Question

Delcatty Design Company manufactures expensive brass doorknobs. It has total assets amounting to ?2,500,000 and liabilities of ?1,500,000.The fixed cost of producing and marketing the

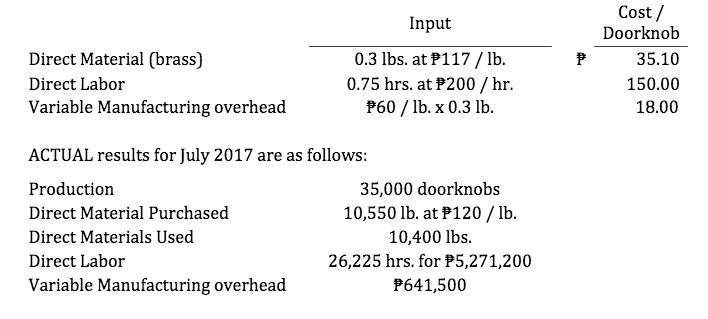

Delcatty Design Company manufactures expensive brass doorknobs. It has total assets amounting to ?2,500,000 and liabilities of ?1,500,000.The fixed cost of producing and marketing the doorknob is ?250,000. The variable costs per unit are the manufacturing costs (materials, labor, and overhead) and marketing costs of ?500 per unit. The normal selling price of a doorknob is ?2,200.After careful study of the production, it was determined that manufacturing overhead was closely related to material usage. Thus, manufacturing overhead to production is allocated based on pounds of materials used.The following are the production STANDARDS:

nDirect Material (brass)??-Input: 0.3 lbs.at ?117/ lb ?-Cost/Doorknob: ?35.10 Direct Labor??-Input: 0.75hrs.at ?200/ hr. ?-Cost/Doorknob: ?150.00Variable Manufacturing overhead??-Input: ?60 / lb.x 0.3 lb. ?-Cost/Doorknob: ?18.00ACTUAL results for July 2017 are as follows:Production: 35,000 doorknobsDirect Material Purchased: 10,550 lb.at ?120/ lb.Direct Materials Used: 10,400 lbs.Direct Labor: 26,225hrs. for ?5,271,200Variable Manufacturing overhead: ?641,500As a managerial accountant and business analyst for Delcatty, the undertakings are as follows: A.Flexible-budget variances. Ascertain whether each is favorable (F) or unfavorable (U) and recommendations for improvement.(1)Materials Price Variance?_________________ (2)Raw Materials Inventory?_________________ (3)Materials Quantity/ Usage Variance ?_________________ (4)Labor Rate Variance ?_________________ (5)Labor Efficiency Variance ?_________________ (6)Variable MOH Rate Variance ?_________________ (7)Variable MOH Efficiency Variance: ?_________________B. Analysis: For interim solutions, use 5 decimal places (d.p.)(8)________________% is the normal contribution margin percentage.(round-off to 2 d.p.)(9)________________units must be sold to break even. (10)________________units must be sold earn a profit of ?2 million (11)?_____________; _________%; ___________ units-the Margin of Safety (MoS) if 1,200 units are sold(12)________________ Degree of Operating Leverage (DOL) if 500 units are sold(round-off to 2 d.p.)(13)________________ % ROI if 500 units are sold(round-off to 2 d.p.)(14)?_______________ Unit Selling Price if the target contribution margin percentage is 75%(round-off to nearest peso)C. Special order. An order has been received from an overseas customer for 1,000 units to be delivered this month. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable marketing cost would be 20% less per unit on this order than on normal sales. Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is at a discounted price of 25% less than its normal selling price per unit. (15) By how much would this special-order increase (decrease) the company's net operating income for the month? ?_________________?

nDirect Material (brass)??-Input: 0.3 lbs.at ?117/ lb ?-Cost/Doorknob: ?35.10 Direct Labor??-Input: 0.75hrs.at ?200/ hr. ?-Cost/Doorknob: ?150.00Variable Manufacturing overhead??-Input: ?60 / lb.x 0.3 lb. ?-Cost/Doorknob: ?18.00ACTUAL results for July 2017 are as follows:Production: 35,000 doorknobsDirect Material Purchased: 10,550 lb.at ?120/ lb.Direct Materials Used: 10,400 lbs.Direct Labor: 26,225hrs. for ?5,271,200Variable Manufacturing overhead: ?641,500As a managerial accountant and business analyst for Delcatty, the undertakings are as follows: A.Flexible-budget variances. Ascertain whether each is favorable (F) or unfavorable (U) and recommendations for improvement.(1)Materials Price Variance?_________________ (2)Raw Materials Inventory?_________________ (3)Materials Quantity/ Usage Variance ?_________________ (4)Labor Rate Variance ?_________________ (5)Labor Efficiency Variance ?_________________ (6)Variable MOH Rate Variance ?_________________ (7)Variable MOH Efficiency Variance: ?_________________B. Analysis: For interim solutions, use 5 decimal places (d.p.)(8)________________% is the normal contribution margin percentage.(round-off to 2 d.p.)(9)________________units must be sold to break even. (10)________________units must be sold earn a profit of ?2 million (11)?_____________; _________%; ___________ units-the Margin of Safety (MoS) if 1,200 units are sold(12)________________ Degree of Operating Leverage (DOL) if 500 units are sold(round-off to 2 d.p.)(13)________________ % ROI if 500 units are sold(round-off to 2 d.p.)(14)?_______________ Unit Selling Price if the target contribution margin percentage is 75%(round-off to nearest peso)C. Special order. An order has been received from an overseas customer for 1,000 units to be delivered this month. This order would have no effect on the company's normal sales and would not change the total amount of the company's fixed costs. The variable marketing cost would be 20% less per unit on this order than on normal sales. Suppose there is ample idle capacity to produce the units required by the overseas customer and the special discounted price on the special order is at a discounted price of 25% less than its normal selling price per unit. (15) By how much would this special-order increase (decrease) the company's net operating income for the month? ?_________________?

Direct Material (brass) Direct Labor Variable Manufacturing overhead Input 0.3 lbs. at P117/lb. 0.75 hrs. at P200/hr. P60/lb. x 0.3 lb. ACTUAL results for July 2017 are as follows: Production Direct Material Purchased Direct Materials Used Direct Labor Variable Manufacturing overhead 35,000 doorknobs 10,550 lb. at P120/lb. 10,400 lbs. 26,225 hrs. for $5,271,200 P641,500 P Cost / Doorknob 35.10 150.00 18.00

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

A Variances 1 Materials Price Variance Actual Price Std Price Qty used 1201171040031200U 2 Raw Materials Inventory Purchased Used inven 1055010400120 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started