Answered step by step

Verified Expert Solution

Question

1 Approved Answer

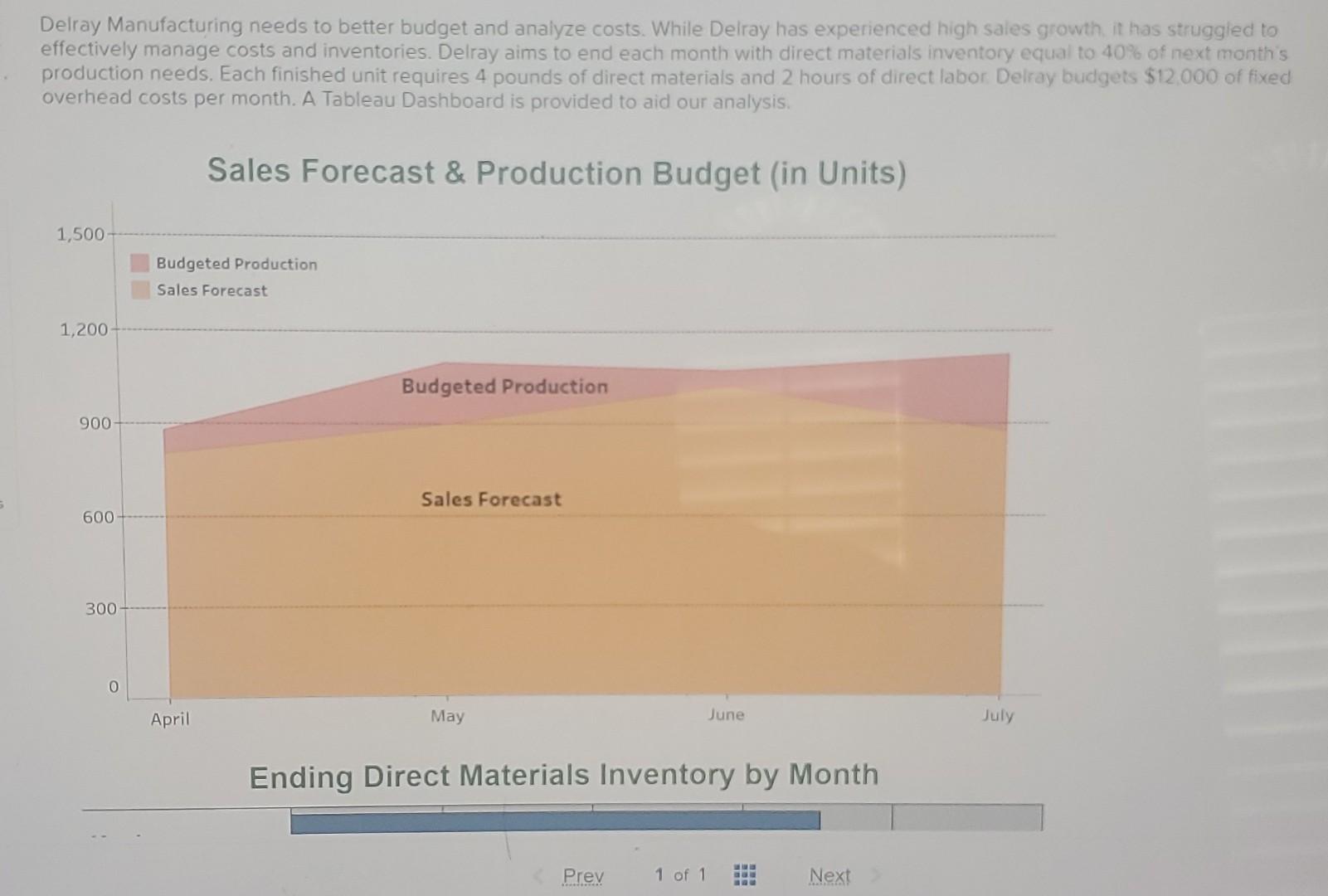

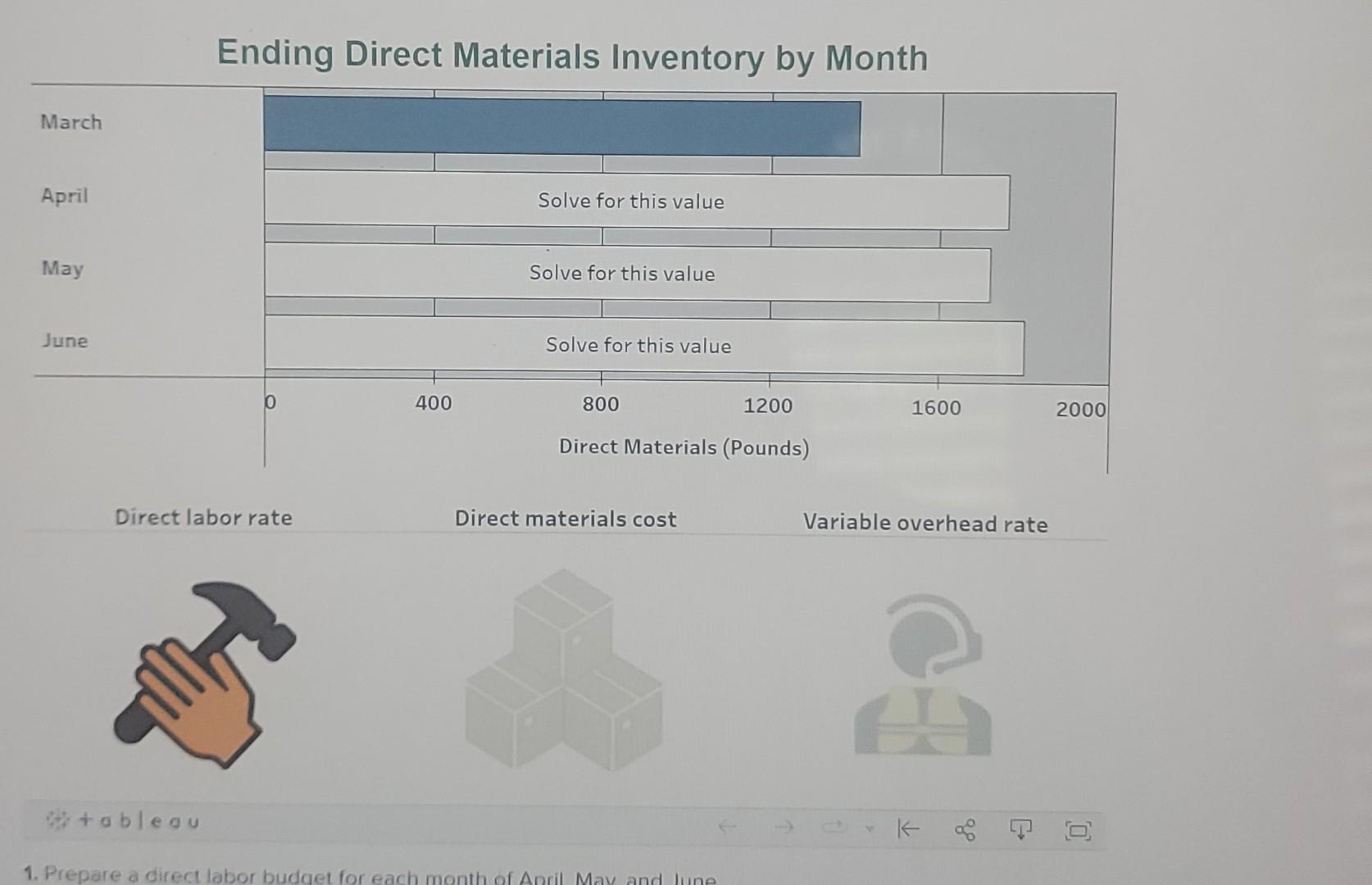

Delray Manufacturing needs to better budget and analyze costs. While Delray has experienced high sales growth it has struggled to effectively manage costs and inventories.

