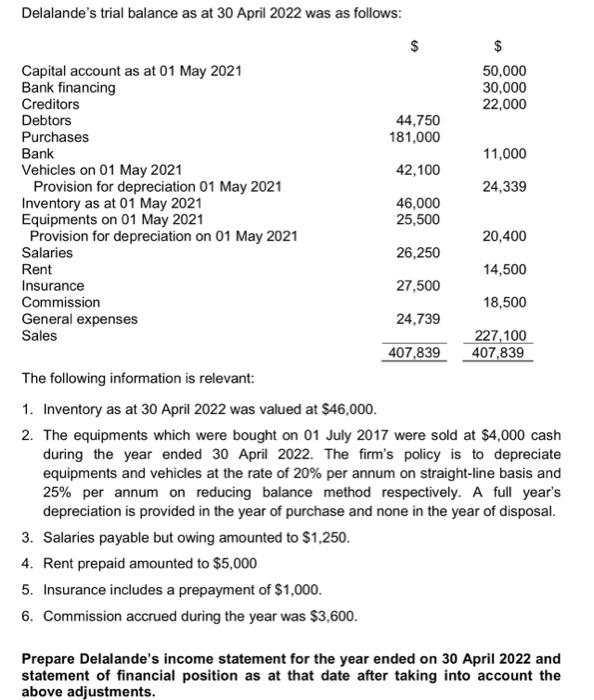

Delalande's trial balance as at 30 April 2022 was as follows: 1. Inventory as at 30 April 2022 was valued at $46,000. 2. The equipments which were bought on 01 July 2017 were sold at $4,000 cash during the year ended 30 April 2022. The firm's policy is to depreciate equipments and vehicles at the rate of 20% per annum on straight-line basis and 25% per annum on reducing balance method respectively. A full year's depreciation is provided in the year of purchase and none in the year of disposal. 3. Salaries payable but owing amounted to $1,250. 4. Rent prepaid amounted to $5,000 5. Insurance includes a prepayment of $1,000. 6. Commission accrued during the year was $3,600. Prepare Delalande's income statement for the year ended on 30 April 2022 and statement of financial position as at that date after taking into account the above adjustments. Delalande's trial balance as at 30 April 2022 was as follows: 1. Inventory as at 30 April 2022 was valued at $46,000. 2. The equipments which were bought on 01 July 2017 were sold at $4,000 cash during the year ended 30 April 2022. The firm's policy is to depreciate equipments and vehicles at the rate of 20% per annum on straight-line basis and 25% per annum on reducing balance method respectively. A full year's depreciation is provided in the year of purchase and none in the year of disposal. 3. Salaries payable but owing amounted to $1,250. 4. Rent prepaid amounted to $5,000 5. Insurance includes a prepayment of $1,000. 6. Commission accrued during the year was $3,600. Prepare Delalande's income statement for the year ended on 30 April 2022 and statement of financial position as at that date after taking into account the above adjustments. Delalande's trial balance as at 30 April 2022 was as follows: 1. Inventory as at 30 April 2022 was valued at $46,000. 2. The equipments which were bought on 01 July 2017 were sold at $4,000 cash during the year ended 30 April 2022. The firm's policy is to depreciate equipments and vehicles at the rate of 20% per annum on straight-line basis and 25% per annum on reducing balance method respectively. A full year's depreciation is provided in the year of purchase and none in the year of disposal. 3. Salaries payable but owing amounted to $1,250. 4. Rent prepaid amounted to $5,000 5. Insurance includes a prepayment of $1,000. 6. Commission accrued during the year was $3,600. Prepare Delalande's income statement for the year ended on 30 April 2022 and statement of financial position as at that date after taking into account the above adjustments. Delalande's trial balance as at 30 April 2022 was as follows: 1. Inventory as at 30 April 2022 was valued at $46,000. 2. The equipments which were bought on 01 July 2017 were sold at $4,000 cash during the year ended 30 April 2022. The firm's policy is to depreciate equipments and vehicles at the rate of 20% per annum on straight-line basis and 25% per annum on reducing balance method respectively. A full year's depreciation is provided in the year of purchase and none in the year of disposal. 3. Salaries payable but owing amounted to $1,250. 4. Rent prepaid amounted to $5,000 5. Insurance includes a prepayment of $1,000. 6. Commission accrued during the year was $3,600. Prepare Delalande's income statement for the year ended on 30 April 2022 and statement of financial position as at that date after taking into account the above adjustments