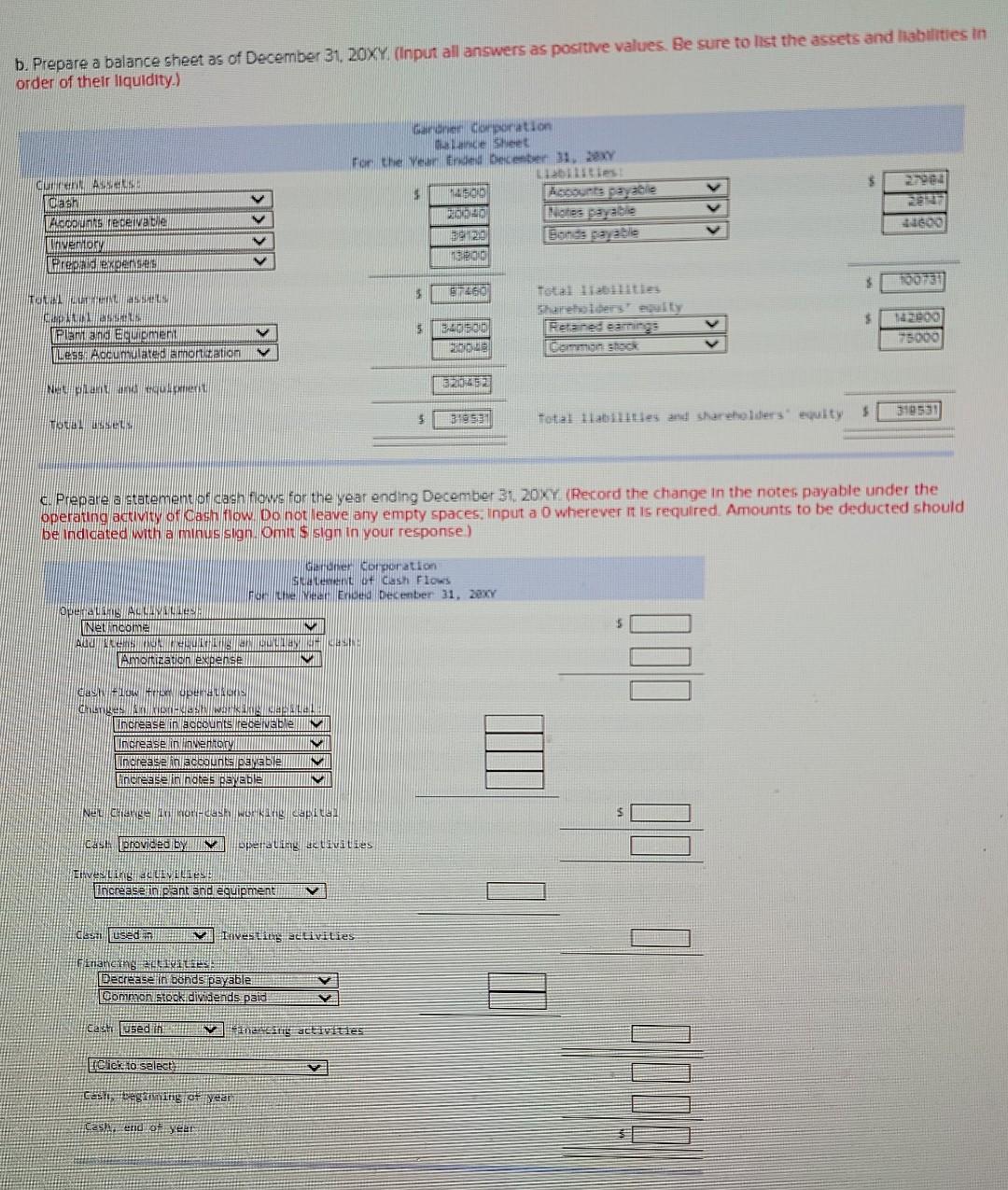

For December 31, 20XX, the balance sheet of the Gardner Corporation is as follows: Balance Sheet Liabilities current Assets $21,200 24,900 55,100 Accounts payable Notes payable Bonds payable $1,700 16,78e 32,600 13,80e counts receivable Invention Mirepaid expenses capital Assets iant and equipmenti keross) Less Accumulated amortization Shareholders' Equity Common stock Retained earnings $75,000 142,see $301,eee 58,800 242,200 Ne plant and equipment $319,000 $319,aee Total liabilities and shareholders' equity ata essets Sales for 20xy were $286.000 with cost of goods sold being 62 percent of sales Amortization expense was 16 percent of plant and equipment at the beginning of the year. Interest expense for the bonds payable was 14 percent, while interest on the notes payable was 15 percent. These are based on December 31, 20XX, balances. Selling and administrative expenses were $31,800, and the tax rate averaged 18 percent During 20XY the cash ba ance and prepaid expense balance were unchanged. Accounts receivable and Inventory each Increased by 20 percent, and accounts payable Increased by B2 percent A new machine was purchased on December 31, 20XY, at a cost of $39.500. A cash dividend of $10.800 was paid to common shareholders at the end of 20XY. Also, notes payable increased by $3 247 and bonds payable decreased by 10.500. The common stock account did not change. a. Prepare an income statement for 20XY. (Input all answers as positive values.) Gardner Corporation Income Statement For the Year Ending December 31, 20XY S Sales Cost of good sold 286000 177320 Gross profit Selling and administrative expense Amortization pense 108680 31800 38752 Operating profit Interest expense 38128 11449 Earnings before faxes Taxes Earnings after taxes b. Prepare a balance sheet as of December 31, 20XY (Input all answers as positive values. Be sure to list the assets and liabilities in order of their liquidity.) 5 NA Dash TOODUDreceivable Gardner Corporation alance Sheet For the Year Ended December 31, XY 12lities S 1500 ASSOUMS Pale 2000 Notes payable 20 Bones parelle 13800 1600 Inventor Pred expense 3 100757 $ TERBO Total lalities Shareholders' esity Retained aming Termign tak 3 TWINS CRIS Pistond Eument Less Addumulated amortization 7000 5 3-40500 2000 75000 BARN denen 1325252 $ $ TOULOUSE 319581 Total Habites and shareholders' equity c. Prepare a statement of cash flows for the year ending December 31, 20XY (Record the change in the notes payable under the operating activity of cash flow Do not leave any empty spaces. Input a 0 wherever it is required. Amounts to be deducted should be indicated with a minus sign. Omit $ sign in your response ) canner Corporation Se o cash Flows Home December 31, 20xY OpenALWAVES Net income ALUAN WAS Tamortization expense V II) dan now FALLS ALTISH walik! Therease in accounts rebe Nube Increase in inventory norease in accounts payable Ancrease in nates palable IV NECRONHUUSHIWINNING CASH provided by y operaLingue tivities Evening Vilies increase in plant and equipment V used in Ieves line at Livities Financing LiviLes: Decrease in bonds payable Common stock dividends paid Casm used in Vinttg activities Click to selecte v Ces begins of yean libre cash or year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started