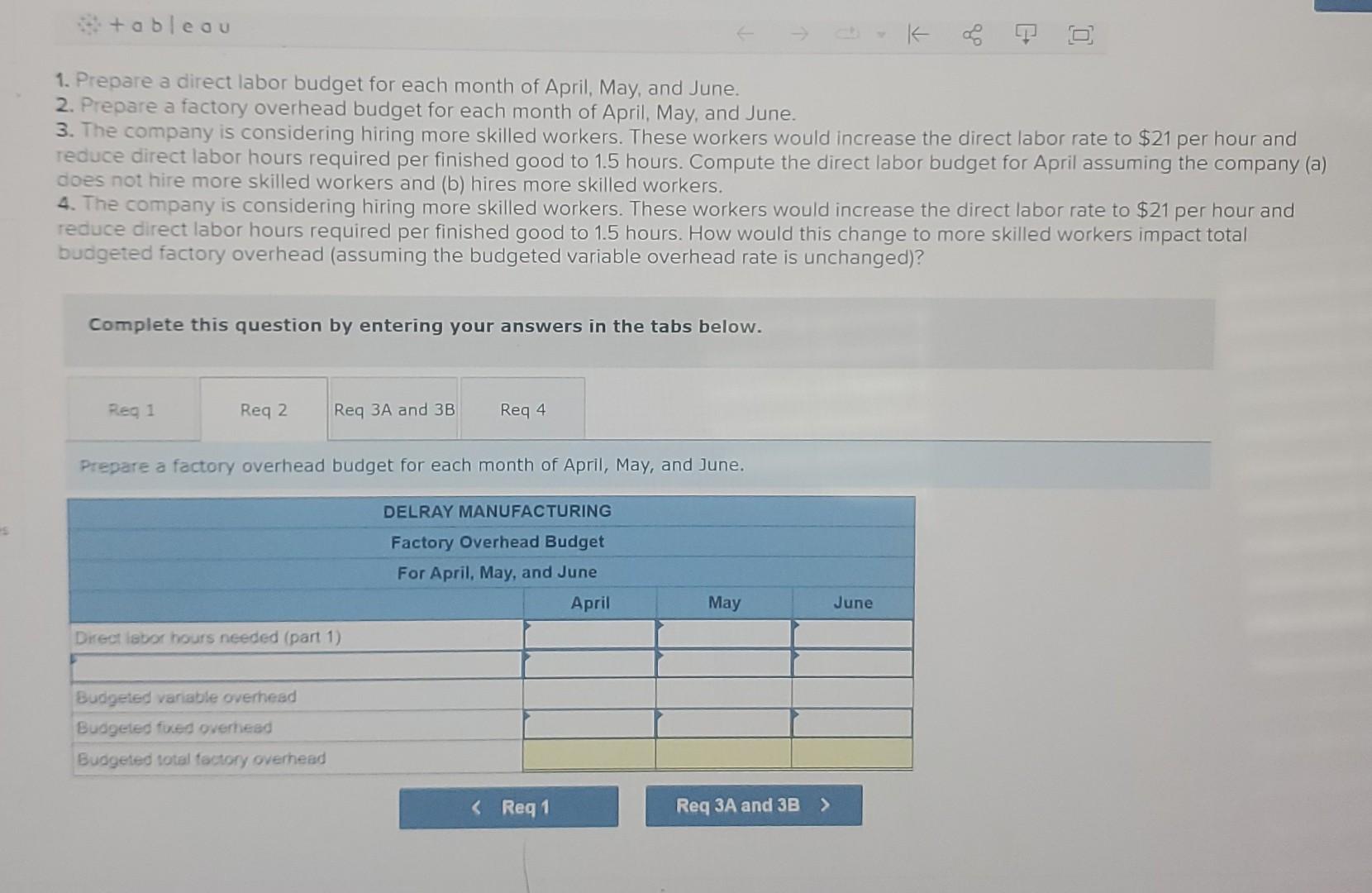

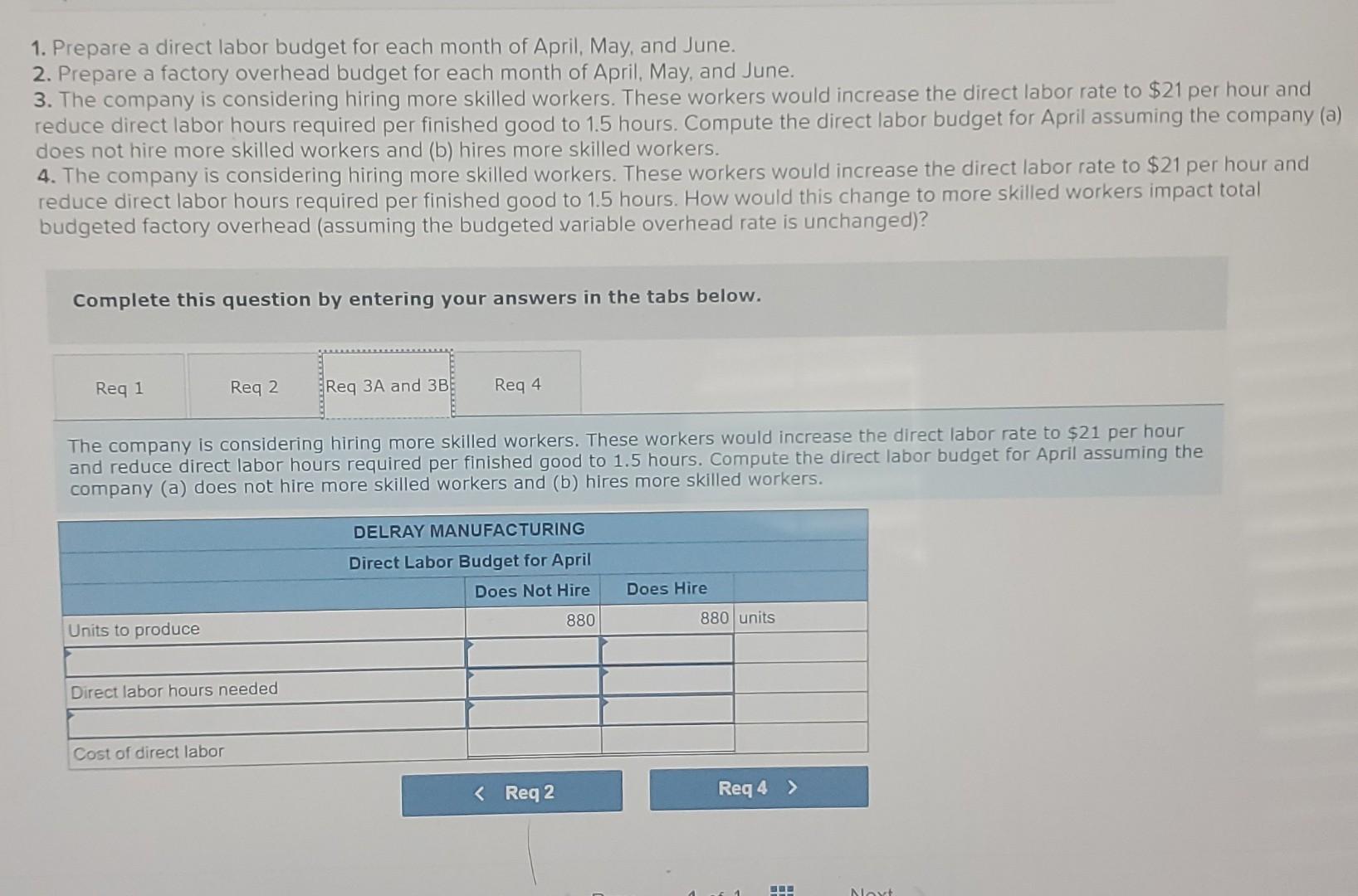

Delray Manufacturing needs to better budget and analyze costs. While Delray has experienced high sales growth it has struggled to effectively manage costs and inventories. Delray aims to end each month with direct materials inventory equal to 40% of next month s production needs. Each finished unit requires 4 pounds of direct materials and 2 hours of direct labor. Delray budgets $12.000 of fixed overhead costs per month. A Tableau Dashboard is provided to aid our analysis. Sales Forecast \& Production Budget (in Units) Ending Direct Materials Inventory by Month March April May Direct labor rate Direct materials cost Variable overhead rate ing tableau 1. Prepare a direct labor budget for each month of April, May, and June. 2. Prepare a factory overhead budget for each month of April, May, and June. 3. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. Compute the direct labor budget for April assuming the company (a) does not hire more skilled workers and (b) hires more skilled workers. 4. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. How would this change to more skilled workers impact total budgeted factory overhead (assuming the budgeted variable overhead rate is unchanged)? Complete this question by entering your answers in the tabs below. Prepare a factory overhead budget for each month of April, May, and June. 1. Prepare a direct labor budget for each month of April, May, and June. 2. Prepare a factory overhead budget for each month of April, May, and June. 3. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. Compute the direct labor budget for April assuming the company (a) does not hire more skilled workers and (b) hires more skilled workers. 4. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. How would this change to more skilled workers impact total budgeted factory overhead (assuming the budgeted variable overhead rate is unchanged)? Complete this question by entering your answers in the tabs below. