Answered step by step

Verified Expert Solution

Question

1 Approved Answer

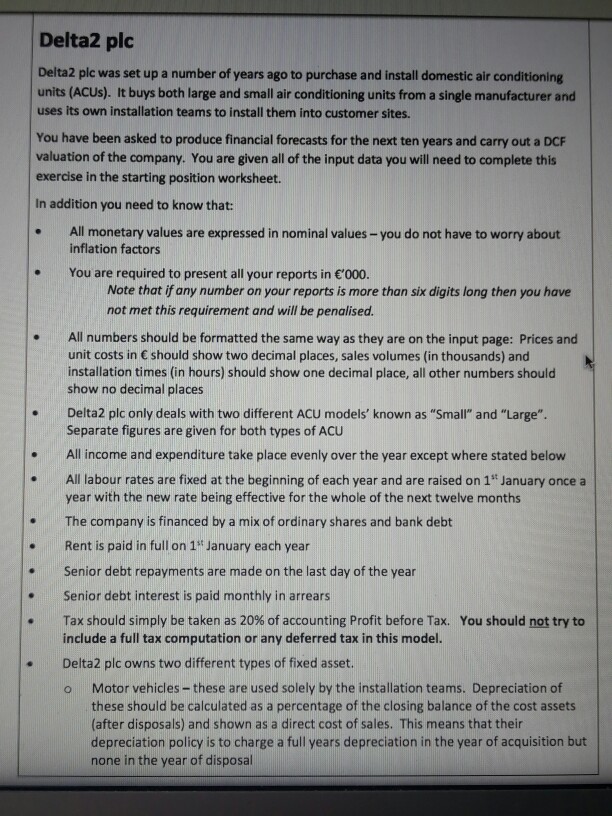

Delta2 plc Delta2 plc was set up a number of years ago to purchase and install domestic air conditioning units (ACUs). It buys both large

