Answered step by step

Verified Expert Solution

Question

1 Approved Answer

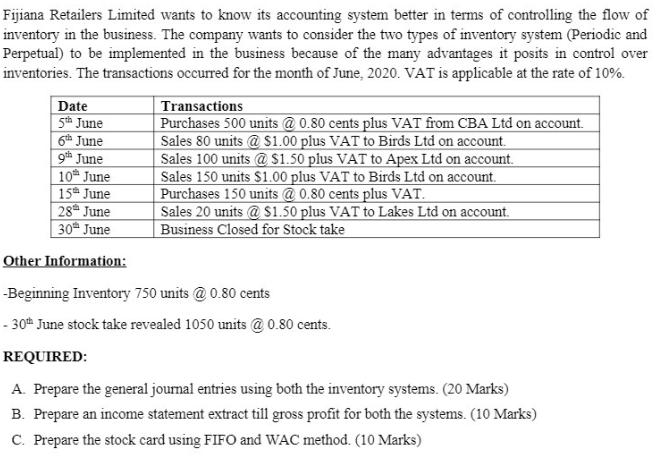

Fijiana Retailers Limited wants to know its accounting system better in terms of controlling the flow of inventory in the business. The company wants

Fijiana Retailers Limited wants to know its accounting system better in terms of controlling the flow of inventory in the business. The company wants to consider the two types of inventory system (Periodic and Perpetual) to be implemented in the business because of the many advantages it posits in control over inventories. The transactions occurred for the month of June, 2020. VAT is applicable at the rate of 10%. Date 5th June 6th June 9th June 10 June 15th June 28 June 30th June Other Information: -Beginning Inventory 750 units @ 0.80 cents -30th June stock take revealed 1050 units @ 0.80 cents. Transactions Purchases 500 units @ 0.80 cents plus VAT from CBA Ltd on account. Sales 80 units @ $1.00 plus VAT to Birds Ltd on account. Sales 100 units @ $1.50 plus VAT to Apex Ltd on account. Sales 150 units $1.00 plus VAT to Birds Ltd on account. Purchases 150 units @ 0.80 cents plus VAT. Sales 20 units @ $1.50 plus VAT to Lakes Ltd on account. Business Closed for Stock take REQUIRED: A. Prepare the general journal entries using both the inventory systems. (20 Marks) B. Prepare an income statement extract till gross profit for both the systems. (10 Marks) C. Prepare the stock card using FIFO and WAC method. (10 Marks)

Step by Step Solution

★★★★★

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The image provided is a case study for Fijiana Retailers Limited which outlines various transactions that occurred over the course of June 2020 It includes information such as the date transaction des...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started