Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dena Liu is 20 years old and is considered a dependent of Dena's parents for tax purposes. Assume the taxable year is 2022. Required: a.

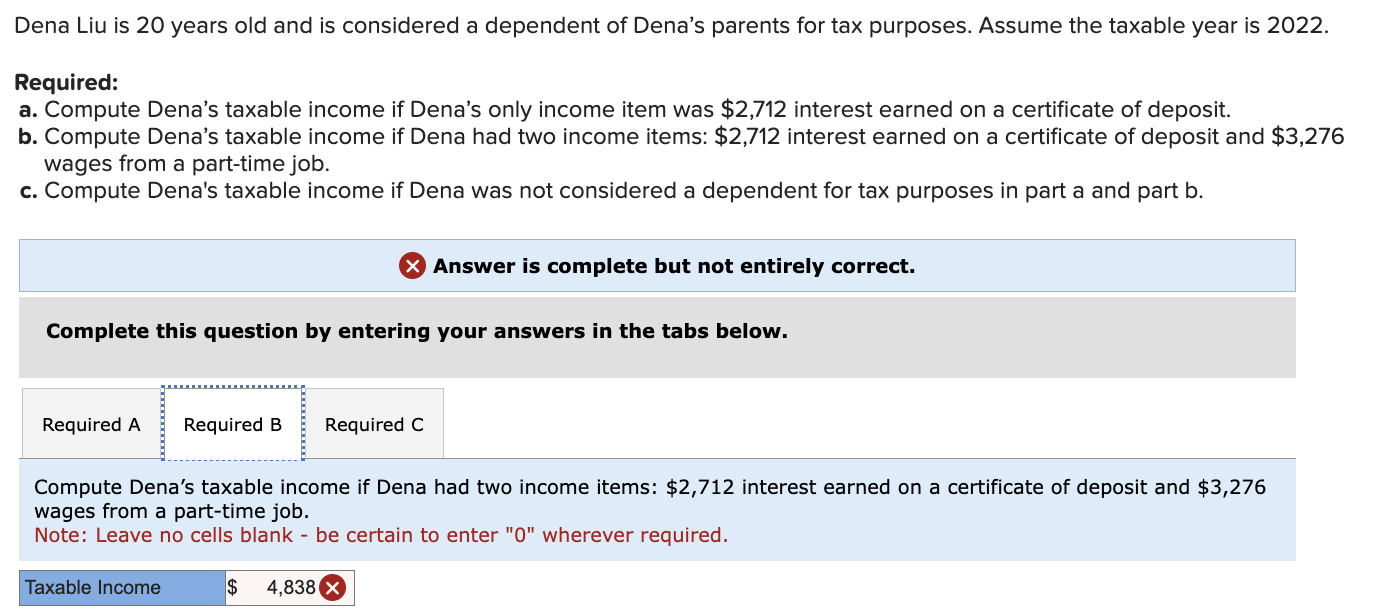

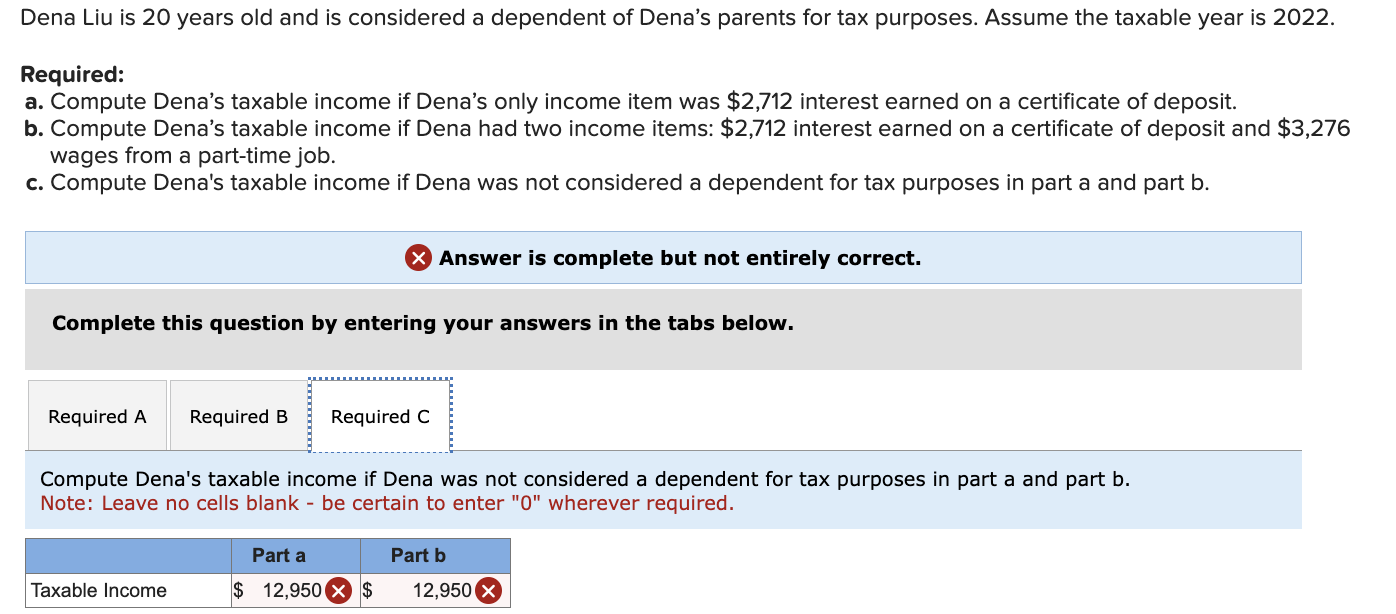

Dena Liu is 20 years old and is considered a dependent of Dena's parents for tax purposes. Assume the taxable year is 2022. Required: a. Compute Dena's taxable income if Dena's only income item was $2,712 interest earned on a certificate of deposit. b. Compute Dena's taxable income if Dena had two income items: $2,712 interest earned on a certificate of deposit and $3,276 wages from a part-time job. c. Compute Dena's taxable income if Dena was not considered a dependent for tax purposes in part a and part b. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Dena's taxable income if Dena had two income items: $2,712 interest earned on a certificate of deposit and $3,276 wages from a part-time job. Note: Leave no cells blank - be certain to enter "0" wherever required. Dena Liu is 20 years old and is considered a dependent of Dena's parents for tax purposes. Assume the taxable year is 2022 . Required: a. Compute Dena's taxable income if Dena's only income item was $2,712 interest earned on a certificate of deposit. b. Compute Dena's taxable income if Dena had two income items: $2,712 interest earned on a certificate of deposit and $3,276 wages from a part-time job. c. Compute Dena's taxable income if Dena was not considered a dependent for tax purposes in part a and part b. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Dena's taxable income if Dena was not considered a dependent for tax purposes in part a and part b. Note: Leave no cells blank - be certain to enter "0" wherever required

Dena Liu is 20 years old and is considered a dependent of Dena's parents for tax purposes. Assume the taxable year is 2022. Required: a. Compute Dena's taxable income if Dena's only income item was $2,712 interest earned on a certificate of deposit. b. Compute Dena's taxable income if Dena had two income items: $2,712 interest earned on a certificate of deposit and $3,276 wages from a part-time job. c. Compute Dena's taxable income if Dena was not considered a dependent for tax purposes in part a and part b. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Dena's taxable income if Dena had two income items: $2,712 interest earned on a certificate of deposit and $3,276 wages from a part-time job. Note: Leave no cells blank - be certain to enter "0" wherever required. Dena Liu is 20 years old and is considered a dependent of Dena's parents for tax purposes. Assume the taxable year is 2022 . Required: a. Compute Dena's taxable income if Dena's only income item was $2,712 interest earned on a certificate of deposit. b. Compute Dena's taxable income if Dena had two income items: $2,712 interest earned on a certificate of deposit and $3,276 wages from a part-time job. c. Compute Dena's taxable income if Dena was not considered a dependent for tax purposes in part a and part b. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Compute Dena's taxable income if Dena was not considered a dependent for tax purposes in part a and part b. Note: Leave no cells blank - be certain to enter "0" wherever required Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started