Question

Delia Company, a multinational company, on January 1, this year, issued a 12% coupon interest rate, 10-year bond with a $1,000 par value that

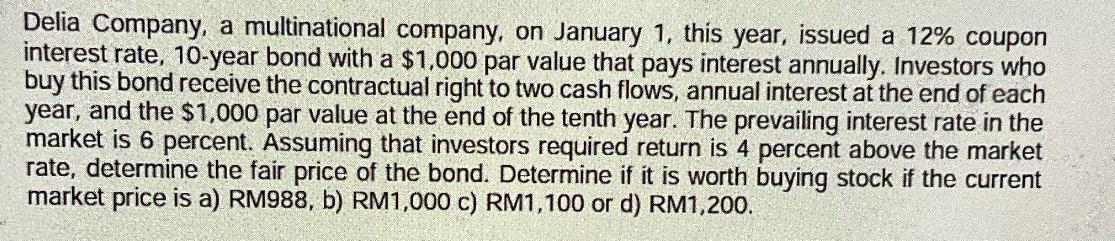

Delia Company, a multinational company, on January 1, this year, issued a 12% coupon interest rate, 10-year bond with a $1,000 par value that pays interest annually. Investors who buy this bond receive the contractual right to two cash flows, annual interest at the end of each year, and the $1,000 par value at the end of the tenth year. The prevailing interest rate in the market is 6 percent. Assuming that investors required return is 4 percent above the market rate, determine the fair price of the bond. Determine if it is worth buying stock if the current market price is a) RM988, b) RM1,000 c) RM1,100 or d) RM1,200.

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Finance

Authors: Arthur Keown, John Martin, J. Petty

10th Global Edition

1292318732, 978-1292318738

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App