Answered step by step

Verified Expert Solution

Question

1 Approved Answer

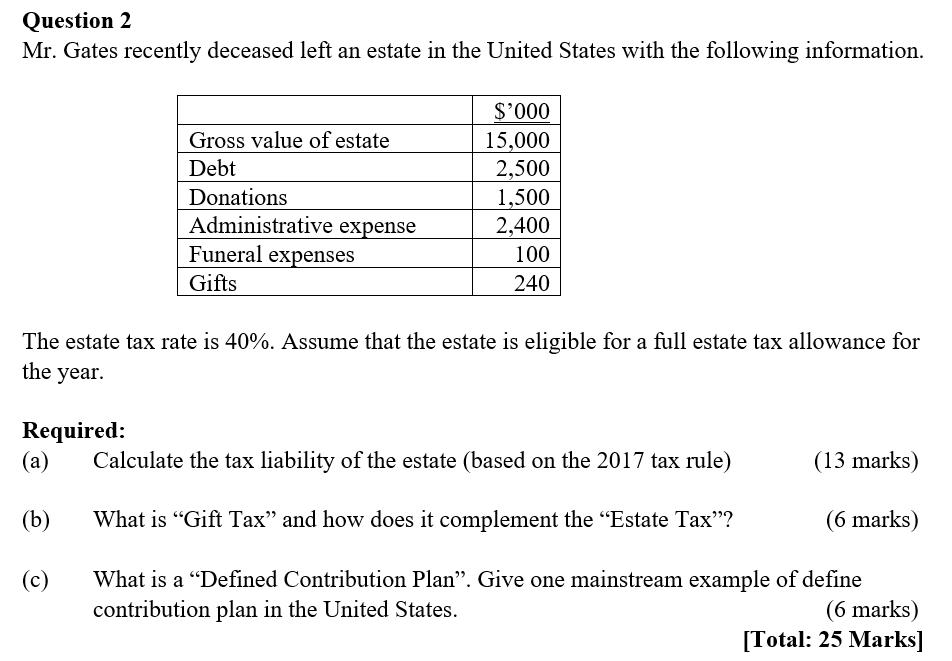

Question 2 Mr. Gates recently deceased left an estate in the United States with the following information. Gross value of estate Debt Required: (a)

Question 2 Mr. Gates recently deceased left an estate in the United States with the following information. Gross value of estate Debt Required: (a) (b) (c) Donations Administrative expense Funeral expenses Gifts $'000 15,000 2,500 1,500 2,400 100 240 The estate tax rate is 40%. Assume that the estate is eligible for a full estate tax allowance for the year. Calculate the tax liability of the estate (based on the 2017 tax rule) What is "Gift Tax" and how does it complement the "Estate Tax"? (6 marks) What is a "Defined Contribution Plan". Give one mainstream example of define contribution plan in the United States. (6 marks) [Total: 25 Marks] (13 marks)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Tax liability 9 15000 500 1 500 2400 foot 240 21740 49 109 X 21 740 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started