Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Deli-Delights Inc. is a U.S. company that is considering expanding its operations into Japan. The company supplies processed foods to storefront delicatessens in large

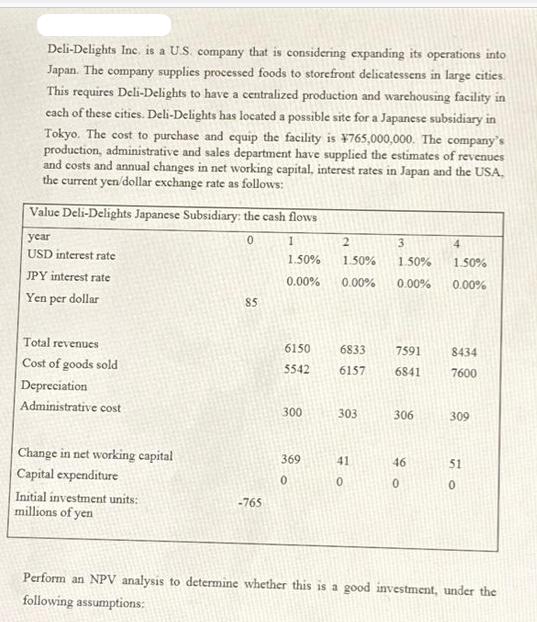

Deli-Delights Inc. is a U.S. company that is considering expanding its operations into Japan. The company supplies processed foods to storefront delicatessens in large cities. This requires Deli-Delights to have a centralized production and warehousing facility in each of these cities. Deli-Delights has located a possible site for a Japanese subsidiary in Tokyo. The cost to purchase and equip the facility is 765,000,000. The company's production, administrative and sales department have supplied the estimates of revenues and costs and annual changes in net working capital, interest rates in Japan and the USA. the current yen/dollar exchange rate as follows: Value Deli-Delights Japanese Subsidiary: the cash flows year 0 I 2 3 4 USD interest rate 1.50% 1.50% 1.50% 1.50% JPY interest rate 0.00% 0.00% 0.00% 0.00% Yen per dollar 85 Total revenues Cost of goods sold 6150 6833 7591 8434 5542 6157 6841 7600 Depreciation Administrative cost Change in net working capital Capital expenditure Initial investment units: millions of yen -765 300 300 303 306 309 369 41 46 51 0 0 0 Perform an NPV analysis to determine whether this is a good investment, under the following assumptions:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started