Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Demonstration Problem 1 0 - 1 Net Present Value / Present Value Index The management team at Savage Corporation is evaluating two alternative capital investment

Demonstration Problem

Net Present ValuePresent Value Index

The management team at Savage Corporation is evaluating two alternative capital investment opportunities. The first alternative, modernizing the company's current machinery, costs $ Management estimates the modernization project will reduce annual net cash outflow by $ per year for the next five years. The second alternative, purchasing a new machine costs $ The new machine is expected to have a fiveyear useful life and a $ salvag value. Management estimates the new machine will generate cash inflows of $ per yea Savage's cost of capital is

Required

a Determine the present value of the cash flow savings expected from the modernizat program.

b Determine the net present value of the modernization project.

c Determine the net present value of investing in the new machine.

d Use present value indices to determine which investment alternative will yield the hi rate of return.

Demonstration Problem

Payback how long it will take the investment to for itselt.

EZ Rentals can purchase a van that costs $ The van has an expected useful life of and no salvage value. EZ expects cash revenue from leasing the van to be $ Alternatively, EZ can purchase a car that costs $ EZ expects cash revenue fror the car to be $ per year over a year useful life. Ignore income taxes.

Required

Determine the payback period for the van.

Determine the payback period for the car.

Indicate which vehicle is the better alternative if payback is used as the sole criteria.

Describe the possible shortcomings of using payback as the investment criteria.

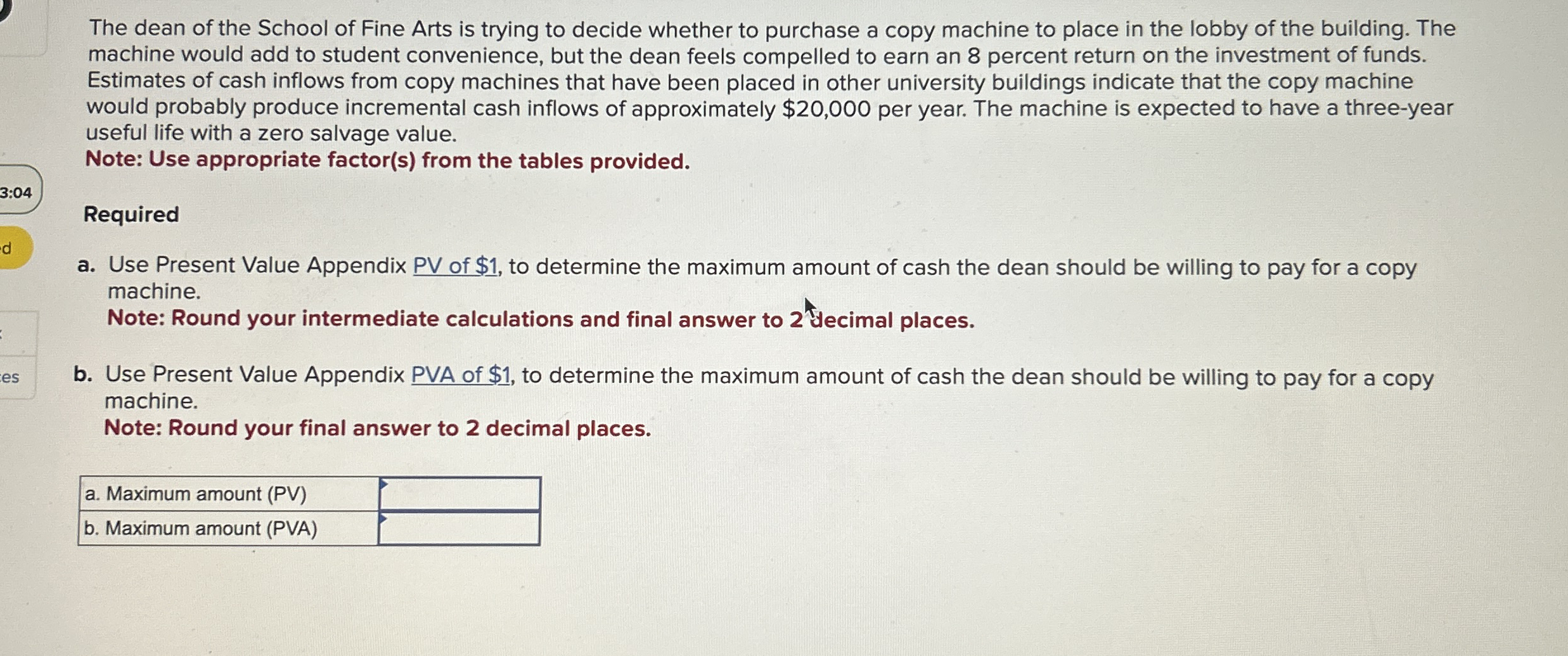

The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine to place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $ per year. The machine is expected to have a threeyear useful life with a zero salvage value.

Note: Use appropriate factors from the tables provided.

Required

a Use Present Value Appendix PV of $ to determine the maximum amount of cash the dean should be willing to pay for a copy machine.

Note: Round your intermediate calculations and final answer to decimal places.

b Use Present Value Appendix PVA of $ to determine the maximum amount of cash the dean should be willing to pay for a copy machine.

Note: Round your final answer to decimal places.

a Maximum amount PV

b Maximum amount PVA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started