Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Delta (Pty) Ltd, a South African resident, acquired trading stock by way of an inheritance on 1 March 2023. The market value on the date

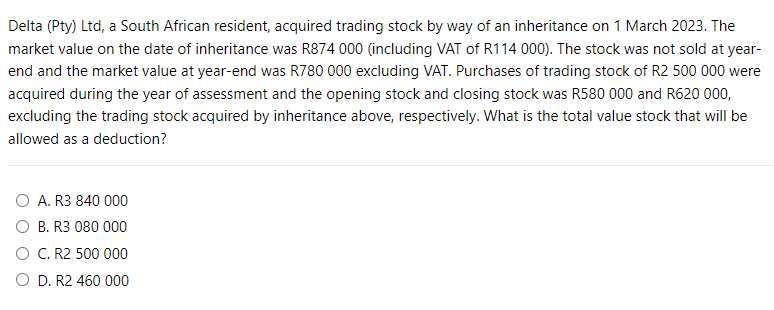

Delta (Pty) Ltd, a South African resident, acquired trading stock by way of an inheritance on 1 March 2023. The market value on the date of inheritance was R874 000 (including VAT of R114 000). The stock was not sold at yearend and the market value at year-end was R780 000 excluding VAT. Purchases of trading stock of R2 500000 were acquired during the year of assessment and the opening stock and closing stock was R580 000 and R620 000, excluding the trading stock acquired by inheritance above, respectively. What is the total value stock that will be allowed as a deduction? A. R3 840000 B. R3 080000 C. R2 500000 D. R2 460000

Delta (Pty) Ltd, a South African resident, acquired trading stock by way of an inheritance on 1 March 2023. The market value on the date of inheritance was R874 000 (including VAT of R114 000). The stock was not sold at yearend and the market value at year-end was R780 000 excluding VAT. Purchases of trading stock of R2 500000 were acquired during the year of assessment and the opening stock and closing stock was R580 000 and R620 000, excluding the trading stock acquired by inheritance above, respectively. What is the total value stock that will be allowed as a deduction? A. R3 840000 B. R3 080000 C. R2 500000 D. R2 460000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started