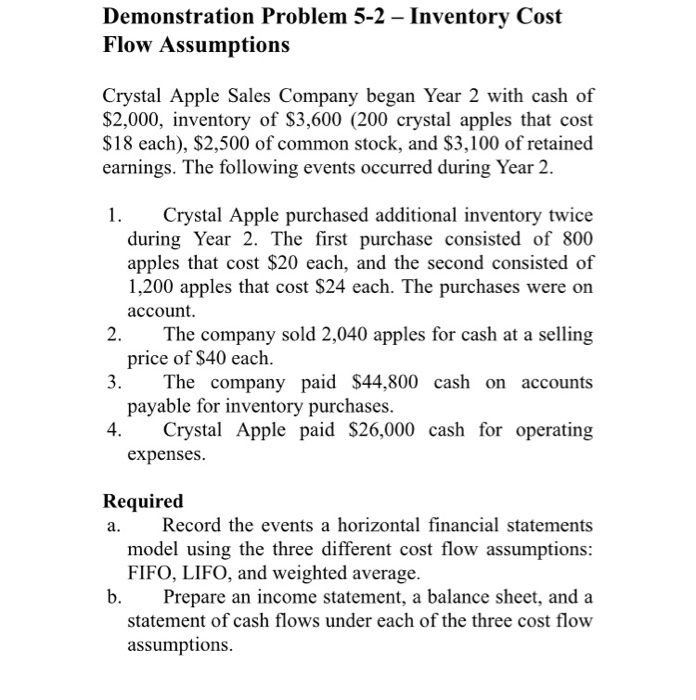

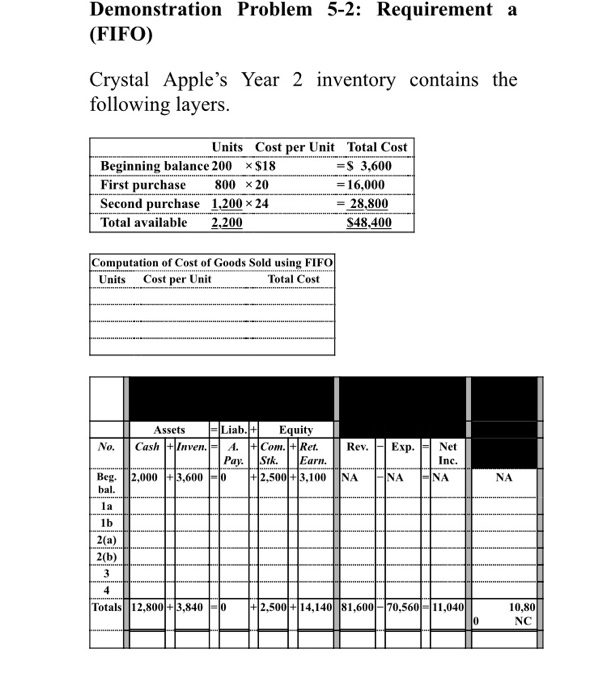

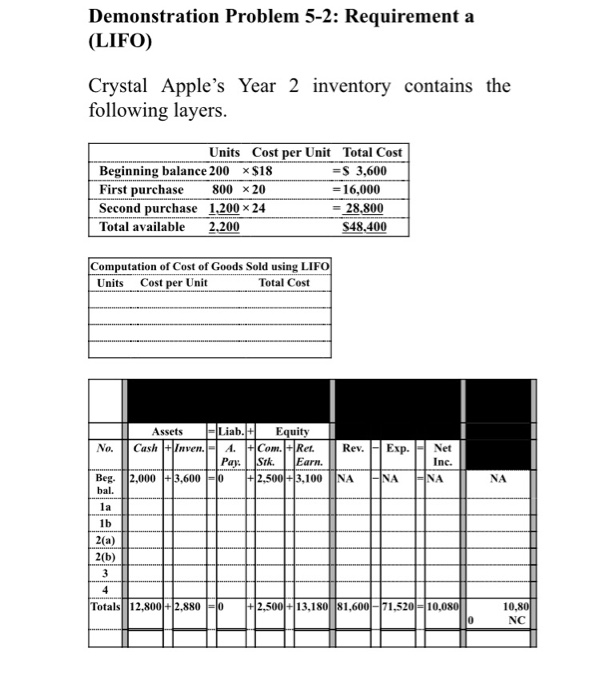

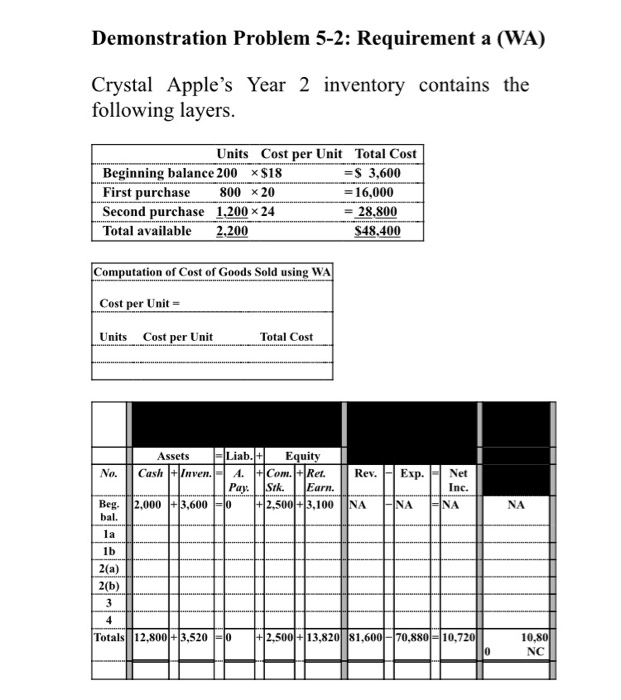

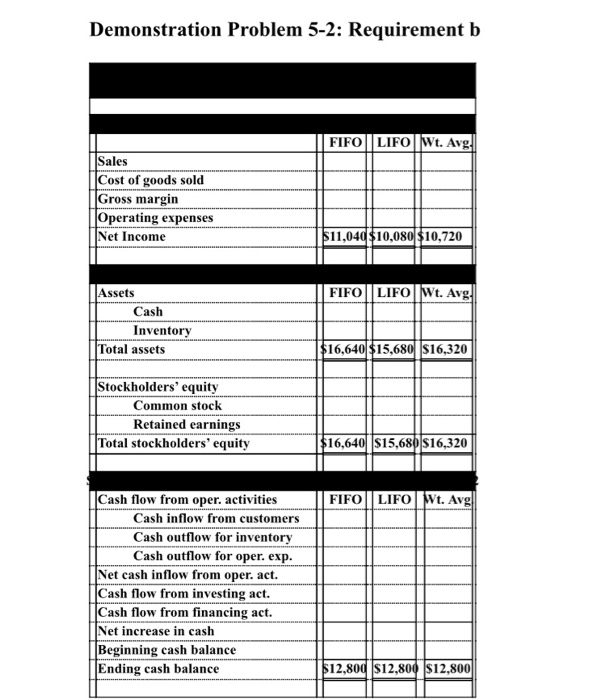

Demonstration Problem 5-2 - Inventory Cost Flow Assumptions Crystal Apple Sales Company began Year 2 with cash of $2,000, inventory of $3,600 (200 crystal apples that cost $18 each), $2,500 of common stock, and $3,100 of retained earnings. The following events occurred during Year 2. 1. Crystal Apple purchased additional inventory twice during Year 2. The first purchase consisted of 800 apples that cost $20 each, and the second consisted of 1,200 apples that cost $24 each. The purchases were on account. 2. The company sold 2,040 apples for cash at a selling price of $40 each. 3. The company paid $44,800 cash on accounts payable for inventory purchases. 4. Crystal Apple paid $26,000 cash for operating expenses. Required a. Record the events a horizontal financial statements model using the three different cost flow assumptions: FIFO, LIFO, and weighted average. b. Prepare an income statement, a balance sheet, and a statement of cash flows under each of the three cost flow assumptions. Demonstration Problem 5-2: Requirement a (FIFO) Crystal Apple's Year 2 inventory contains the following layers. Units Cost per Unit Total Cost Beginning balance 200 $18 =$ 3,600 First purchase 800 x 20 = 16,000 Second purchase 1,200 x 24 Total available 2.200 $48,400 Computation of Cost of Goods Sold using FIFO Units Cost per Unit Total Cost Assets Liab. + Equity No. | Cash + Inven. 