Question

Dell Computer Corp., founded in 1984 by Michael Dell, is a well-known success story. The strategy of selling computers directly to customers in an efficient

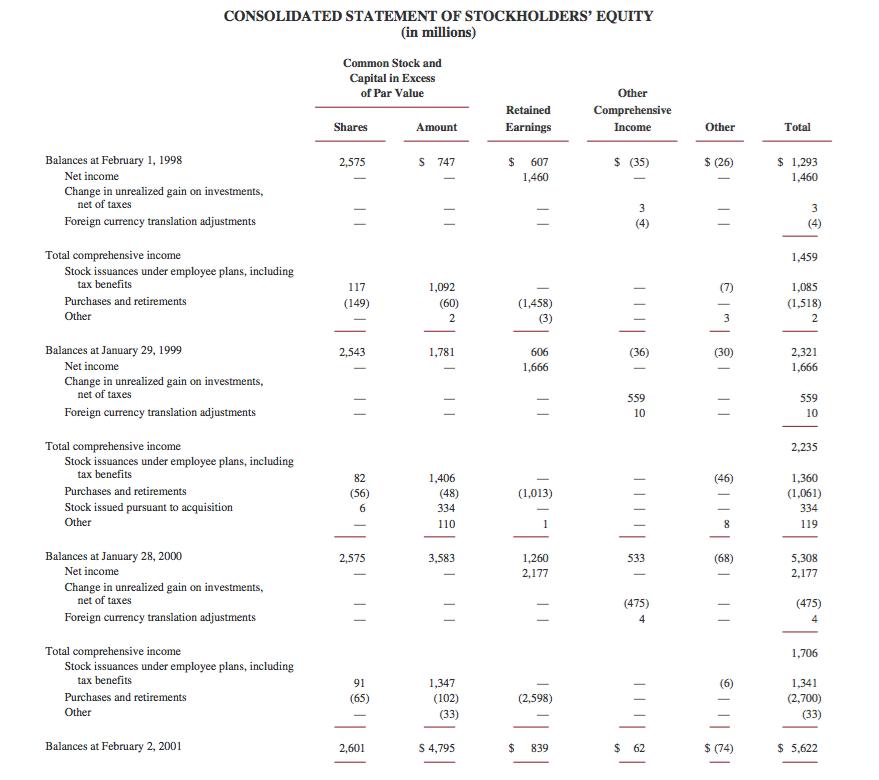

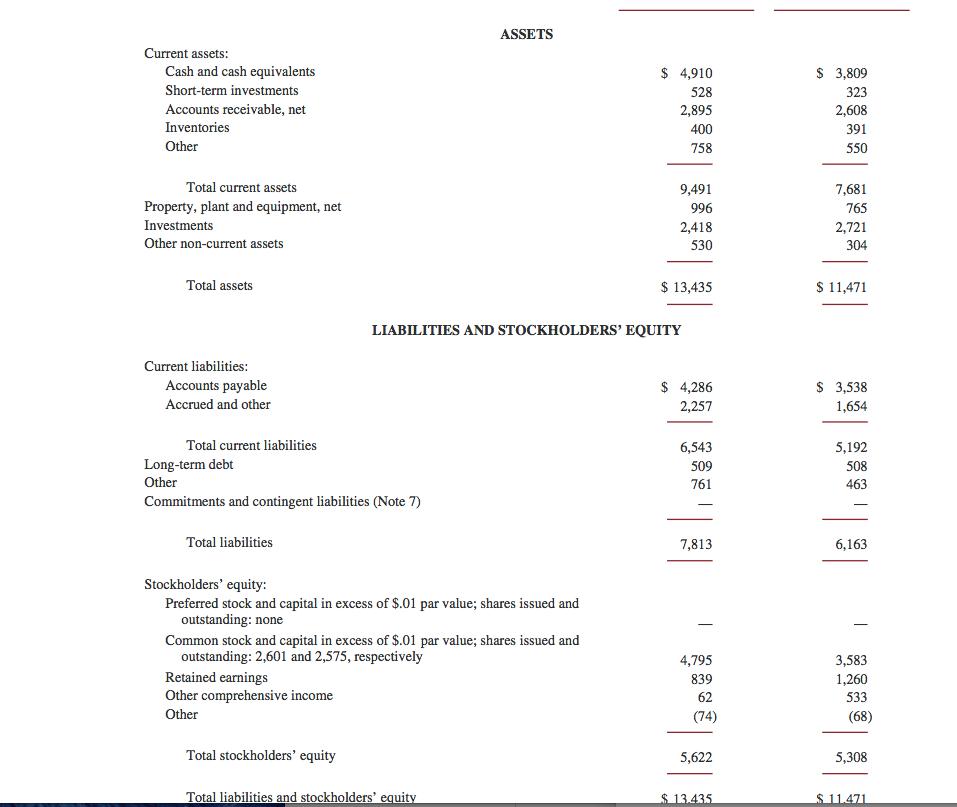

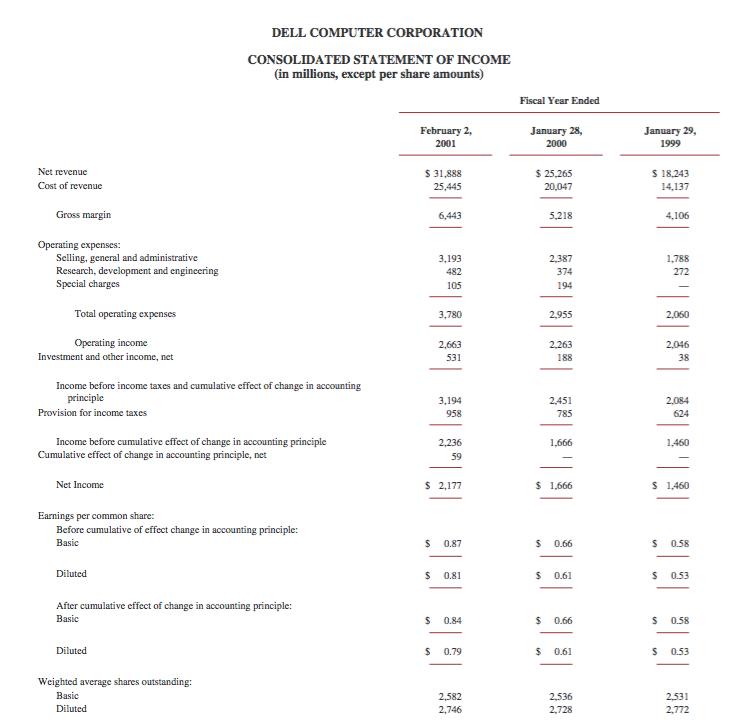

Dell Computer Corp., founded in 1984 by Michael Dell, is a well-known success story. The strategy of selling computers directly to customers in an efficient and economical fashion catapulted Dell into one of the largest PC makers in the United States. The company, which went public in 1988 for $8.50 a share, was worth over $70 billion at July 30, 2001, earning a stock return of over 1500% in the last 5 years alone (see Figure 1). During this time Dell split its stock 5 times and spent over $6 billion buying back its stock. Attached are excerpts from Dell’s 2001 Annual Report.

a. How many shares did Dell buy back during fiscal 2001 (ending February 2, 2001)?

b. What was the average price per share Dell paid to buy back these shares?

c. How many shares did Dell issue under their employee plan during fiscal year 2001?

d. What was the average amount per share Dell received from their employees on issuances under employee plans during fiscal year 2001?

e. How does the amount you calculated in part (d) compare with the average price Dell paid to buy back their shares during fiscal year 2001?

