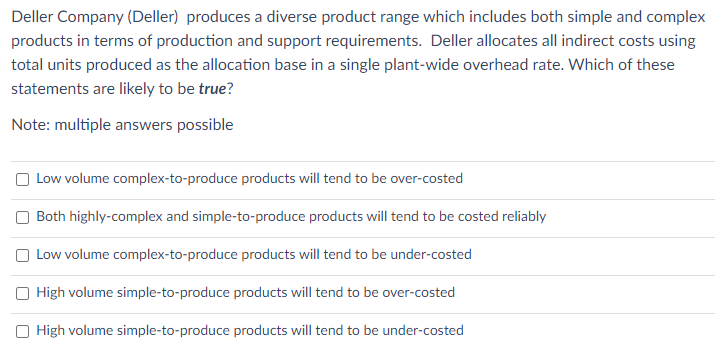

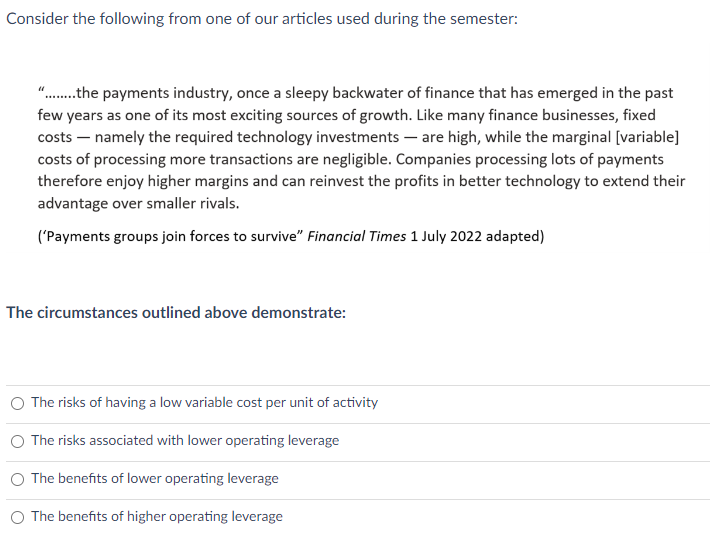

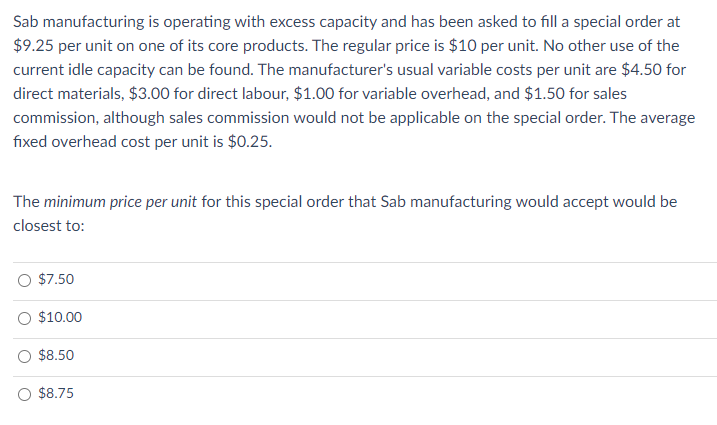

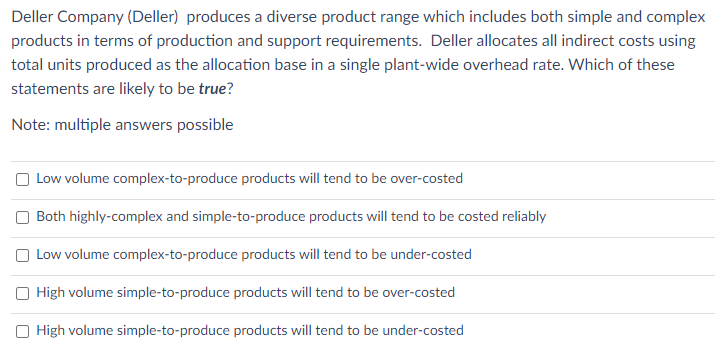

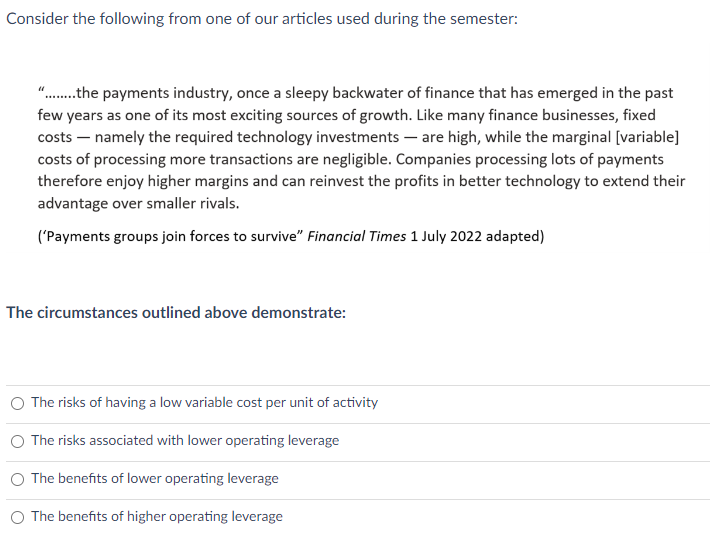

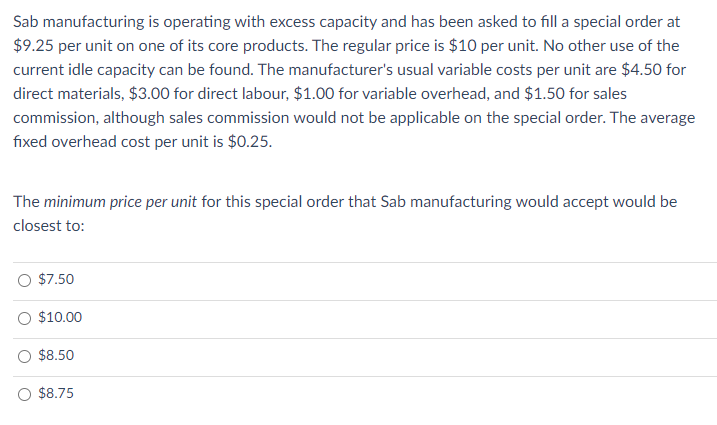

Deller Company (Deller) produces a diverse product range which includes both simple and complex products in terms of production and support requirements. Deller allocates all indirect costs using total units produced as the allocation base in a single plant-wide overhead rate. Which of these statements are likely to be true? Note: multiple answers possible Low volume complex-to-produce products will tend to be over-costed Both highly-complex and simple-to-produce products will tend to be costed reliably Low volume complex-to-produce products will tend to be under-costed High volume simple-to-produce products will tend to be over-costed High volume simple-to-produce products will tend to be under-costed Consider the following from one of our articles used during the semester: "........the payments industry, once a sleepy backwater of finance that has emerged in the past few years as one of its most exciting sources of growth. Like many finance businesses, fixed costs - namely the required technology investments - are high, while the marginal [variable] costs of processing more transactions are negligible. Companies processing lots of payments therefore enjoy higher margins and can reinvest the profits in better technology to extend their advantage over smaller rivals. ('Payments groups join forces to survive" Financial Times 1 July 2022 adapted) The circumstances outlined above demonstrate: The risks of having a low variable cost per unit of activity The risks associated with lower operating leverage The benefits of lower operating leverage The benefits of higher operating leverage Sab manufacturing is operating with excess capacity and has been asked to fill a special order at $9.25 per unit on one of its core products. The regular price is $10 per unit. No other use the current idle capacity can be found. The manufacturer's usual variable costs $4.50 for direct materials, $3.00 for direct labour, $1.00 for variable overhead, and $1.50 for sales commission, although sales commission would not be applicable on the special order. The average fixed overhead cost per unit is $0.25. The minimum price per unit for this special order that Sab manufacturing would accept would be closest to: $7.50 $10.00$8.50 $8.75