Question

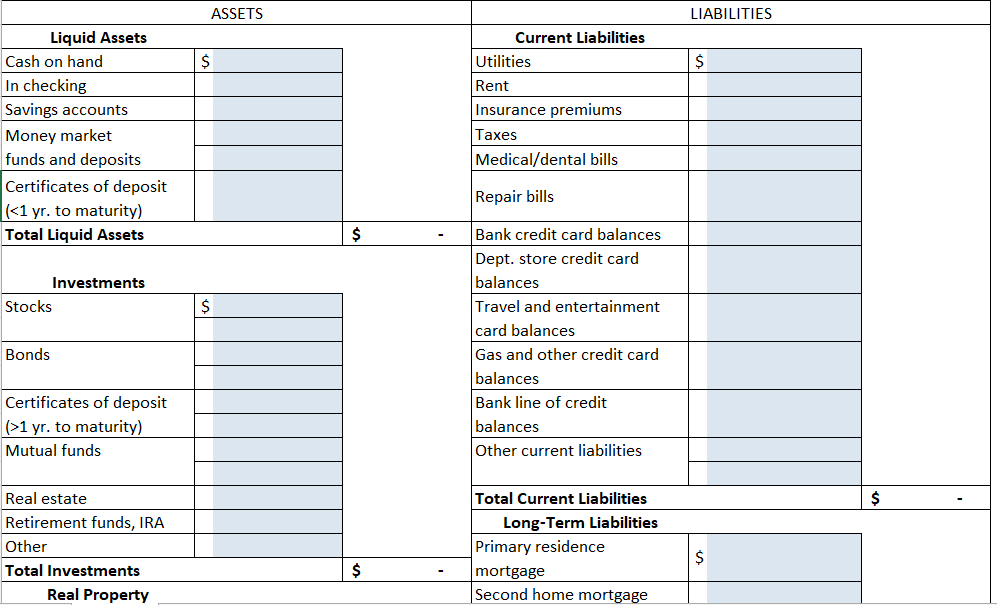

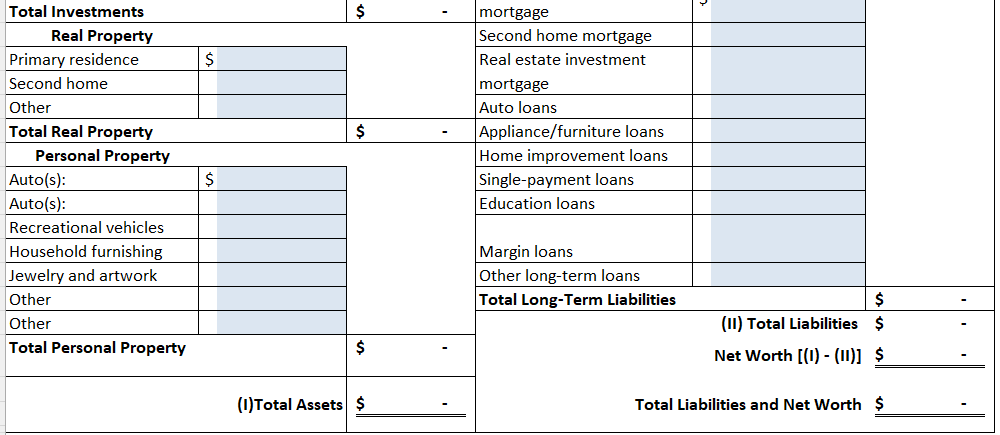

Denise Fishers banker has requested a personal balance sheet in support of her application for a home improvement loan. She has made the following list

Denise Fishers banker has requested a personal balance sheet in support of her application for a home improvement loan. She has made the following list of her assets and liabilities as of 12/31/21:

She has $70 cash on hand.

She has $200 in her checking account.

She has $1,650 in a money market deposit account with Southwest Savings.

She paid $20,000 on a Honda Civic a few years ago. It is now worth $15,000 and the outstanding loan balance is $13,000.

She spent $5,000 on clothing and furniture. While she owes $3,500 on the clothing and furniture loans, she estimates the personal property to be worth $1,950.

She bought a condo for $160,000. While the condos value is now $168,000, she still owes $152,000 on the condo mortgage.

She has $500 invested in US savings bonds and has stock of Harvestor Corp. worth $3,000.

She has current unpaid monthly bills outstanding of $1,300.

Complete Worksheet 2.1. Determine her net worth and compute her solvency ratio.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started