Question

Denote by X, the change of the value of a portfolio at the i-th day. Assume that {X} are iid (independent and identically distributed)

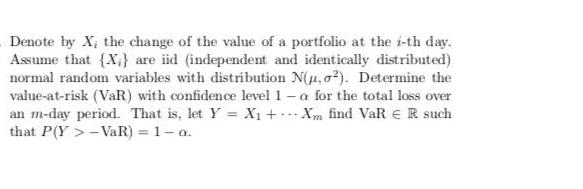

Denote by X, the change of the value of a portfolio at the i-th day. Assume that {X} are iid (independent and identically distributed) normal random variables with distribution N(u,0). Determine the value-at-risk (VaR) with confidence level 1 -a for the total loss over an m-day period. That is, let Y= X + Xm find VaR R such that P(Y>-VaR) = 1-a.

Step by Step Solution

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer The total loss over an mday period is given by the sum of the daily changes i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Operations Research

Authors: Frederick S. Hillier, Gerald J. Lieberman

10th edition

978-0072535105, 72535105, 978-1259162985

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App