Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dennis sells short 325 shares of ARC stock at $88 per share on January 15, 2023. He buys 650 shares of ARC stock on

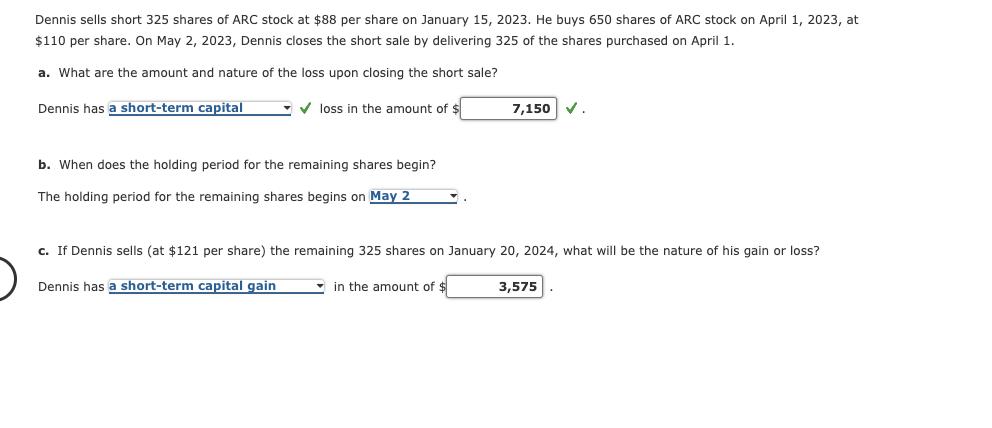

Dennis sells short 325 shares of ARC stock at $88 per share on January 15, 2023. He buys 650 shares of ARC stock on April 1, 2023, at $110 per share. On May 2, 2023, Dennis closes the short sale by delivering 325 of the shares purchased on April 1. a. What are the amount and nature of the loss upon closing the short sale? Dennis has a short-term capital loss in the amount of $ b. When does the holding period for the remaining shares begin? The holding period for the remaining shares begins on May 2 7,150 . c. If Dennis sells (at $121 per share) the remaining 325 shares on January 20, 2024, what will be the nature of his gain or loss? Dennis has a short-term capital gain in the amount of $ 3,575

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the amount and nature of the loss upon closing the short sale we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started