Demo Ltd manufactures two models of its only product, model X and model Y. Before, the company only manufactured model X. Since the introduction

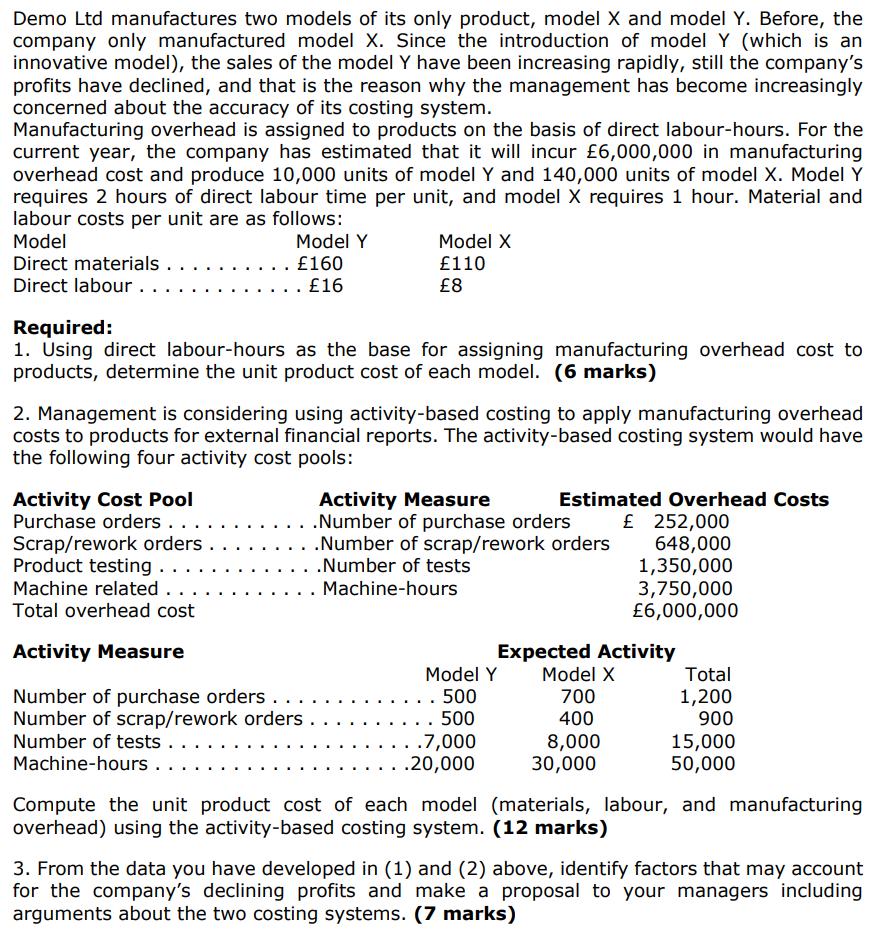

Demo Ltd manufactures two models of its only product, model X and model Y. Before, the company only manufactured model X. Since the introduction of model Y (which is an innovative model), the sales of the model Y have been increasing rapidly, still the company's profits have declined, and that is the reason why the management has become increasingly concerned about the accuracy of its costing system. Manufacturing overhead is assigned to products on the basis of direct labour-hours. For the current year, the company has estimated that it will incur 6,000,000 in manufacturing overhead cost and produce 10,000 units of model Y and 140,000 units of model X. Model Y requires 2 hours of direct labour time per unit, and model X requires 1 hour. Material and labour costs per unit are as follows: Model Direct materials .. Direct labour... Model Y 160 16 Required: 1. Using direct labour-hours as the base for assigning manufacturing overhead cost to products, determine the unit product cost of each model. (6 marks) Model X 110 8 2. Management is considering using activity-based costing to apply manufacturing overhead costs to products for external financial reports. The activity-based costing system would have the following four activity cost pools: Activity Cost Pool Purchase orders . . . . Scrap/rework orders Product testing ... Machine related .. Total overhead cost Activity Measure Number of purchase orders Number of scrap/rework orders Number of tests ... Machine-hours . . Activity Measure . .Number of purchase orders .Number of scrap/rework orders .Number of tests Machine-hours . Model Y . . 500 . 500 ..7,000 .20,000 Estimated Overhead Costs 252,000 648,000 1,350,000 3,750,000 6,000,000 Expected Activity Model X 700 400 8,000 30,000 Total 1,200 900 15,000 50,000 Compute the unit product cost of each model (materials, labour, and manufacturing overhead) using the activity-based costing system. (12 marks) 3. From the data you have developed in (1) and (2) above, identify factors that may account for the company's declining profits and make a proposal to your managers including arguments about the two costing systems. (7 marks)

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of Unit Product Cost using Direct LabourHours For Model Y Direct materials cost per unit 160 Direct labour cost per unit 16 Direct labourhours per unit 2 Total direct labour cost for Mod...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started