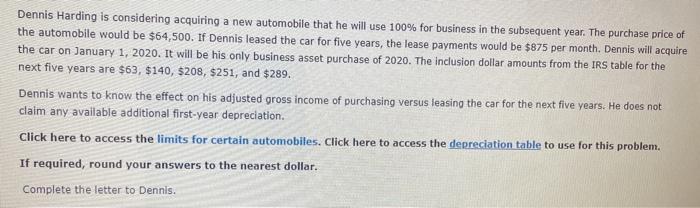

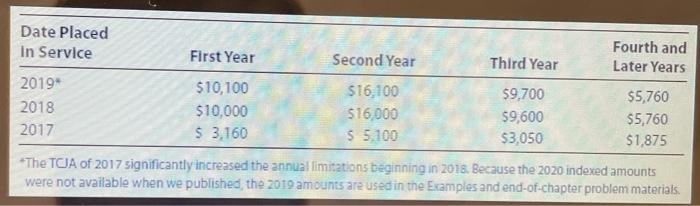

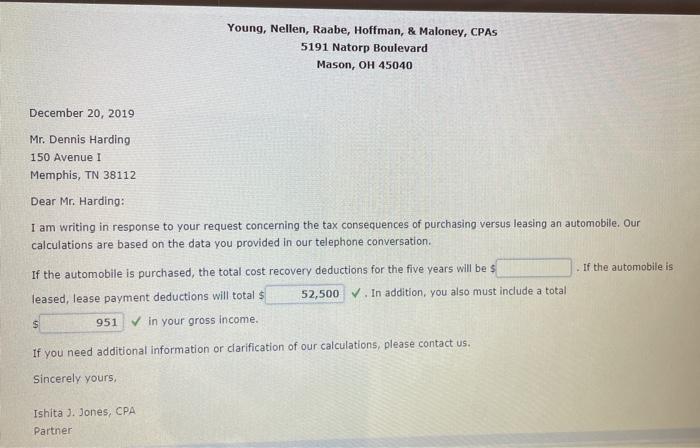

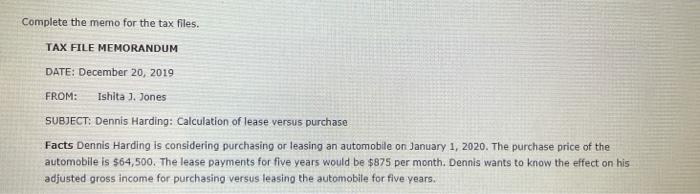

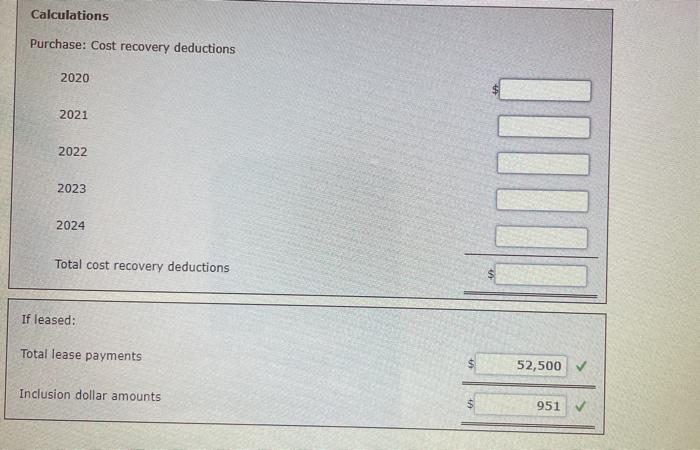

Dennis Harding is considering acquiring a new automobile that he will use 100% for business in the subsequent year. The purchase price of the automobile would be $64,500. If Dennis leased the car for five years, the lease payments would be $875 per month. Dennis will acquire the car on January 1, 2020. It will be his only business asset purchase of 2020. The inclusion dollar amounts from the IRS table for the next five years are $63, $140, $208, $251, and $289. Dennis wants to know the effect on his adjusted gross income of purchasing versus leasing the car for the next five years. He does not claim any available additional first-year depreciation. Click here to access the limits for certain automobiles. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. Complete the letter to Dennis. Date Placed Fourth and In Service First Year Second Year Third Year Later Years 2019* $10,100 $16.100 $9,700 $5,760 2018 $10,000 516,000 59,600 $5,760 2017 $ 3,160 5 5.100 $3,050 $1,875 *The TCJA of 2017 significantly increased the annual limitations beginning in 2018. Because the 2020 indexed amounts were not available when we published the 2019 amounts are used in the Examples and end-of-chapter problem materials. Young, Nellen, Raabe, Hoffman, & Maloney, CPAS 5191 Natorp Boulevard Mason, OH 45040 December 20, 2019 Mr. Dennis Harding 150 Avenue 1 Memphis, TN 38112 Dear Mr. Harding: I am writing in response to your request concerning the tax consequences of purchasing versus leasing an automobile. Our calculations are based on the data you provided in our telephone conversation . If the automobile is If the automobile is purchased, the total cost recovery deductions for the five years will be $ leased, lease payment deductions will total $ 52,500. In addition, you also must include a total $ 951 in your gross income. If you need additional information or clarification of our calculations, please contact us. Sincerely yours, Ishita J. Jones, CPA Partner Complete the memo for the tax files. TAX FILE MEMORANDUM DATE: December 20, 2019 FROM: Ishita J. Jones SUBJECT: Dennis Harding: calculation of lease versus purchase Facts Dennis Harding is considering purchasing or leasing an automobile on January 1, 2020. The purchase price of the automobile is $64,500. The lease payments for five years would be $875 per month. Dennis wants to know the effect on his adjusted gross income for purchasing versus leasing the automobile for five years. Calculations Purchase: Cost recovery deductions 2020 2021 DONE 2022 2023 2024 Total cost recovery deductions If leased: Total lease payments 52,500 Inclusion dollar amounts 951