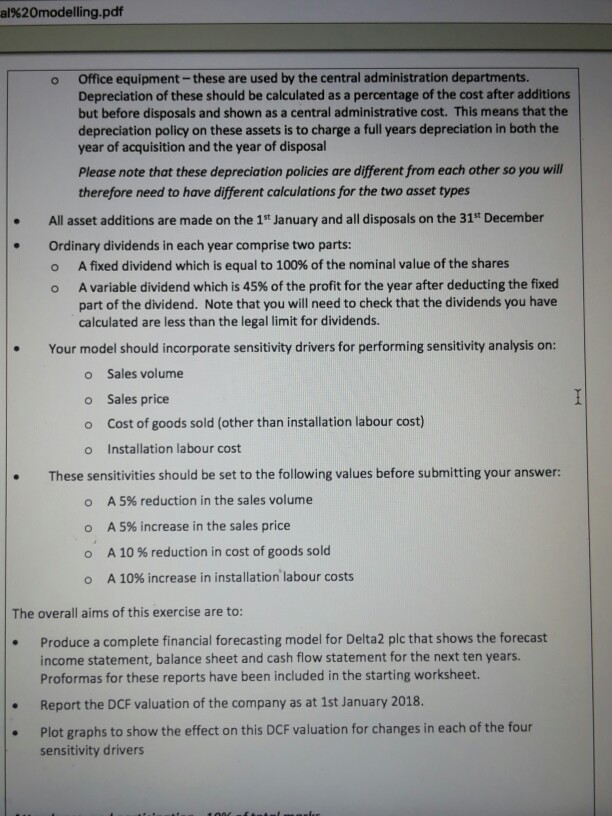

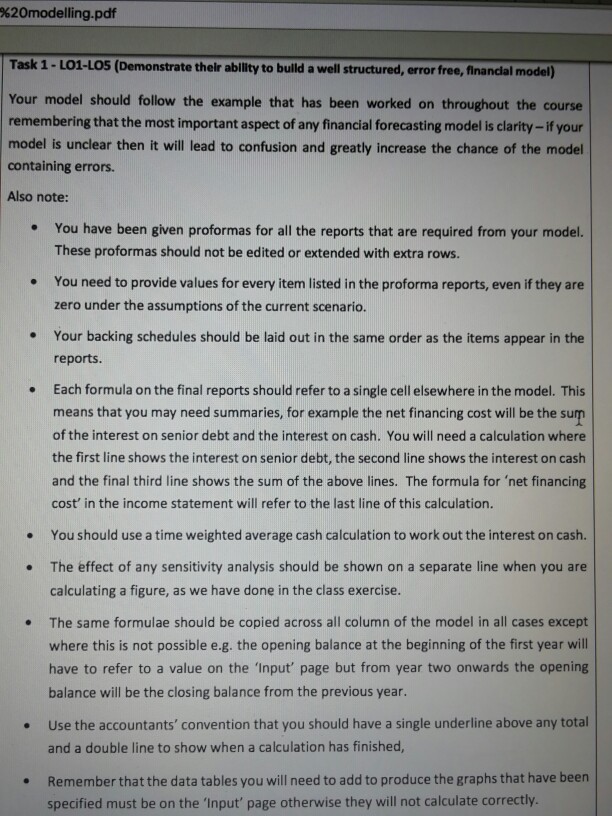

Delta2 plc Delta2 plc was set up a number of years ago to purchase and install domestic air conditioning units (ACUs). It buys both large and small air conditioning units from a single manufacturer and uses its own installation teams to install them into customer sites You have been asked to produce financial forecasts for the next ten years and carry out a DCF valuation of the company. You are given all of the input data you will need to complete this exercise in the starting position worksheet. In addition you need to know that: All monetary values are expressed in nominal values-you do not have to worry about inflation factors eYou are required to present all your reports in '000. Note that if any number on your reports is more than six digits long then you have not met this requirement and will be penalised. All numbers should be formatted the same way as they are on the input page: Prices and unit costs in should show two decimal places, sales volumes (in thousands) and installation times (in hours) should show one decimal place, all other numbers should show no decimal places .Delta2 plc only deals with two different ACU models' known as "Small" and "Large". Separate figures are given for both types of ACU All income and expenditure take place evenly over the year except where stated below .All labour rates are fixed at the beginning of each year and are raised on 1s January once a year with the new rate being effective for the whole of the next twelve months .The company is financed by a mix of ordinary shares and bank debt .Rent is paid in full on 1f January each year Senior debt repayments are made on the last day of the year Senior debt interest is paid monthly in arrears Tax should simply be taken as 20% of accounting Profit before Tax. include a full tax computation or any deferred tax in this model. You should not try to .Delta2 plc owns two different types of fixed asset. Motor vehicles- these are used solely by the installation teams. Depreciation of these should be calculated as a percentage of the closing balance of the cost assets (after disposals) and shown as a direct cost of sales. This means that their depreciation policy is to charge a full years depreciation in the year of acquisition but none in the year of disposal o Delta2 plc Delta2 plc was set up a number of years ago to purchase and install domestic air conditioning units (ACUs). It buys both large and small air conditioning units from a single manufacturer and uses its own installation teams to install them into customer sites You have been asked to produce financial forecasts for the next ten years and carry out a DCF valuation of the company. You are given all of the input data you will need to complete this exercise in the starting position worksheet. In addition you need to know that: All monetary values are expressed in nominal values-you do not have to worry about inflation factors eYou are required to present all your reports in '000. Note that if any number on your reports is more than six digits long then you have not met this requirement and will be penalised. All numbers should be formatted the same way as they are on the input page: Prices and unit costs in should show two decimal places, sales volumes (in thousands) and installation times (in hours) should show one decimal place, all other numbers should show no decimal places .Delta2 plc only deals with two different ACU models' known as "Small" and "Large". Separate figures are given for both types of ACU All income and expenditure take place evenly over the year except where stated below .All labour rates are fixed at the beginning of each year and are raised on 1s January once a year with the new rate being effective for the whole of the next twelve months .The company is financed by a mix of ordinary shares and bank debt .Rent is paid in full on 1f January each year Senior debt repayments are made on the last day of the year Senior debt interest is paid monthly in arrears Tax should simply be taken as 20% of accounting Profit before Tax. include a full tax computation or any deferred tax in this model. You should not try to .Delta2 plc owns two different types of fixed asset. Motor vehicles- these are used solely by the installation teams. Depreciation of these should be calculated as a percentage of the closing balance of the cost assets (after disposals) and shown as a direct cost of sales. This means that their depreciation policy is to charge a full years depreciation in the year of acquisition but none in the year of disposal o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started