Question

Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at year-end) who qualify as their

Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at year-end) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple received salary income of $96,500 and qualified business income of $18,500 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $242,500 and they sold it for $292,500. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $18,200 of itemized deductions (no charitable contributions), and they had $4,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. (Use the 2022 tax rate schedules.)

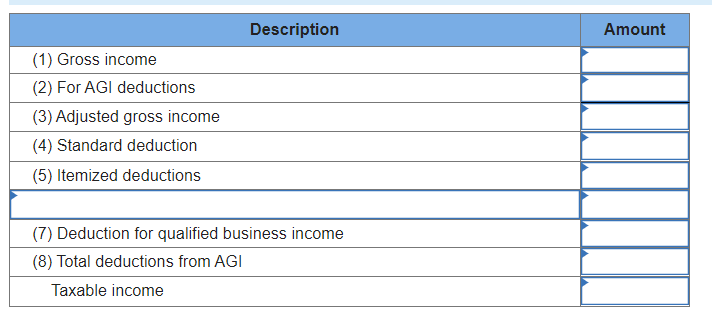

c. What would their taxable income be if their itemized deductions totaled $29,700 instead of $18,200?

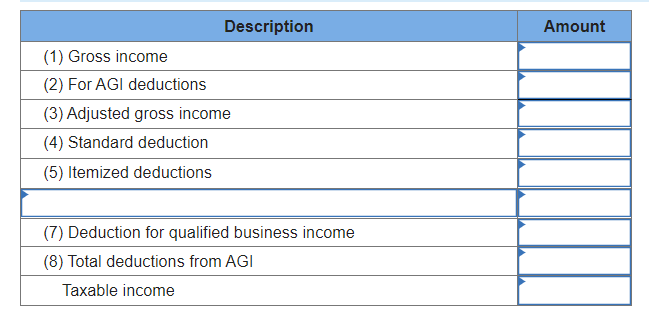

d. What would their taxable income be if they had $0 itemized deductions and $9,400 of for AGI deductions?

e. Assume the original facts but now suppose the Jacksons also incurred a loss of $5,850 on the sale of some of their investment assets. What effect does the $5,850 loss have on their taxable income?

f. Assume the original facts but now suppose the Jacksons own investments that appreciated by $10,000 during the year. The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year. What is the Jacksons' taxable income?

\begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Description } \\ \hline (1) Gross income \\ \hline (2) For AGl deductions \\ \hline (3) Adjusted gross income \\ \hline (4) Standard deduction & Amount \\ \hline (5) Itemized deductions & \\ \hline (7) Deduction for qualified business income & \\ \hline (8) Total deductions from AGI & \\ \hline Taxable income & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Description } \\ \hline (1) Gross income & Amount \\ \hline (2) For AGl deductions \\ \hline (3) Adjusted gross income \\ \hline (4) Standard deduction & \\ \hline (5) Itemized deductions & \\ \hline & (7) Deduction for qualified business income \\ \hline (8) Total deductions from AGI & \\ \hline Taxable income & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Description } \\ \hline (1) Gross income \\ \hline (2) For AGl deductions \\ \hline (3) Adjusted gross income \\ \hline (4) Standard deduction & Amount \\ \hline (5) Itemized deductions & \\ \hline (7) Deduction for qualified business income & \\ \hline (8) Total deductions from AGI & \\ \hline Taxable income & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Description } \\ \hline (1) Gross income & Amount \\ \hline (2) For AGl deductions \\ \hline (3) Adjusted gross income \\ \hline (4) Standard deduction & \\ \hline (5) Itemized deductions & \\ \hline & (7) Deduction for qualified business income \\ \hline (8) Total deductions from AGI & \\ \hline Taxable income & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started