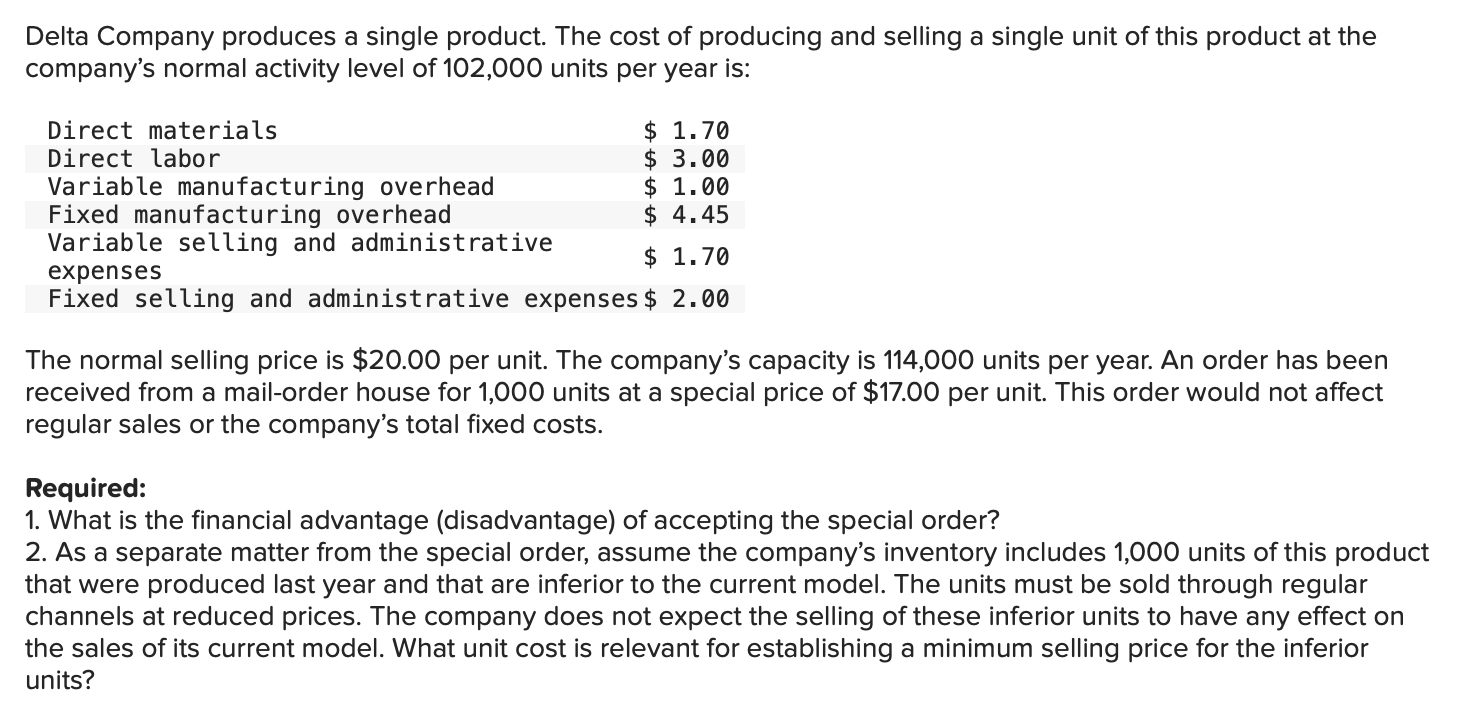

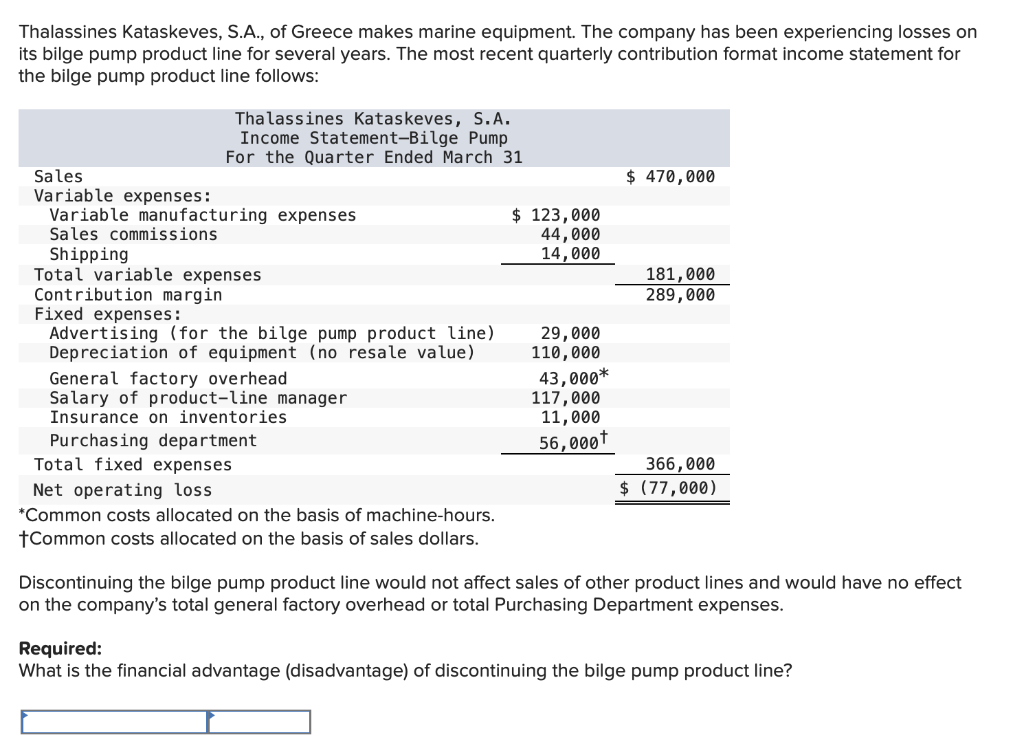

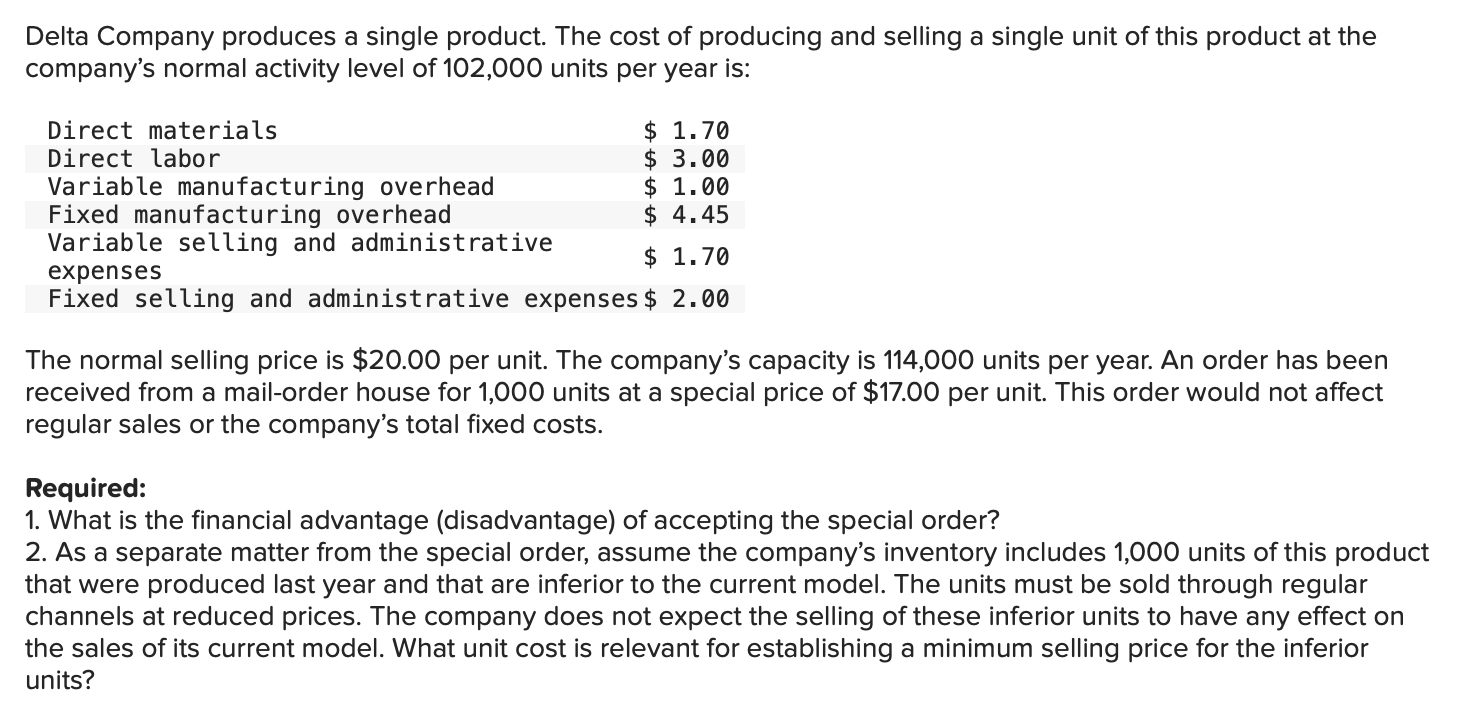

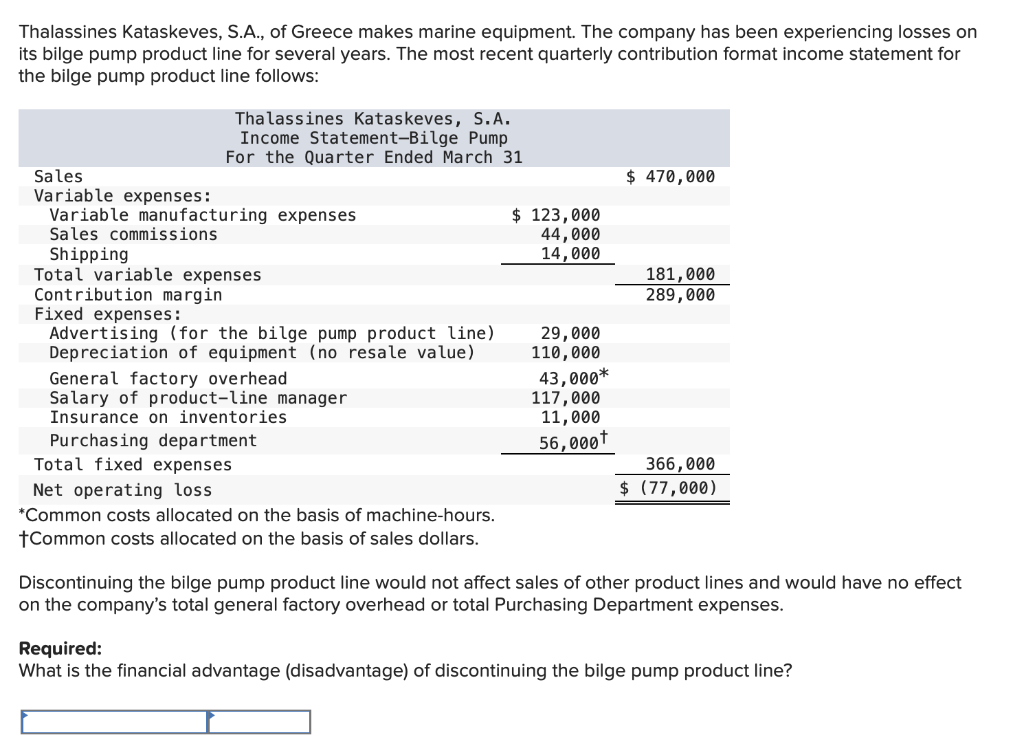

Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 102,000 units per year is: Direct materials $ 1.70 Direct labor $ 3.00 Variable manufacturing overhead $ 1.00 Fixed manufacturing overhead $ 4.45 Variable selling and administrative $ 1.70 expenses Fixed selling and administrative expenses $ 2.00 The normal selling price is $20.00 per unit. The company's capacity is 114,000 units per year. An order has been received from a mail-order house for 1,000 units at a special price of $17.00 per unit. This order would not affect regular sales or the company's total fixed costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels at reduced prices. The company does not expect the selling of these inferior units to have any effect on the sales of its current model. What unit cost is relevant for establishing a minimum selling price for the inferior units? Thalassines kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump product line follows: Thalassines kataskeves, S.A. Income Statement-Bilge Pump For the Quarter Ended March 31 Sales $ 470,000 Variable expenses: Variable manufacturing expenses $ 123,000 Sales commissions 44,000 Shipping 14,000 Total variable expenses 181,000 Contribution margin 289,000 Fixed expenses: Advertising (for the bilge pump product line) 29,000 Depreciation of equipment (no resale value) 110,000 General factory overhead 43,000* Salary of product-line manager 117,000 Insurance on inventories 11,000 Purchasing department 56,000+ Total fixed expenses 366,000 Net operating loss $ (77,000) *Common costs allocated on the basis of machine-hours. tCommon costs allocated on the basis of sales dollars. Discontinuing the bilge pump product line would not affect sales of other product lines and would have no effect on the company's total general factory overhead or total Purchasing Department expenses. Required: What is the financial advantage (disadvantage) of discontinuing the bilge pump product line