Answered step by step

Verified Expert Solution

Question

1 Approved Answer

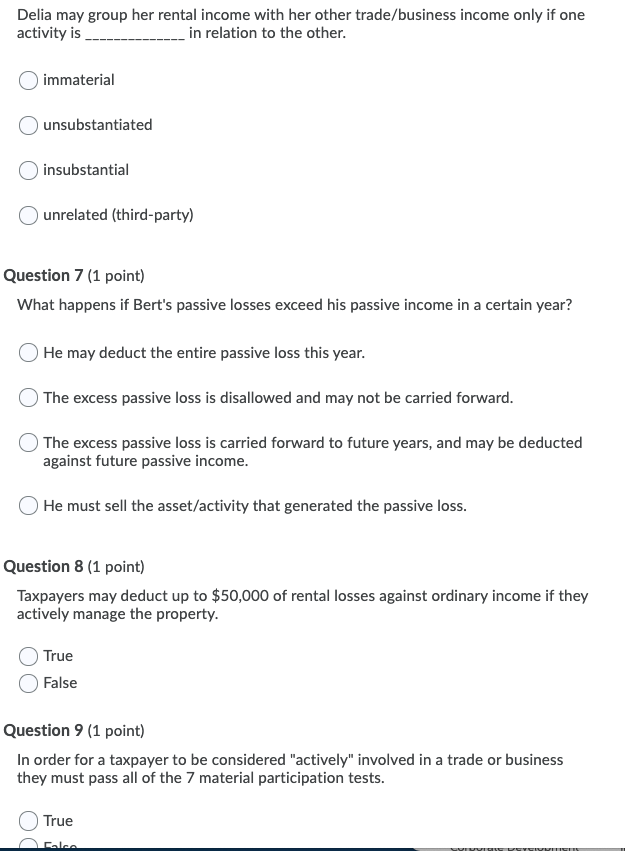

Delia may group her rental income with her other trade/business income only if one activity is in relation to the other. immaterial unsubstantiated insubstantial unrelated

Delia may group her rental income with her other trade/business income only if one activity is in relation to the other. immaterial unsubstantiated insubstantial unrelated (third-party) Question 7 (1 point) What happens if Bert's passive losses exceed his passive income in a certain year? He may deduct the entire passive loss this year. The excess passive loss is disallowed and may not be carried forward. The excess passive loss is carried forward to future years, and may be deducted against future passive income. He must sell the asset/activity that generated the passive loss. Question 8 (1 point) Taxpayers may deduct up to $50,000 of rental losses against ordinary income if they actively manage the property. True False Question 9 (1 point) In order for a taxpayer to be considered "actively involved in a trade or business they must pass all of the 7 material participation tests. True

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started