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. Compute the direct labor budget for April assuming the company (a) does not hire more skilled workers and (b) hires more skilled workers. Delray Manufacturing needs to better budget and analyze costs. While Delray has experienced high sales growth it has struggled to effectively manage costs and inventories. Delray aims to end each month with direct materials inventory equal to 40% of next month s production needs. Each finished unit requires 4 pounds of direct materials and 2 hours of direct labor. Delray budgets $12.000 of fixed overhead costs per month. A Tableau Dashboard is provided to aid our analysis. Sales Forecast \& Production Budget (in Units) Ending Direct Materials Inventory by Month March April May Direct labor rate Direct materials cost Variable overhead rate ing tableau 1. Prepare a direct labor budget for each month of April, May, and June. 2. Prepare a factory overhead budget for each month of April, May, and June. 3. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. Compute the direct labor budget for April assuming the company (a) does not hire more skilled workers and (b) hires more skilled workers. 4. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. How would this change to more skilled workers impact total budgeted factory overhead (assuming the budgeted variable overhead rate is unchanged)? Complete this question by entering your answers in the tabs below. Prepare a factory overhead budget for each month of April, May, and June. 1. Prepare a direct labor budget for each month of April, May, and June. 2. Prepare a factory overhead budget for each month of April, May, and June. 3. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. Compute the direct labor budget for April assuming the company (a) does not hire more skilled workers and (b) hires more skilled workers. 4. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. How would this change to more skilled workers impact total budgeted factory overhead (assuming the budgeted variable overhead rate is unchanged)? Complete this question by entering your answers in the tabs below. The company is considering hiring more skilled workers. These workers would increase the direct labor rate to $21 per hour and reduce direct labor hours required per finished good to 1.5 hours. Compute the direct labor budget for April assuming the company (a) does not hire more skilled workers and (b) hires more skilled workers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started