Answered step by step

Verified Expert Solution

Question

1 Approved Answer

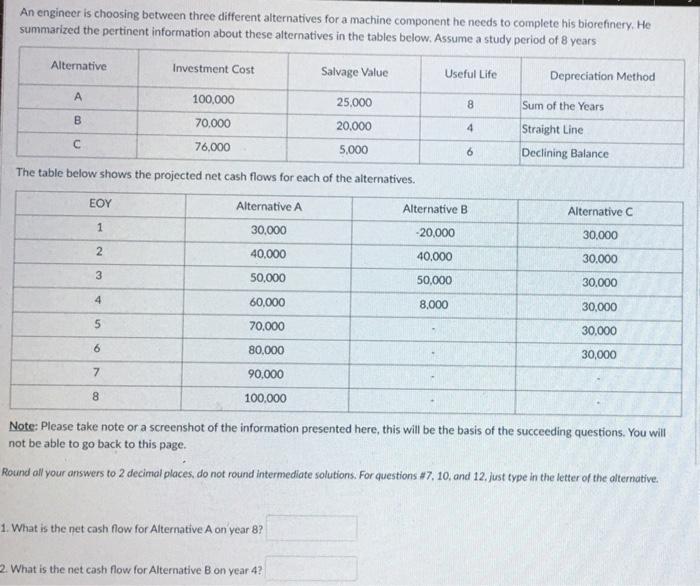

An engineer is choosing between three different alternatives for a machine component he needs to complete his biorefinery. He summarized the pertinent information about

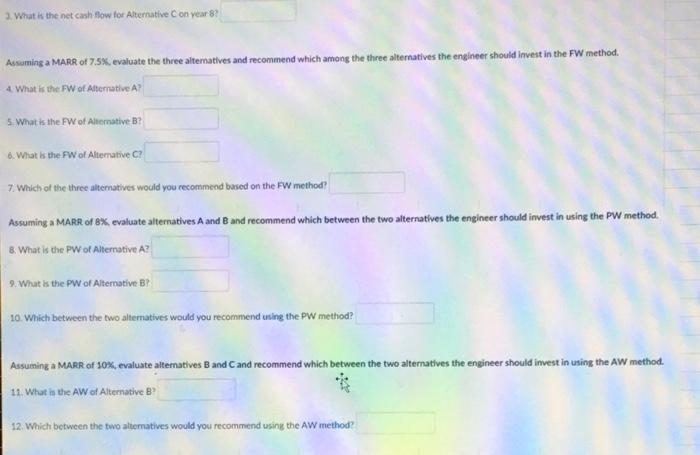

An engineer is choosing between three different alternatives for a machine component he needs to complete his biorefinery. He summarized the pertinent information about these alternatives in the tables below. Assume a study period of 8 years Alternative A B C Investment Cost 100,000 70,000 76,000 Depreciation Method Salvage Value Useful Life 25,000 8 Sum of the Years 20.000 4 Straight Line 5,000 6 Declining Balance The table below shows the projected net cash flows for each of the alternatives. EOY Alternative A Alternative B Alternative C 1 30,000 -20,000 30,000 2 40,000 40,000 30.000 3 50,000 50,000 30,000 4 60,000 8,000 30,000 5 70,000 30,000 6 80,000 30,000 7 90,000 8 100,000 Note: Please take note or a screenshot of the information presented here, this will be the basis of the succeeding questions. You will not be able to go back to this page. Round all your answers to 2 decimal places, do not round intermediate solutions. For questions #7, 10, and 12. just type in the letter of the alternative. 1. What is the net cash flow for Alternative A on year 8? 2. What is the net cash flow for Alternative B on year 4? 3. What is the net cash flow for Alternative C on year 8? Assuming a MARR of 7.5%, evaluate the three alternatives and recommend which among the three alternatives the engineer should invest in the FW method. 4. What is the FW of Alternative A? 5. What is the FW of Alternative B? 6. What is the FW of Alternative C? 7. Which of the three alternatives would you recommend based on the FW method? Assuming a MARR of 8%, evaluate alternatives A and B and recommend which between the two alternatives the engineer should invest in using the PW method. 8. What is the PW of Alternative A? 9. What is the PW of Alternative B? 10. Which between the two alternatives would you recommend using the PW method? Assuming a MARR of 10%, evaluate alternatives B and C and recommend which between the two alternatives the engineer should invest in using the AW method. 11. What is the AW of Alternative B 12. Which between the two alternatives would you recommend using the AW method?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The net cash flow for Alternative A on year 8 is 100000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started