Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Demean Limited was registered with a capital of 300 000 ordinary shares @ $3. The directors of the Company decided on 1 January, 2021

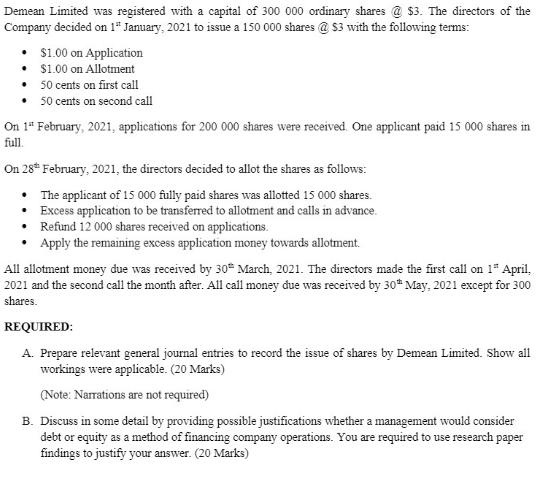

Demean Limited was registered with a capital of 300 000 ordinary shares @ $3. The directors of the Company decided on 1 January, 2021 to issue a 150 000 shares @ $3 with the following terms: $1.00 on Application $1.00 on Allotment 50 cents on first call 50 cents on second call On 15 February, 2021, applications for 200 000 shares were received. One applicant paid 15 000 shares in full. On 28* February, 2021, the directors decided to allot the shares as follows: The applicant of 15 000 fully paid shares was allotted 15 000 shares. Excess application to be transferred to allotment and calls in advance. Refund 12 000 shares received on applications. Apply the remaining excess application money towards allotment. All allotment money due was received by 30 March, 2021. The directors made the first call on 15 April, 2021 and the second call the month after. All call money due was received by 30th May, 2021 except for 300 shares. REQUIRED: A. Prepare relevant general journal entries to record the issue of shares by Demean Limited. Show all workings were applicable. (20 Marks) (Note: Narrations are not required) B. Discuss in some detail by providing possible justifications whether a management would consider debt or equity as a method of financing company operations. You are required to use research paper findings to justify your answer. (20 Marks)

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A General Journal Entries for the Issue of Shares by Demean Limited To record the issuance of shares by Demean Limited we need to make journal entries for various transactions Below are the journal en...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started