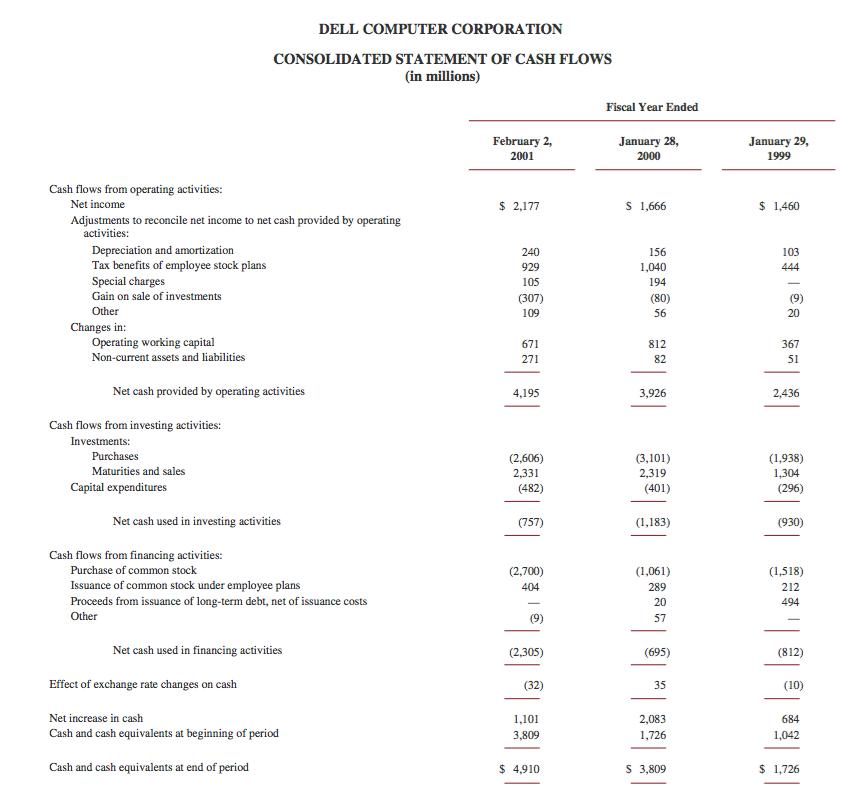

DELL COMPUTER CORPORATION CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) Fiscal Year Ended February 2, January 28, January 29, 2001 2000 1999 Cash flows from operating activities: Net income $ 2,177 S 1,666 $ 1,460 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Tax benefits of employee stock plans Special charges Gain on sale of investments 240 156 103 929 1,040 444 105 194 | (307) (80) (9) Other 109 56 20 Changes in: Operating working capital Non-current assets and liabilities 671 812 367 271 82 51 Net cash provided by operating activities 4,195 3,926 2,436 Cash flows from investing activities: Investments: Purchases (2,606) (3,101) (1,938) 1,304 (296) Maturities and sales 2,331 2,319 Capital expenditures (482) (401) Net cash used in investing activities (757) (1,183) (930) Cash flows from financing activities: Purchase of common stock (2,700) (1,061) (1,518) Issuance of common stock under employee plans Proceeds from issuance of long-term debt, net of issuance costs 404 289 212 20 494 Other 57 Net cash used in financing activities (2,305) (695) (812) Effect of exchange rate changes on cash (32) 35 (10) Net increase in cash 1,101 2,083 684 Cash and cash equivalents at beginning of period 3,809 1,726 1,042 Cash and cash equivalents at end of period $ 4,910 S 3,809 $ 1,726

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started