Question: Define and identify the components of: a. Operating cycle b. Cash conversion cycle 2. What is the impact of longer cash conversion cycles on

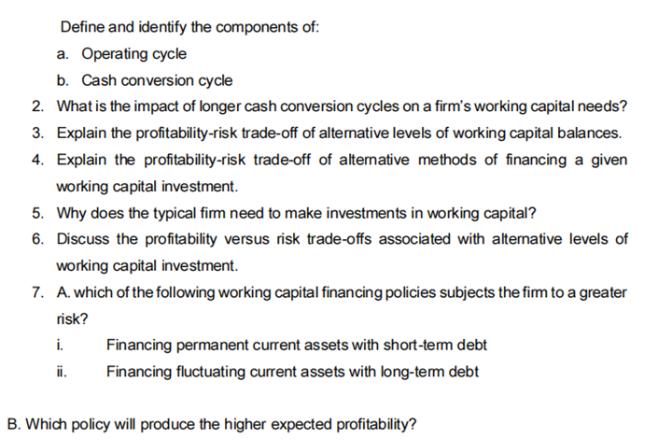

Define and identify the components of: a. Operating cycle b. Cash conversion cycle 2. What is the impact of longer cash conversion cycles on a firm's working capital needs? 3. Explain the profitability-risk trade-off of alternative levels of working capital balances. 4. Explain the profitability-risk trade-off of alternative methods of financing a given working capital investment. 5. Why does the typical firm need to make investments in working capital? 6. Discuss the profitability versus risk trade-offs associated with alternative levels of working capital investment. 7. A. which of the following working capital financing policies subjects the firm to a greater risk? i. ii. Financing permanent current assets with short-term debt Financing fluctuating current assets with long-term debt B. Which policy will produce the higher expected profitability?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

1 a Operating cycle refers to the time it takes for a firm to convert its inventory into cash It includes the following components Inventory conversion period the time it takes for a firm to convert i... View full answer

Get step-by-step solutions from verified subject matter experts