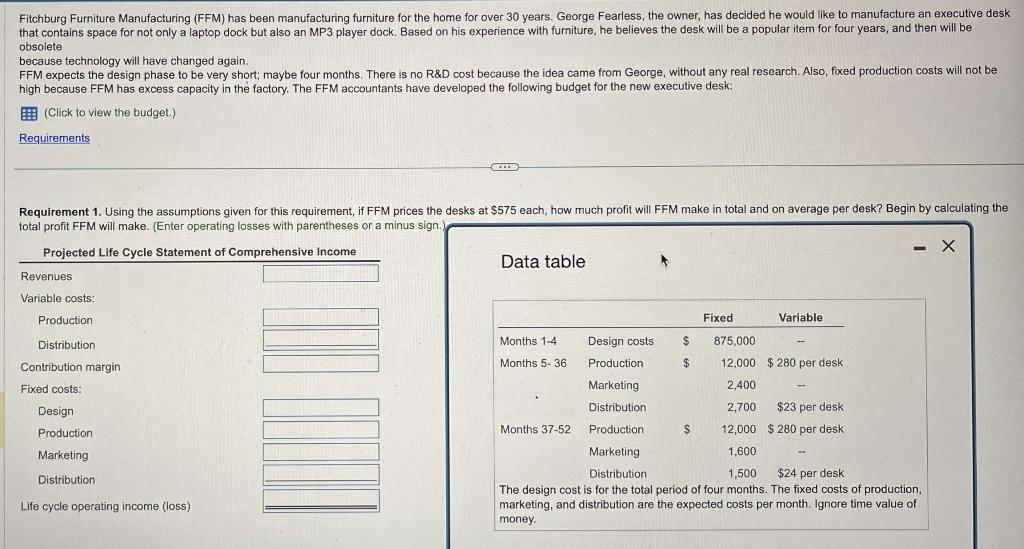

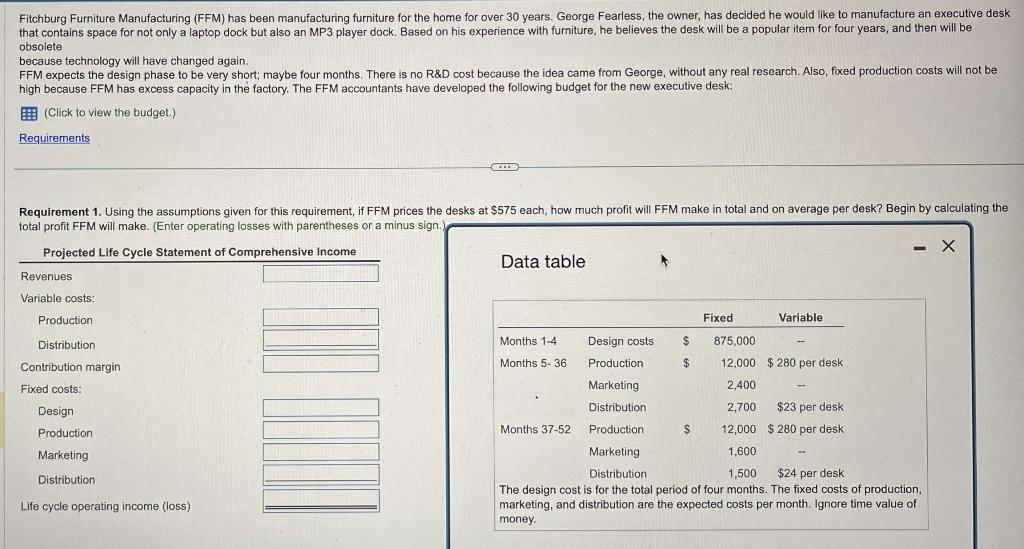

Definition 1. Assume FFM expects to make and sell 19,200 units in the first 32 months (months 5 - 36) of production (600 units per month) and 5,200 units ( 325 per month) in the last 16 months (months 3752 ) of production. If FFM prices the desks at $575 each, how much profit will FFM make in total and on otal and on average average per desk? 2. Suppose FFM is wrong about the demand for these executive desks, and after the first 36 months it stops making them altogether. It sells 19,200 desks for $475 each with the costs described for months 536, and then incurs no additional costs and generates no additional revenue. Will this have been a profitable venture for FFM? 3. Will your answer to Requirement 2 change if FFM still must incur the estimated fixed production costs for the whole period through month 52 , even if FFM stops making executive desks at the end of 36 months? Fitchburg Furniture Manufacturing (FFM) has been manufacturing furniture for the home for over 30 years. George Fearless, the owner, has decided he would like to manufacture an executive desk that contains space for not only a laptop dock but also an MP3 player dock. Based on his experience with furniture, he believes the desk will be a popular item for four years, and then will be obsolete because technology will have changed again. FFM expects the design phase to be very short; maybe four months. There is no R\&D cost because the idea came from George, without any real research. Also, fixed production costs will not be high because FFM has excess capacity in the factory. The FFM accountants have developed the following budget for the new executive desk: (Click to view the budget.) Requirement 1. Using the assumptions given for this requirement, if FFM prices the desks at $575 each, how much profit will FFM make in total and on average per desk? Begin by calculating the total profit FFM will make. (Enter operating losses with parentheses or a minus sign.) Data table I he design cost is for the total penod or tour montns. I ne tixed costs or production, marketing, and distribution are the expected costs per month. Ignore time value of money