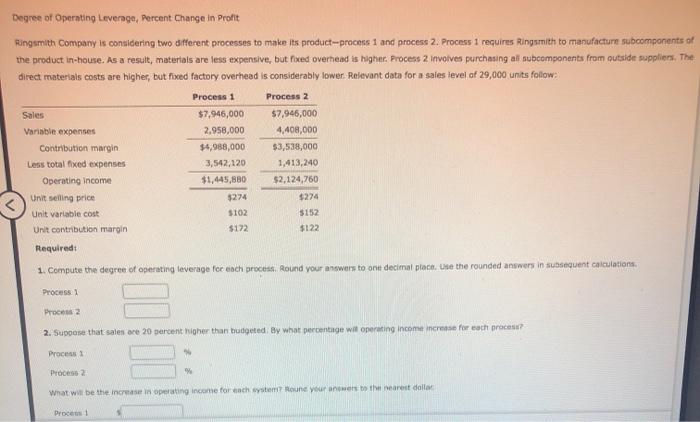

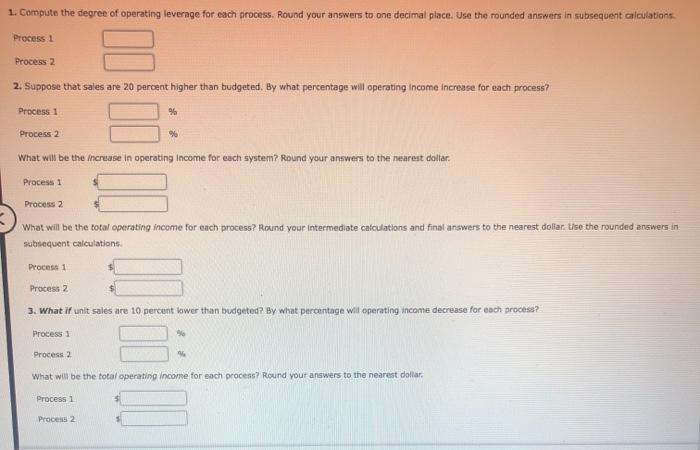

Degree of Operating Leverage, Percent Change in Profit Ringsmith Company is considering two different processes to make its product-process 1 and process 2. Process 1 requires Ringsmith to manufacture subcomponents of the product in-house. As a result, materials are less expensive, but fixed overhead is higher Process 2 involves purchasing al subcomponents from outside suppliers. The direct materials costs are higher, but fixed factory overhead is considerably lower Relevant data for a sales level of 29,000 units follow Process 1 Process 2 Sales $7,946,000 $7,946,000 Variable expenses 2,958,000 4.408,000 Contribution margin $4,988,000 $3,538,000 Less total fixed expenses 3,542,120 1,413,240 Operating Income $1,445,880 $2,124,760 Unit selling price 3274 $274 Unit variable cost $102 $152 Unit contribution margin $172 $122 Required: 1. Compute the degree of operating leverage for each process. Round your answers to one decimal place. Use the rounded answers in subsequent calculations Process 1 Process 2 2. Suppone that sales are 20 percent higher than budgeted By what percentage will operating income increase for each procesa? Process Process 2 what will be the increase in operating income for each system on your answers to the nearest dalla Droce 1 1. Compute the degree of operating leverage for each process. Round your answers to one decimal place. Use the rounded answers in subsequent calculations Process 1 Process 2 2. Suppose that sales are 20 percent higher than budgeted. By what percentage will operating income increase for each process? Process 1 % Process 2 9% What will be the increase in operating income for each system? Round your answers to the nearest dollar. Process 1 Process 2 What will be the total operating income for each process? Round your intermediate calculations and final answers to the nearest dollar tise the rounded answers in subsequent calculations Process 1 Process 2 3. What if unit sales are 10 percent lower than budgeted? By what percentage will operating income decrease for each process? Process 1 Process 2 What will be the total operating Income for each process Round your answers to the nearest dollar Process 1 Process 2