Question

Delroy Garrett, CEO of Garrett Distribution, Inc. (GDI), looked out his office window at another sweltering day and wondered what could have gone wrong at

Delroy Garrett, CEO of Garrett Distribution, Inc. (GDI), looked out his office window at another sweltering day and wondered what could have gone wrong at his company. He just finished reviewing his companys recent financial performance and noticed something that worried him. GDI had experienced a period of robust growth over the last 4 years. What could be going wrong? he thought to himself. Our sales have been growing at an average rate of 8 percent over the last 4 years but we still appear to be worse off than before. He sat back in his chair with a heavy sigh and continued reviewing the report on his desk. Sales had risen consistently over the past 4 years but the future was uncertain. Delroy Garrett was aware that part of the past growth had largely been the result of a few competitors in the region going out of business, a situation that was unlikely to continue. Net earnings, however, had been declining for the last 3 years and were expected to decline next year. Garrett was determined to turn his company around within the next 3 years. He sat back from his desk and buzzed his personal assistant: Jelene, could you ask Ororo and Eric to come up? Background The distribution business, in its simplest form, involves the purchase of inventory from a variety of manufacturers and its resale to retailers. Over the last 3-5 years, demands on inventory changed considerably; neither manufactures nor retailers want to handle inventory, leaving distributors to pick up the slack. In addition, an increased tendency of retailers to order directly from manufacturers placed further strain on the profitability of distributorships in general. After humble beginnings in a shed behind the house of Garretts grandmother, the company moved to a 10, 000 square-foot leased facility. Ten years ago, GDI began distributing high-end appliance products to supplement its low-margin products. GDI entered into an agreement with CulinaryAssist Corp., a large manufacturer of high-end kitchen appliances, located 35 miles from Moline, IL, to distribute CulinaryAssist appliances to customers in the region. Over the years GDI enjoyed steady growth and expanded its area of coverage. Currently, Garrett was covering an area with a radius of 200 miles from the companys main facility. Given the rapid growth, GDI purchased the leased facility and made additions to bring its capacity to 30,000 sq feet. The demise of several of its competitors resulted in the acquisition of the new retailer

customers and some new product lines. Traditional ordering in the retailer-distributer- manufacturer chain took place via fax or telephone. Garrett considered implementing an

Internet-based ordering system but was unsure of the potential operational and marketing benefits that it could provide.

Concerns Market Direct competition from distributors increased over the past 5 years. As a result, the most successful distributors adopted a value-added strategy in order to remain competitive. Retailers want dependable delivery to support sales promotions and promised to customers. They also want the freedom to hold sales promotions at any time as competitive conditions dictate and with only short notice to distributors. They also want the opportunity to choose from a wide variety of appliances. Nonetheless, many orders are won on the basis of price and lost on the basis of delivery problems. Financial Manufacturers commonly demand payment in 30-45 days and provide no financing considerations. Retailers, on the other hand, pay in 50-60 days. This difference often leaves GDI in a cash-poor situation that puts an unnecessary strain on its current operating loan. The companys borrowing capacity has almost been exhausted. Any additional financing will have to be sought from alternative sources. Given GDIs financial situation, any additional financing will be issued at a higher charge than the companys existing dept. Operations Inventory turnover also presented a problem for the past 5 years. In the past 2 years, however, a significant downturn in turnover occurred. This trend seems likely to continue. Orders from retailers come in as their customers near completion of construction or renovations. Even though historical information provided a good benchmark of future sales, the changing market lessened the reliability of the information. The changes also affect GDIs ordering. Manufacturers require projections 60, 90, and 120 days out in order to budget their production. Sometimes penalties are assessed when GDI changes an order after it is placed with a manufacturer. Strategic Issues As Ororo and Eric walked into Garretts office, he was still pondering the report. Grab a seat, he grunted. They knew they were going to have a long day. Garrett quickly briefed them on why he had summoned them, and they all immediately dove into a spirited discussion. Garrett pointed out the GDI would need to be properly structured to deal with the recession and the reality of todays market. We need to be well-positioned for growth as the market stabilizes, , he said. In order to meet this challenge, GDI must evaluate a number of alternative options. Some of the possible options might include expanding current systems and, when necessary, developing new systems that interface with suppliers, customers, and commercial transportation resources to gain total asset visibility.

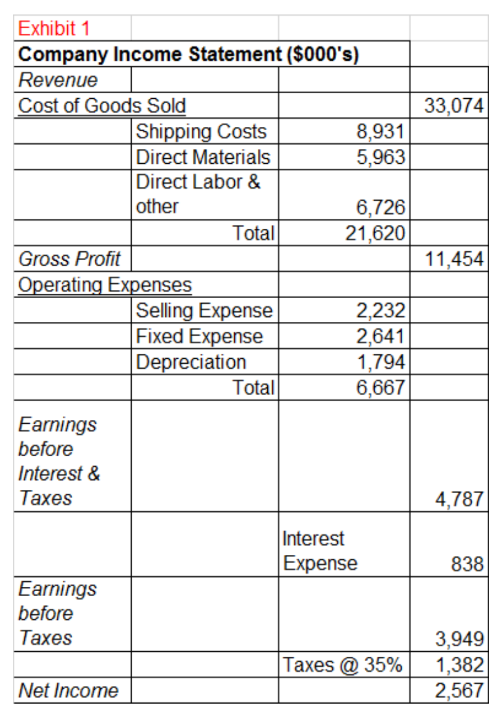

Before making any investment decision, Garrett reminded them that GDI would have to evaluate any new capital requirements, as well as the expected contribution to the companys bottom line and market share, that any option might provide. Exhibit 1 shows the income statement for the current year. Investing in New Infrastructure Eric Brooks, vice president of operations, said, Since Associated Business Distribution

