Answered step by step

Verified Expert Solution

Question

1 Approved Answer

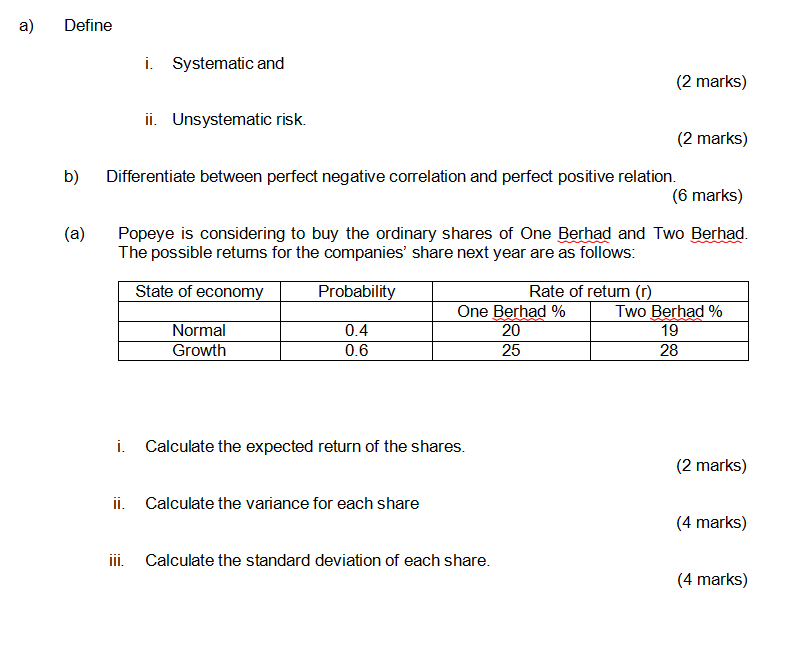

Define i. Systematic and (2 marks) ii. Unsystematic risk. (2 marks) b) Differentiate between perfect negative correlation and perfect positive relation. (6 marks) (a) Popeye

Define i. Systematic and (2 marks) ii. Unsystematic risk. (2 marks) b) Differentiate between perfect negative correlation and perfect positive relation. (6 marks) (a) Popeye is considering to buy the ordinary shares of One Berhad and Two Berhad. The possible returns for the companies' share next year are as follows: i. Calculate the expected return of the shares. (2 marks) ii. Calculate the variance for each share (4 marks) iii. Calculate the standard deviation of each share

Define i. Systematic and (2 marks) ii. Unsystematic risk. (2 marks) b) Differentiate between perfect negative correlation and perfect positive relation. (6 marks) (a) Popeye is considering to buy the ordinary shares of One Berhad and Two Berhad. The possible returns for the companies' share next year are as follows: i. Calculate the expected return of the shares. (2 marks) ii. Calculate the variance for each share (4 marks) iii. Calculate the standard deviation of each share Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started