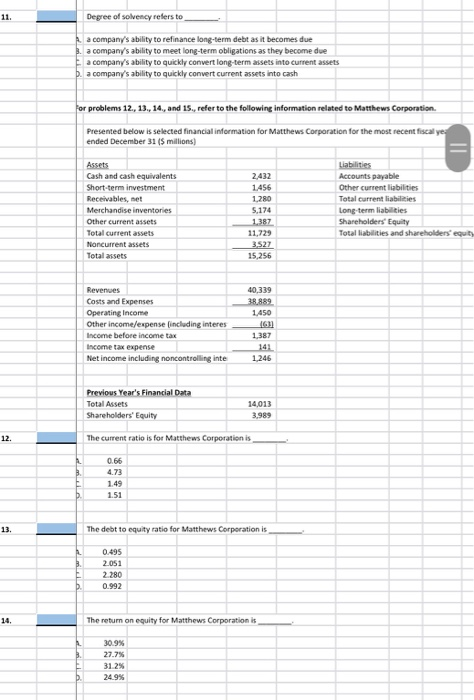

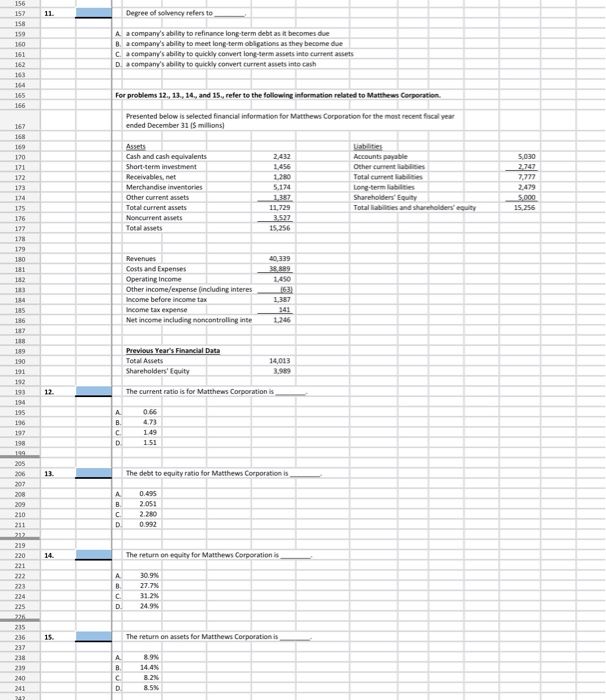

Degree of solvency refers to a company's ability to refinance long-term debt as it becomes due B. a company's ability to meet long-term obligations as they become due a company's ability to quickly convert long-term assets into current assets D. a company's ability to quickly convert current assets into cash For problems 12., 13., 14., and 15., refer to the following information related to Matthews Corporation Presented below is selected financial information for Matthews Corporation for the most recent fiscal ye ended December 31 ($ millions) 2.432 1.456 1.280 Assets Cash and cash equivalents Short-term investment Receivables, net Merchandise inventories Other current assets Total current assets Noncurrent assets Total assets Liabilities Accounts payable Other current liabilities Total current liabilities Long-term liabilities Shareholders' Equity Total liabilities and shareholders' equity 5.174 1387 11,729 3,527 15,256 40.339 38 889 1.450 Revenues Costs and Expenses Operating Income Other income/expense including interes Income before income tax Income tax expense Net income including noncontrolling inte 1187 14: 1.246 Previous Year's Financial Data Total Assets Shareholders' Equity 14.013 3.989 The current ratio is for Matthews Corporation is The debt to equity ratio for Matthews Corporation is 0.495 2.051 2 280 0.992 The return on equity for Matthews Corporation is 30.9% 27.7% 31 295 24.9% Degree of solvency refers to A a company's ability to refinance long-term debt as it becomes due a company's ability to meet long-term obligations as they become due ca company's ability to quickly convert long-term assets into current assets Da company's ability to quickly convert current assets into cash For problems 12., 13., 14., and 15., refer to the following information related to Matthews Corporation Presented below is selected financial information for Matthews Corporation for the most recent fiscal year ended December 31 millions 2.432 Accounts payable Assets Cash and cash equivalents Short-erm investim Receivables, net Merchandise inventories Other Totalcuments Long-term abilities Shareholders' Equity Total liabilities and shareholders' equity 4339 Couts and Expenses Operating Income Other income/expense including interes Income before income tax Net income including noncontrolling inte 1246 Previous Year's Financial Data Total Assets Shareholders' Equity The current ratio is for Matthews Corporation is The debt to equity ratio for Matthews Corporation 0.495 The return on equity for Matthews Corporati 30.9% 27.7% The return on assets for Matthews Corporation is 89% 14.4% 8.2