Corp. ceased operations 4 years ago, we have been inundated with phone calls and e- mails from potential customers across the Midwest looking for an alternative to ABDs

services. These requests come not only from former ABD customers, but also from potential customers that have not dealt with either ABD or us in the past. We cannot adequately service this market from our current warehouse because the customers do not want to wait for warehouse because the customers do not want to wait for lengthy deliveries. We are currently servicing some customers in that region; however, I do not think we can keep them much longer because of delayed deliveries. In order to take advantage of this opportunity, strained resources and forward position inventory to shorten our delivery times to customers on short notice. We are challenged by an inadequate infrastructure far too small for our requirements. We only have the Moline warehouse at this time. The addition of new facilities would provide GDI with an opportunity for increased penetration in key industrial markets in the upper Midwest where the company has had a limited presence. The financing resources for this option would be a challenge, given that GDI was approaching its credit limit with its principal bank. Additional financing form larger banks in Chicago, however, was not ruled out. IT would be expensive (with current interest rates for long-term loans starting at 11 percent). According to Brandley, this option would cost $2 million for property and $10 million fort plant and equipment. The new warehouse facilities would be depreciated over 20 years. The 20-year loan would be repaid with a single balloon payment at the end of the loan. With the additional infrastructure, GDI would be able to increase its annual sales by $4,426,000. In addition, delivery lead times to customers in the region would be reduced from 5 days to 2 days, which would be very competitive. Because of the added warehouse capacity, GDI could also increase the number of brands and models of appliances to better serve the retailers needs for more variety. However, certain categories in the costs of goods sold would also increase. Total annual shipping costs, which include supplier deliveries to the warehouse as well as deliveries to the customer, would increase by $955,000. Annual materials costs (for the sold appliances) and labor costs would each increase by 6 percent. Total assets would increase from $30,170,000 to $43,551,000. This increase takes into account changes to inventory investment, which would become $7,200,000, accounts receivable property, and plant and equipment.

Streamlining the Distribution System Ororo Munroe, the vice president of logistics, stated, I believe there is an opportunity to capitalize on the void left by our fallen rivals by utilizing a cost-efficient distribution system. We do not need a new facility; we can continue to serve the customers in the Midwest as best we can. However, what we do need is an efficient distribution system. We are holding a considerable amount of stock that has not moved simply because of our inefficient inventory systems. One of our top priorities is working diligently with inventory control department to keep what we need and dispose of what we do not need. This approach will allow us to us the space recovered from the unneeded items for automated warehouse equipment that will enable us to become more efficient. Everything we do and every dollar we spend affects our customer. We need to keep our prices competitive. Our cost of operations is our customers cost. Our goal is to enable customers to spend their resources on readiness and the tools of their trade, not logistics. This option will not help us much with product variety or delivery speed; however, it will increase our on-time delivery performance and improve our flexibility to respond to changes in retailer orders to support their sales programs. The option of having an integrated center, comprised of sophisticated automation systems, advanced materials handling equipment, and specially developed information technology, would provide GDI with both the versatility and capacity to offer improved products and services to Garretts customers. The system would support real-time ordering, logistics planning and scheduling, and after-sales service. When an order is received through a call center at Garretts offices in Moline, it will be forwarded to a logistics center for processing. The customer is given a delivery date based on truck availability. Orders would be grouped by destination so that trucks could be efficiently loaded to maximize the truck capacity. The order would then be scheduled for delivery and the customer notified of the estimated arrival. This new information technology would improve GDIs reliability in delivering the products when promised. The system also includes an automatic storage and retrieval system (AS/RS). The AS/RS selects a customer order and moves it to a dock for loading on a truck headed for the customers location. The capital cost for this system would be $7 million, which would be depreciated over a 10-year period. The operating costs, including training, would run at $0.5 million each year. These costs would be considered fixed expenses by Garrett. The improved system, however, would save up to 16 percent in shipping expenses and 16 percent in labor expenses annually. Total assets would increase from $30,170,000 to $35,932,000 to account for changes in accounts receivables and equipment. Aggregate inventories would be only $4,500,000 because of the reduced need for safety stock inventories. GDI could finance this option using a 10-year loan at a 10 percent rate of interest. The loan would be repaid with a balloon payment at the end of the loan. These savings would come from more efficient handling of customers orders by the call center, better planning and scheduling of shipments, and improved communication with the warehouse and the customer, resulting in a dramatic reduction in the shipping costs in the supply chain. Additional savings would result from the reduction in personnel costs; fewer operators

would be required. Ororo Munroe thought that GDI could maintain its current level of service with her option while becoming much more efficient. The Decision Delroy Garrett pondered the two options posed by Eric Brooks and Ororo Munroe. Erics option enabled the firm to increase its revenues by serving more customers. The capital outlay was sizable, however. Ororos option focused on serving the firms existing customers more efficiently. The value of that option was its dramatic reduction in costs; however, it was uncertain whether GDI could hold onto its current upper Midwest customers. Garrett realized that he could not undertake both options, given the companys current financial position. Garrett uses a 12 percent cost of capital as the discount rate when making financial decisions. How will each option affect the firms operational and financial performance measures, which investors watch closely? Which supply chain design option would be better for the company? What type of information is vital for Mr. Garrett to even make a decision? What role does the market play in this scenario? Are there nuances?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started