4. Com. + Ret. Pay. Stk. Earn. Beg. 12,000 +13,600 -10 +2.500+ 3,100 bal. Rev. Exp. Net Inc. 12 1b 2(a) 2(b) Totals 12,800 +13,840 1- +2,500 +14,140 81,6001 - 70,560 -11,040 10,80 NC Demonstration Problem 5-2: Requirement a (LIFO) Crystal Apple's Year 2 inventory contains the following layers. Units Cost per Unit Total Cost Beginning balance 200 x $18 =$ 3,600 First purchase 800 x 20 = 16,000 Second purchase 1.200 x 24 = 28.800 Total available 2.200 S48,400 Computation of Cost of Goods Sold using LIFO Units Cost per Unit T otal Cost No. Assets Liab. + Equity Cash + inven. - 4. Com. + Ref. PayStk. Earn 2,000 +3,6000 2.500 + 3.100 Rev. Exp. H Net Inc. NA LA NA Beg NA Totals||12,800 +2.880 l H2,500+13,180|81,600|-|71,520 -10,08011 Demonstration Problem 5-2: Requirement a (WA) Crystal Apple's Year 2 inventory contains the following layers. Units Cost per Unit Total Cost Beginning balance 200 * $18 =$ 3,600 First purchase 800 x 20 = 16,000 Second purchase 1,200 x 24 = 28.800 Total available 2,200 $48,400 Computation of Cost of Goods Sold using WA Cost per Unit Units Cost per Unit Assets Liab. + Equity No. Cash + Inven. - A. Com. Ret. Pay Stk. Earn. Beg. 2.000 + 3,600 FO +2.500 +3,100 | Rev. Exp. H Net Inc. NA NA NA bal. 1a 2(a) Z(b) Totals 12,800 +3,520 = 0 +2.500 + 13,820 81,6001 - 70,880 10,720 | Demonstration Problem 5-2: Requirement b FIFO LIFO Wt. Avg. Sales Cost of goods sold Gross margin Operating expenses Net Income $11,040 $10,080 $10,720 FIFO LIFO Wt. Avg. Assets Cash Inventory Total assets 16,640 $15,680 S16,320 Stockholders' equity Common stock Retained earnings Total stockholders' equity $16,640 $15,680 $16,320 FIFOLIFOWt. Avg Cash flow from oper. activities Cash inflow from customers Cash outflow for inventory Cash outflow for oper. exp. Net cash inflow from oper. act. Cash flow from investing act. ||Cash flow from financing act. Net increase in cash Beginning cash balance Ending cash balance 2.800 $12,800 $12,800